Unlocking the Future of Vanillin: How Lignin Valorization is Transforming Synthesis Pathways in 2025. Explore Market Growth, Technological Breakthroughs, and Sustainable Opportunities Shaping the Next Five Years.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Lignin Valorization: Technology Overview and Process Innovations

- Current and Emerging Players: Company Strategies and Partnerships

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Sustainability Impact: Environmental and Economic Benefits

- Intellectual Property and Regulatory Developments

- Supply Chain Dynamics: Feedstock Sourcing and Logistics

- End-Use Applications: Food, Fragrance, and Beyond

- Challenges, Risks, and Barriers to Commercialization

- Future Outlook: Investment Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

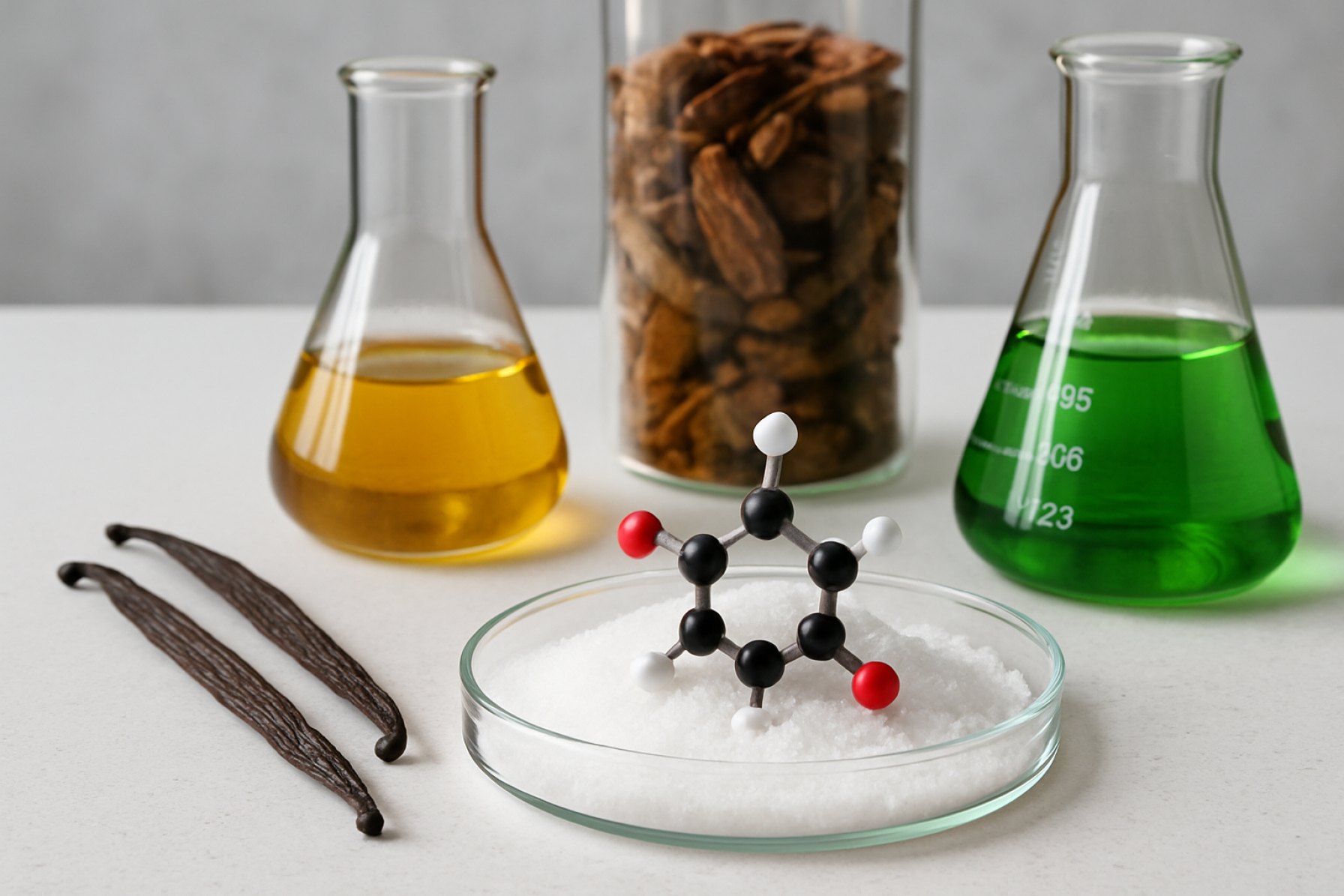

The global market for vanillin, a key flavoring and fragrance compound, is undergoing a significant transformation in 2025, driven by advances in lignin valorization technologies. Traditionally, vanillin has been produced either by chemical synthesis from petrochemical precursors or by extraction from vanilla beans, the latter accounting for less than 1% of global supply due to high cost and limited availability. The shift toward sustainable and bio-based vanillin is accelerating, with lignin—a major byproduct of the pulp and paper industry—emerging as a promising renewable feedstock.

Lignin valorization involves converting this abundant, aromatic polymer into high-value chemicals such as vanillin. In 2025, several industry leaders and technology developers are scaling up processes that enable the selective oxidation of lignin to vanillin, leveraging both catalytic and biotechnological approaches. Companies such as Borregaard, headquartered in Norway, have established themselves as pioneers in this field, operating one of the world’s only commercial-scale facilities for lignin-based vanillin production. Their process utilizes sustainable wood raw materials, positioning the company as a key supplier to the food, flavor, and fragrance industries.

The market landscape is further shaped by growing consumer demand for natural and sustainable ingredients, as well as regulatory pressures to reduce reliance on fossil-based chemicals. In response, major flavor and fragrance houses are increasingly sourcing vanillin derived from lignin. Solvay, a global chemical company, has also invested in bio-based vanillin production, although its primary focus remains on ferulic acid-based processes. Nevertheless, the company’s ongoing research into lignin valorization reflects broader industry trends toward circularity and resource efficiency.

Key drivers in 2025 include advancements in catalytic oxidation technologies, improved lignin fractionation methods, and the integration of biorefinery concepts. These innovations are reducing production costs and improving product purity, making lignin-derived vanillin increasingly competitive with synthetic alternatives. Additionally, sustainability certifications and traceability are becoming standard requirements, with companies like Borregaard emphasizing their commitment to responsible sourcing and transparent supply chains.

Looking ahead, the outlook for vanillin synthesis via lignin valorization is robust. Industry analysts anticipate continued investment in process optimization and capacity expansion, particularly in regions with established pulp and paper industries. As technology matures and economies of scale are realized, lignin-based vanillin is expected to capture a growing share of the global vanillin market, supporting the transition to a more sustainable and circular bioeconomy.

Lignin Valorization: Technology Overview and Process Innovations

Vanillin, a key flavor and fragrance compound, has traditionally been produced either by extraction from vanilla beans or via petrochemical synthesis. However, the valorization of lignin—a major byproduct of the pulp and paper industry—has emerged as a sustainable alternative for vanillin synthesis. Lignin valorization leverages the aromatic structure of lignin, enabling its conversion into high-value chemicals such as vanillin through oxidative depolymerization and catalytic processes.

As of 2025, the commercial landscape for lignin-based vanillin is led by a handful of pioneering companies. Borregaard, headquartered in Norway, remains the global leader in this field. The company operates the world’s largest biorefinery dedicated to lignin valorization, producing vanillin under the brand name “EuroVanillin.” Borregaard’s process involves the controlled oxidation of lignosulfonates—lignin derivatives from sulfite pulping—using proprietary catalytic systems. This approach yields vanillin with a significantly lower carbon footprint compared to petrochemical routes, aligning with growing consumer and regulatory demand for bio-based ingredients.

Process innovations in recent years have focused on improving yield, selectivity, and process integration. Borregaard has reported ongoing investments in process optimization, including advanced separation technologies and energy integration, to further reduce environmental impact and production costs. The company’s vanillin is certified for use in food, cosmetics, and pharmaceuticals, and it is marketed as a non-GMO, allergen-free, and sustainable alternative to synthetic vanillin.

Other industry players are also exploring lignin valorization. Stora Enso, a Finnish-Swedish renewable materials company, has announced R&D initiatives targeting the conversion of lignin into aromatic chemicals, including vanillin, leveraging their access to kraft lignin from pulp mills. While not yet at the same commercial scale as Borregaard, Stora Enso’s efforts reflect a broader industry trend toward lignin-based bioproducts.

Looking ahead, the outlook for vanillin synthesis via lignin valorization is promising. The global push for sustainable and circular bioeconomy solutions is expected to drive further investment and technological advancements. Key challenges remain, including the heterogeneity of lignin feedstocks and the need for robust, scalable catalytic processes. However, with ongoing R&D and increasing market acceptance, lignin-derived vanillin is poised to capture a growing share of the flavor and fragrance market in the next few years, particularly as major food and consumer goods companies seek to decarbonize their supply chains.

Current and Emerging Players: Company Strategies and Partnerships

The landscape of vanillin synthesis via lignin valorization is rapidly evolving, with several established chemical producers and innovative startups intensifying their focus on sustainable production methods. As of 2025, the drive to commercialize lignin-derived vanillin is shaped by strategic partnerships, technology licensing, and investments in pilot and demonstration-scale facilities.

Among the most prominent players, Borregaard stands out as a global leader. Headquartered in Norway, Borregaard has decades of experience in biorefining and is the only large-scale producer of vanillin from lignin, marketed under the brand “EuroVanillin.” The company’s process utilizes lignosulfonates from its own pulp operations, and Borregaard continues to invest in process optimization and capacity expansion to meet growing demand for bio-based vanillin in food, fragrance, and pharmaceutical sectors. In recent years, Borregaard has also engaged in collaborations with downstream users to tailor vanillin properties for specific applications.

In France, Solvay has historically been a major vanillin producer, though its primary focus has been on synthetic vanillin from petrochemical sources. However, Solvay has signaled interest in lignin valorization, exploring partnerships and R&D initiatives aimed at diversifying its vanillin portfolio with more sustainable options. The company’s open innovation approach and established customer base position it as a potential key player should it scale up lignin-based processes.

Emerging technology companies are also making significant strides. Anellotech, a US-based sustainable chemicals developer, is advancing catalytic processes to convert lignin-rich biomass into aromatic chemicals, including vanillin precursors. Anellotech’s partnerships with global consumer goods companies and chemical manufacturers underscore the commercial interest in lignin valorization routes. Similarly, Avantium in the Netherlands is leveraging its expertise in renewable chemistry to develop lignin valorization technologies, with pilot projects targeting high-value aromatic compounds.

Strategic alliances are a hallmark of the sector’s current phase. Companies are increasingly collaborating with pulp and paper producers to secure lignin feedstocks and with flavor and fragrance houses to ensure product quality and regulatory compliance. For example, Borregaard’s partnerships with food ingredient suppliers and Anellotech’s alliances with packaging and chemical firms exemplify the cross-sectoral approach required for successful commercialization.

Looking ahead, the next few years are expected to see further scale-up of demonstration plants, new joint ventures, and increased licensing of proprietary lignin-to-vanillin technologies. The sector’s trajectory will be shaped by the ability of these players to deliver cost-competitive, high-purity vanillin that meets the sustainability criteria demanded by global brands and consumers.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

The global market for vanillin synthesized via lignin valorization is poised for significant growth between 2025 and 2030, driven by increasing demand for sustainable and bio-based flavoring agents. Traditionally, vanillin production has relied on petrochemical sources or extraction from vanilla beans, but these methods face sustainability and cost challenges. Lignin, a major byproduct of the pulp and paper industry, offers a renewable and abundant feedstock for vanillin synthesis, aligning with the food, fragrance, and pharmaceutical sectors’ shift toward greener ingredients.

As of 2025, the market for lignin-derived vanillin remains a niche segment within the broader vanillin industry, which is dominated by synthetic vanillin produced from guaiacol. However, the segment is expanding rapidly due to technological advancements and increasing consumer preference for natural and sustainable products. Key players such as Borregaard—a Norwegian company recognized as a pioneer in lignin-based vanillin production—have established commercial-scale operations, supplying vanillin under the “EuroVanillin” brand. Borregaard utilizes proprietary biorefinery processes to convert lignin into high-purity vanillin, catering to food, beverage, and fragrance manufacturers seeking non-petrochemical alternatives.

Market segmentation is primarily based on end-use industries (food and beverages, fragrances, pharmaceuticals), product purity, and geographic regions. The food and beverage sector accounts for the largest share, driven by the demand for clean-label and natural flavorings. Europe leads in adoption, supported by stringent regulations and consumer awareness, while North America and Asia-Pacific are witnessing increased investments and pilot projects.

From 2025 to 2030, the lignin-derived vanillin market is projected to grow at a compound annual growth rate (CAGR) significantly higher than the overall vanillin market, with estimates ranging from 8% to 12% annually. This growth is underpinned by ongoing R&D, scale-up of biorefinery capacities, and strategic partnerships between pulp producers and flavor houses. For example, Borregaard continues to expand its production capabilities and collaborate with global food companies to integrate lignin-based vanillin into mainstream products.

Other notable industry participants include Solvay, which has explored bio-based vanillin routes, and several emerging technology firms in Europe and North America developing proprietary lignin valorization processes. The outlook for 2025–2030 suggests that as production costs decrease and supply chains mature, lignin-derived vanillin will capture a growing share of the global vanillin market, contributing to the broader transition toward bio-based chemicals and circular economy models.

Sustainability Impact: Environmental and Economic Benefits

Vanillin synthesis via lignin valorization is gaining significant momentum in 2025, driven by the dual imperatives of sustainability and economic efficiency. Traditionally, vanillin—an essential flavor and fragrance compound—has been produced either by extraction from vanilla beans or through petrochemical routes. However, both methods face sustainability challenges: vanilla bean extraction is limited by agricultural constraints and high costs, while petrochemical synthesis relies on non-renewable resources and generates substantial environmental burdens.

Lignin, a major byproduct of the pulp and paper industry, represents an abundant and underutilized renewable resource. Valorizing lignin for vanillin production not only diverts waste from landfills but also reduces reliance on fossil-based feedstocks. In 2025, several industry leaders are scaling up lignin-to-vanillin processes, leveraging advances in biorefinery and green chemistry. For example, Borregaard, a Norwegian company, operates one of the world’s largest biorefineries and is recognized for its commercial-scale production of bio-based vanillin from lignin. Their process utilizes sustainable wood sources and integrates energy recovery, minimizing greenhouse gas emissions and water usage compared to conventional methods.

The environmental benefits of lignin valorization are substantial. Life cycle assessments indicate that vanillin derived from lignin can reduce carbon emissions by up to 90% compared to petrochemical synthesis. Additionally, the process supports circular economy principles by transforming industrial byproducts into high-value chemicals, thus enhancing resource efficiency. Companies such as Solvay are also exploring lignin valorization technologies, aiming to expand their portfolio of sustainable aroma ingredients and reduce their environmental footprint.

Economically, lignin valorization offers pulp and paper producers a new revenue stream, potentially offsetting the volatility of traditional markets. The global demand for vanillin continues to rise, particularly in food, beverage, and cosmetics sectors, creating strong incentives for bio-based alternatives. As regulatory and consumer pressures mount for greener supply chains, bio-vanillin is increasingly favored by major brands seeking to meet sustainability targets.

Looking ahead, ongoing investments in process optimization, feedstock flexibility, and scale-up are expected to further improve the cost-competitiveness and environmental profile of lignin-based vanillin. Industry collaborations and public-private partnerships are accelerating technology transfer and market adoption, positioning lignin valorization as a cornerstone of the sustainable chemicals industry in the coming years.

Intellectual Property and Regulatory Developments

The landscape of intellectual property (IP) and regulatory frameworks surrounding vanillin synthesis via lignin valorization is rapidly evolving as the industry seeks sustainable alternatives to petrochemical and traditional biosynthetic routes. In 2025, patent activity remains robust, with leading chemical and biotechnology companies filing for protection of novel catalysts, bioprocesses, and integrated valorization platforms. Notably, companies such as BASF and Solvay—both with established portfolios in aroma chemicals—have expanded their IP filings to cover proprietary enzymatic and oxidative depolymerization methods for converting lignin into vanillin and related aromatic compounds.

The regulatory environment is also adapting to the emergence of lignin-derived vanillin. In the European Union, the European Food Safety Authority (EFSA) and the European Chemicals Agency (ECHA) are reviewing dossiers for vanillin produced from lignin, focusing on traceability, purity, and the absence of harmful byproducts. The U.S. Food and Drug Administration (FDA) is similarly evaluating Generally Recognized as Safe (GRAS) notifications for vanillin sourced from lignin valorization, with an emphasis on process transparency and compliance with food additive regulations. These regulatory reviews are expected to set precedents for the classification and labeling of “natural” versus “nature-identical” vanillin, a distinction critical for food and fragrance manufacturers.

Several industry consortia and standards organizations, such as the International Organization for Standardization (ISO), are actively developing guidelines for the authentication and quality control of lignin-derived vanillin. These efforts aim to harmonize analytical methods and ensure that products meet both safety and authenticity requirements, facilitating broader market acceptance.

Looking ahead, the next few years are likely to see increased collaboration between technology developers, regulatory agencies, and end-users to streamline approval processes and establish clear definitions for lignin-based vanillin. Companies like Borregaard, a pioneer in biorefining and lignin valorization, are expected to play a central role in shaping both the IP landscape and regulatory standards, leveraging their experience in scaling up lignin-to-vanillin processes. As regulatory clarity improves and patent protections solidify, the commercialization of lignin-derived vanillin is poised to accelerate, supporting the transition to more sustainable and circular chemical supply chains.

Supply Chain Dynamics: Feedstock Sourcing and Logistics

The supply chain dynamics for vanillin synthesis via lignin valorization are undergoing significant transformation as the industry seeks to scale up sustainable production. Lignin, a complex aromatic polymer found in plant cell walls, is primarily sourced as a byproduct from the pulp and paper industry, as well as from emerging biorefinery operations. In 2025, the availability and logistics of lignin feedstock are increasingly influenced by the integration of advanced biorefinery concepts and the growing demand for renewable chemicals.

Major pulp and paper producers, such as UPM-Kymmene Corporation and Stora Enso, are at the forefront of lignin extraction and supply. These companies operate large-scale facilities in Europe and North America, where they have developed proprietary processes to isolate high-purity lignin suitable for downstream valorization. For instance, Stora Enso markets its Lineo™ lignin as a renewable alternative for various chemical applications, including vanillin synthesis. The logistics of lignin transport are optimized through established networks that leverage existing pulp mill infrastructure, reducing additional transportation costs and emissions.

In parallel, biorefinery operators such as Borregaard in Norway have developed integrated value chains, where lignin is not only a byproduct but a central feedstock for specialty chemicals. Borregaard is recognized for its vanillin production from lignin, utilizing a closed-loop system that ensures traceability and consistent quality. The company’s supply chain is vertically integrated, encompassing wood procurement, lignin extraction, and chemical conversion, which enhances supply security and product sustainability.

Feedstock variability remains a challenge, as lignin properties can differ based on wood species, pulping process, and extraction method. To address this, suppliers are investing in feedstock standardization and real-time quality monitoring. Digitalization and blockchain-based traceability systems are being piloted to ensure transparency from forest to final vanillin product, aligning with the sustainability requirements of food and fragrance industries.

Looking ahead, the supply chain for lignin-derived vanillin is expected to benefit from increased collaboration between pulp mills, biorefineries, and chemical manufacturers. Strategic partnerships and offtake agreements are being established to secure long-term lignin supply, while investments in logistics infrastructure—such as dedicated lignin storage and handling facilities—are anticipated to support market growth. As regulatory and consumer pressures for bio-based ingredients intensify, the robustness and flexibility of lignin supply chains will be critical to the continued expansion of vanillin synthesis via lignin valorization.

End-Use Applications: Food, Fragrance, and Beyond

Vanillin, the primary flavor and aroma compound in vanilla, is experiencing a transformation in its production landscape, with lignin valorization emerging as a sustainable and scalable route. Traditionally, vanillin has been synthesized from petrochemical precursors or extracted from vanilla beans, but these methods face challenges related to cost, sustainability, and supply constraints. In 2025 and the coming years, lignin-derived vanillin is poised to make significant inroads across end-use sectors, particularly food, fragrance, and specialty chemicals.

The food industry remains the largest consumer of vanillin, utilizing it as a flavoring agent in baked goods, confectionery, dairy, and beverages. As consumer demand for natural and sustainable ingredients intensifies, food manufacturers are increasingly interested in vanillin produced from lignin—a renewable byproduct of the pulp and paper industry. Companies such as Borregaard, a global leader in biorefining, have commercialized processes to convert lignin into vanillin at industrial scale. Their flagship product, marketed as “wood-based vanillin,” is already used by major food brands seeking to reduce their reliance on synthetic or petrochemical-derived flavors.

In the fragrance sector, vanillin is a key ingredient in perfumes, personal care products, and household items. The unique olfactory profile of lignin-derived vanillin, which can offer subtle differences compared to synthetic variants, is attracting attention from perfumers and formulators. The traceability and lower carbon footprint of lignin-based vanillin are also valued by brands aiming to meet sustainability targets and appeal to eco-conscious consumers. Borregaard and other emerging players are actively collaborating with fragrance houses to expand the use of lignin-derived vanillin in new product lines.

Beyond food and fragrance, lignin-derived vanillin is finding applications in pharmaceuticals, agrochemicals, and polymer industries. Its antioxidant and antimicrobial properties make it a candidate for use in drug formulations and as a bio-based additive in plastics and coatings. The versatility of lignin valorization processes allows for the tailoring of vanillin purity and co-product streams, opening new avenues for specialty chemical applications.

Looking ahead, the outlook for lignin-based vanillin is robust. Ongoing investments in process optimization, supply chain integration, and certification (such as non-GMO and natural labeling) are expected to further drive adoption. As more companies, including Borregaard, scale up production and diversify their customer base, lignin valorization is set to play a pivotal role in the sustainable supply of vanillin for a wide array of end-use applications through 2025 and beyond.

Challenges, Risks, and Barriers to Commercialization

The commercialization of vanillin synthesis via lignin valorization faces several significant challenges, risks, and barriers as of 2025 and looking ahead. While the valorization of lignin—a major byproduct of the pulp and paper industry—offers a sustainable alternative to petrochemical and synthetic vanillin, the path to large-scale adoption is complex.

One of the primary technical challenges is the heterogeneity and recalcitrance of lignin itself. Lignin’s complex, irregular polymeric structure varies depending on its botanical source and extraction process, making it difficult to achieve consistent yields and purity of vanillin. Current industrial processes, such as those piloted by companies like Borregaard, which operates one of the world’s only commercial-scale biovanillin plants, rely on highly optimized conditions and specific lignin feedstocks. Scaling these processes to accommodate diverse lignin sources from various biorefineries remains a major hurdle.

Economic viability is another barrier. The cost of isolating, purifying, and converting lignin to vanillin is still higher than that of traditional petrochemical synthesis or even fermentation-based biovanillin. The price competitiveness is further challenged by the established supply chains and economies of scale enjoyed by synthetic vanillin producers such as Solvay and Evolva, both of which have robust global distribution networks and established customer bases. Unless lignin valorization technologies can significantly reduce operational costs or receive policy incentives, widespread market penetration will be limited.

Regulatory and consumer acceptance also pose risks. While lignin-derived vanillin can be labeled as “natural” under certain jurisdictions, regulatory definitions vary globally, and consumer perception of “wood-based” flavors may lag behind those of fermentation-derived or plant-extracted vanillin. Companies must navigate complex food safety and labeling regulations, which can delay product launches and increase compliance costs.

Supply chain integration is a further challenge. Most lignin valorization projects are tied to pulp mills or biorefineries, such as those operated by Stora Enso and UPM, which are exploring lignin-based chemicals. However, aligning the production of high-quality lignin with downstream vanillin synthesis requires close coordination and investment in new infrastructure.

Looking forward, the sector’s outlook will depend on advances in lignin depolymerization technologies, improved process economics, and supportive regulatory frameworks. Strategic partnerships between pulp producers, chemical companies, and flavor houses will be crucial to overcoming these barriers and achieving commercial viability for lignin-derived vanillin in the coming years.

Future Outlook: Investment Opportunities and Strategic Recommendations

The future outlook for vanillin synthesis via lignin valorization is shaped by a convergence of sustainability imperatives, technological advancements, and evolving consumer preferences. As of 2025, the global demand for bio-based vanillin continues to rise, driven by the food, beverage, and fragrance industries’ shift toward natural and renewable ingredients. Lignin, a major byproduct of the pulp and paper industry, represents an abundant and underutilized feedstock for vanillin production, offering a compelling alternative to petrochemical and traditional extraction methods.

Several industry leaders are actively investing in lignin valorization technologies. Borregaard, headquartered in Norway, remains a pioneer in commercial-scale production of bio-based vanillin from lignin, leveraging proprietary processes to supply global markets. The company’s continued expansion and R&D investments underscore the commercial viability and scalability of lignin-derived vanillin. Similarly, Solvay has maintained a strong presence in the vanillin sector, with ongoing efforts to integrate more sustainable feedstocks and improve process efficiencies.

In North America, Domtar and West Fraser are among the pulp and paper producers exploring lignin valorization pathways, including partnerships and pilot projects aimed at diversifying revenue streams and reducing waste. These initiatives are supported by increasing regulatory and consumer pressure to adopt circular economy principles and reduce reliance on fossil-based chemicals.

From an investment perspective, the sector presents multiple opportunities across the value chain. Startups and established firms are developing novel catalytic and biotechnological processes to enhance lignin depolymerization and vanillin yield. Strategic investments in process intensification, enzyme engineering, and downstream purification are expected to further improve cost-competitiveness and product quality. Additionally, collaborations between technology providers, pulp mills, and end-users are likely to accelerate commercialization and market adoption.

Looking ahead, the next few years will likely see increased capital flows into lignin valorization infrastructure, particularly in regions with strong forestry and pulp industries. Investors should monitor advancements in process integration, regulatory developments favoring bio-based chemicals, and evolving certification standards for natural ingredients. Companies with established lignin supply chains, robust R&D capabilities, and strategic partnerships are well-positioned to capture market share as demand for sustainable vanillin intensifies.

In summary, vanillin synthesis via lignin valorization offers a promising avenue for sustainable growth, with significant investment potential for stakeholders across the chemical, forestry, and consumer goods sectors. Proactive engagement with technology innovators and alignment with sustainability trends will be key to capitalizing on emerging opportunities in this dynamic field.

Sources & References

- Borregaard

- Anellotech

- BASF

- International Organization for Standardization

- UPM-Kymmene Corporation

- Evolva

- Domtar

- West Fraser