Metamaterial Antenna Technology in 2025: Unlocking Next-Gen Wireless Performance and Market Expansion. Explore how advanced materials are reshaping antenna design, enabling unprecedented efficiency and new applications across industries.

- Executive Summary: Key Trends and Market Drivers

- Metamaterial Antenna Fundamentals: Science and Technology Overview

- Current Market Landscape and Leading Players

- Breakthrough Innovations in 2025: Materials, Designs, and Performance

- Emerging Applications: 5G/6G, IoT, Aerospace, and Automotive

- Competitive Analysis: Company Strategies and Partnerships

- Market Forecast 2025–2030: Revenue, Volume, and Regional Insights

- Regulatory Environment and Industry Standards

- Challenges and Barriers to Adoption

- Future Outlook: Disruptive Potential and Long-Term Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers

Metamaterial antenna technology is poised for significant advancement in 2025, driven by the escalating demand for high-performance wireless communication, the proliferation of 5G and emerging 6G networks, and the need for compact, energy-efficient solutions across industries. Metamaterials—engineered structures with properties not found in nature—enable antennas to achieve unprecedented control over electromagnetic waves, resulting in enhanced directivity, miniaturization, and reconfigurability.

A key trend in 2025 is the integration of metamaterial antennas into next-generation wireless infrastructure. As mobile operators and equipment manufacturers race to deploy 5G and prepare for 6G, the unique capabilities of metamaterial antennas—such as beam steering, low-profile form factors, and multi-band operation—are increasingly attractive. Companies like Kyocera Corporation and Fractus Antennas are actively developing and commercializing metamaterial-based antenna solutions for smartphones, IoT devices, and automotive applications. These antennas offer improved signal quality and reduced interference, addressing the challenges of dense urban environments and the growing number of connected devices.

Another driver is the adoption of metamaterial antennas in satellite communications and aerospace. The ability to create lightweight, conformal, and electronically steerable antennas is critical for next-generation satellite constellations and unmanned aerial vehicles (UAVs). Kymeta Corporation is a notable player, providing flat-panel, electronically steered antennas based on metamaterial technology for mobile and fixed satellite connectivity. Their solutions are being adopted for land, maritime, and government applications, reflecting the versatility and scalability of metamaterial designs.

Automotive and defense sectors are also accelerating adoption. Advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communications, and radar systems benefit from the compactness and performance of metamaterial antennas. Companies such as Metamagnetics are innovating in this space, focusing on high-frequency, low-loss metamaterial components for radar and electronic warfare.

Looking ahead, the outlook for metamaterial antenna technology is robust. Ongoing research and commercialization efforts are expected to yield further improvements in efficiency, bandwidth, and integration with semiconductor processes. As the technology matures, cost reductions and standardization will drive broader adoption across consumer electronics, telecommunications, automotive, and aerospace sectors. The convergence of metamaterial innovation with the global rollout of advanced wireless networks positions this technology as a cornerstone of future connectivity solutions.

Metamaterial Antenna Fundamentals: Science and Technology Overview

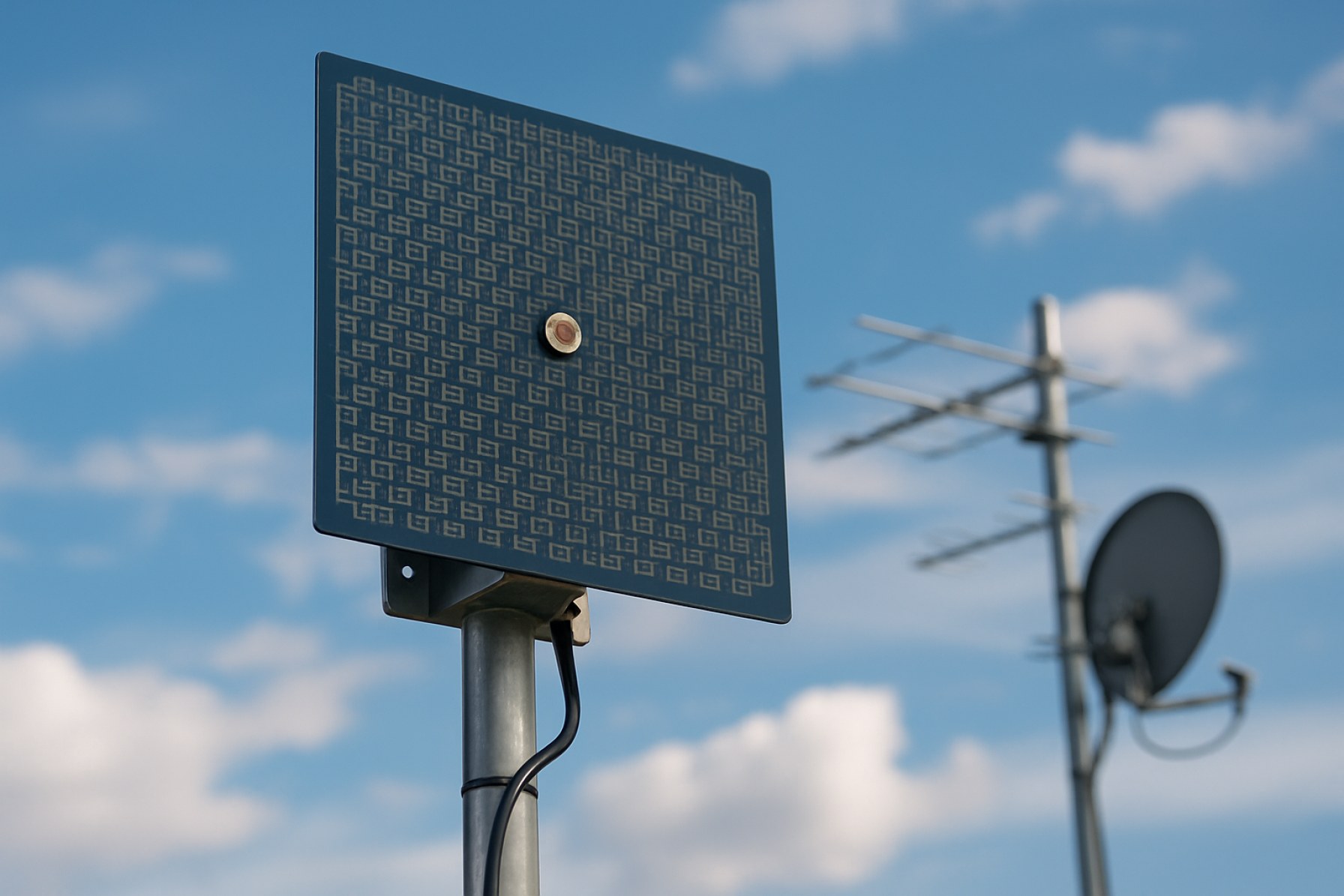

Metamaterial antenna technology leverages artificially engineered structures—metamaterials—to manipulate electromagnetic waves in ways not possible with conventional materials. These structures, typically composed of periodic or aperiodic arrangements of subwavelength elements, enable unique electromagnetic properties such as negative refractive index, electromagnetic bandgaps, and tailored permittivity and permeability. In 2025, the field is characterized by rapid advancements in both the fundamental science and practical engineering of metamaterial-based antennas, driven by the demands of 5G/6G wireless, satellite communications, and emerging IoT applications.

The core scientific principle behind metamaterial antennas is the ability to control wave propagation, radiation patterns, and impedance matching at a subwavelength scale. This allows for the realization of antennas with reduced size, enhanced bandwidth, improved directivity, and dynamic beam steering capabilities. Recent research has focused on tunable and reconfigurable metamaterials, often incorporating varactors, MEMS, or phase-change materials to enable real-time adaptability. In 2025, the integration of active components and digital control is increasingly common, enabling software-defined antennas that can dynamically alter their electromagnetic response.

Several industry leaders are actively developing and commercializing metamaterial antenna solutions. Kymeta Corporation is notable for its electronically steered flat-panel antennas based on metamaterial technology, targeting satellite and mobile connectivity markets. Their antennas utilize a proprietary metamaterial surface to achieve electronic beam steering without mechanical movement, offering low-profile, lightweight solutions for land, sea, and air platforms. Meta Materials Inc. (META®) is another key player, focusing on advanced functional materials and nanostructures for electromagnetic applications, including antennas for automotive radar and wireless communications. Fractal Antenna Systems, Inc. explores fractal-based metamaterial designs to achieve multiband and compact antennas, with applications in defense and commercial wireless.

The technology is also being adopted by major aerospace and defense contractors. Lockheed Martin has publicly discussed research into metamaterial-based antennas for next-generation radar and communications systems, aiming to reduce antenna size and weight while enhancing performance. Similarly, Northrop Grumman is exploring metamaterial surfaces for advanced sensor and communication payloads.

Looking ahead, the outlook for metamaterial antenna technology is robust. The convergence of digital control, advanced materials, and scalable manufacturing is expected to yield antennas with unprecedented flexibility and performance. As 5G/6G networks, satellite constellations, and autonomous systems proliferate, demand for compact, high-performance, and reconfigurable antennas will accelerate. Ongoing collaboration between material scientists, RF engineers, and system integrators is likely to drive further breakthroughs, positioning metamaterial antennas as a foundational technology for the next generation of wireless infrastructure.

Current Market Landscape and Leading Players

The metamaterial antenna technology market in 2025 is characterized by rapid innovation, increasing commercialization, and a growing roster of industry participants. Metamaterials—engineered structures with properties not found in naturally occurring materials—are enabling antennas with unprecedented performance in terms of size, weight, efficiency, and beam-steering capabilities. These advances are particularly relevant for applications in 5G/6G telecommunications, satellite communications, defense, and emerging IoT devices.

A key player in this space is Kyocera Corporation, which has been actively developing and commercializing metamaterial-based antennas for mobile devices and infrastructure. Their solutions focus on miniaturization and improved signal quality, addressing the needs of next-generation wireless networks. Another prominent company, Kymeta Corporation, specializes in electronically steered flat-panel antennas using metamaterial technology, targeting satellite communications for mobility, government, and enterprise markets. Kymeta’s u8 terminal, for example, is designed for seamless connectivity on moving platforms such as vehicles and vessels.

In the defense and aerospace sectors, Lockheed Martin has invested in metamaterial antenna research, aiming to enhance radar, communications, and electronic warfare systems. Their work includes the integration of reconfigurable and low-profile antennas into advanced platforms, supporting both military and commercial applications. Similarly, Northrop Grumman is exploring metamaterial-based solutions for next-generation phased array antennas, with a focus on improved performance and reduced form factor.

Startups and specialized firms are also shaping the competitive landscape. Meta Materials Inc. (META®) is notable for its broad portfolio of metamaterial-based products, including antennas for automotive, aerospace, and consumer electronics. The company collaborates with industry leaders to integrate its technology into commercial systems, emphasizing scalability and manufacturability. Fractal Antenna Systems, Inc. leverages fractal and metamaterial designs to deliver compact, wideband antennas for both commercial and defense markets.

Looking ahead, the market is expected to see increased adoption as 5G/6G rollouts accelerate and demand for high-performance, low-profile antennas grows. Industry partnerships, government funding, and standardization efforts are likely to drive further innovation and commercialization. The next few years will be pivotal as established players and agile startups compete to define the future of wireless connectivity through metamaterial antenna technology.

Breakthrough Innovations in 2025: Materials, Designs, and Performance

Metamaterial antenna technology is poised for significant breakthroughs in 2025, driven by advances in engineered materials, novel design architectures, and performance optimization for next-generation wireless systems. Metamaterials—artificially structured composites with properties not found in nature—enable antennas with unprecedented control over electromagnetic waves, leading to miniaturization, enhanced directivity, and tunable frequency responses.

A key innovation in 2025 is the integration of tunable and reconfigurable metamaterials into antenna arrays, supporting dynamic beam steering and frequency agility essential for 5G-Advanced and early 6G deployments. Companies such as Kyocera Corporation and Nokia are actively developing metamaterial-based antennas for base stations and user devices, leveraging materials like low-loss ceramics and engineered polymers to achieve high efficiency and compact form factors. Kyocera Corporation has demonstrated prototype antennas using layered metamaterial substrates, achieving up to 30% size reduction compared to conventional designs while maintaining or improving gain and bandwidth.

Another area of rapid progress is the commercialization of metasurface antennas—ultra-thin, planar structures that manipulate wavefronts with subwavelength precision. Kymeta Corporation has advanced electronically steered flat-panel antennas for satellite and terrestrial communications, utilizing liquid crystal and tunable dielectric metamaterials to enable real-time beam steering without mechanical movement. In 2025, Kymeta’s latest models are expected to support multi-band operation and higher data rates, targeting applications in mobility, defense, and IoT.

Material science breakthroughs are also accelerating performance gains. Murata Manufacturing Co., Ltd. is investing in high-permittivity ceramic metamaterials for millimeter-wave (mmWave) antennas, crucial for dense urban 5G and future 6G networks. These materials offer low dielectric loss and thermal stability, enabling antennas with higher efficiency and reliability under demanding conditions.

Looking ahead, the outlook for metamaterial antenna technology is robust. Industry roadmaps indicate that by 2026–2027, mass adoption in smartphones, automotive radar, and satellite terminals is likely, as manufacturing processes mature and costs decrease. Standardization efforts by industry bodies such as the International Telecommunication Union are expected to accelerate interoperability and deployment. As a result, metamaterial antennas are set to become foundational components in the wireless infrastructure of the coming years, enabling smarter, more connected environments.

Emerging Applications: 5G/6G, IoT, Aerospace, and Automotive

Metamaterial antenna technology is rapidly advancing, with significant implications for emerging applications in 5G/6G communications, the Internet of Things (IoT), aerospace, and automotive sectors. As of 2025, the integration of engineered metamaterials—artificially structured materials with unique electromagnetic properties—into antenna systems is enabling unprecedented performance improvements, including miniaturization, beam steering, and enhanced signal efficiency.

In the 5G and upcoming 6G landscape, metamaterial antennas are addressing critical challenges such as high-frequency signal loss and the need for compact, high-gain solutions. Companies like Kyocera Corporation and Fractus Antennas are actively developing metamaterial-based antennas for mobile devices and infrastructure, focusing on multi-band operation and reduced form factors. These innovations are crucial for supporting the dense, high-capacity networks required by next-generation wireless standards. Additionally, Kymeta Corporation is leveraging metamaterial technology to create electronically steerable antennas, which are essential for dynamic beamforming in 5G/6G base stations and user equipment.

The IoT sector is also benefiting from metamaterial antennas, particularly in applications demanding ultra-compact, low-power, and highly efficient wireless connectivity. Fractus Antennas has introduced chip-sized metamaterial antennas that can be integrated into a wide range of IoT devices, from smart meters to wearable health monitors. These antennas enable reliable connectivity even in challenging environments, supporting the proliferation of IoT networks in urban and industrial settings.

In aerospace, the adoption of metamaterial antennas is accelerating, driven by the need for lightweight, low-profile, and high-performance solutions for satellite communications and avionics. Kymeta Corporation is a notable player, providing flat-panel, electronically steerable antennas for satellite broadband on aircraft and unmanned aerial vehicles (UAVs). These antennas offer significant advantages over traditional parabolic dishes, including reduced drag and the ability to maintain connectivity with moving satellites.

The automotive industry is exploring metamaterial antennas for advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communications, and in-car connectivity. Companies such as Kyocera Corporation are developing automotive-grade metamaterial antennas that support multiple wireless standards, including cellular, Wi-Fi, and satellite, within a single compact module. This integration is expected to enhance vehicle safety, enable autonomous driving features, and support the growing demand for in-vehicle infotainment.

Looking ahead, the next few years are likely to see further commercialization and standardization of metamaterial antenna technology across these sectors. As manufacturing processes mature and costs decrease, adoption is expected to accelerate, driving innovation in wireless connectivity and enabling new applications that were previously unattainable with conventional antenna designs.

Competitive Analysis: Company Strategies and Partnerships

The competitive landscape for metamaterial antenna technology in 2025 is characterized by a dynamic interplay of established industry leaders, innovative startups, and strategic partnerships aimed at accelerating commercialization and deployment. Companies are leveraging proprietary metamaterial designs to address challenges in 5G, satellite communications, and next-generation wireless connectivity, with a focus on miniaturization, beam steering, and energy efficiency.

A key player, Kymeta Corporation, continues to advance its electronically steered flat-panel antennas based on metamaterial science. In 2024 and 2025, Kymeta has expanded its partnerships with satellite operators and mobility solution providers, targeting applications in land mobile, maritime, and government sectors. Their u8 terminal, for example, integrates with LEO and GEO satellite networks, reflecting a strategy of interoperability and global reach.

Another significant competitor, Meta Materials Inc., is actively developing and licensing its proprietary metamaterial antenna technologies for both terrestrial and space-based applications. The company’s focus on scalable manufacturing and integration with existing communication infrastructure has led to collaborations with aerospace and defense contractors, as well as automotive OEMs seeking advanced connectivity solutions.

In Europe, Isotropic Systems (now rebranded as All.Space) is making strides with its multi-beam, multi-orbit antennas, which utilize metamaterial-inspired architectures to enable simultaneous connectivity across different satellite constellations. Their partnerships with satellite network operators and defense agencies underscore a strategy of targeting high-value, mission-critical markets.

Meanwhile, Fractal Antenna Systems, Inc. is leveraging its patented fractal and metamaterial designs to offer compact, wideband antennas for commercial and military applications. The company’s approach emphasizes intellectual property protection and direct engagement with government agencies, positioning it as a specialist supplier in the defense and aerospace sectors.

Strategic alliances are a hallmark of the sector’s evolution. Companies are increasingly forming joint ventures and R&D partnerships to accelerate product development and market entry. For instance, collaborations between antenna manufacturers and satellite service providers are enabling rapid field trials and early adoption in mobility and IoT markets. Additionally, several firms are working with semiconductor and materials companies to optimize the integration of metamaterial antennas into chipsets and devices.

Looking ahead, the competitive environment is expected to intensify as more players enter the market and as established telecom and aerospace companies invest in in-house metamaterial R&D. The next few years will likely see further consolidation, with mergers and acquisitions driven by the need for scale, intellectual property, and access to global distribution channels.

Market Forecast 2025–2030: Revenue, Volume, and Regional Insights

The global market for metamaterial antenna technology is poised for significant growth between 2025 and 2030, driven by escalating demand for advanced wireless communication, 5G/6G infrastructure, and next-generation satellite connectivity. Industry leaders and innovators are scaling up production and deployment, with North America, Europe, and Asia-Pacific emerging as key regions for both revenue and volume expansion.

In 2025, the market is expected to surpass several hundred million USD in annual revenue, with projections indicating a compound annual growth rate (CAGR) exceeding 20% through 2030. This surge is attributed to the rapid adoption of metamaterial-based antennas in telecommunications, aerospace, defense, and automotive sectors. The technology’s ability to deliver high-gain, low-profile, and beam-steering capabilities is particularly attractive for 5G/6G base stations, IoT devices, and satellite terminals.

North America is anticipated to maintain its leadership, fueled by robust R&D investments and early commercialization efforts by companies such as Kyocera Corporation—which has developed advanced metamaterial antennas for mobile and automotive applications—and Kymeta Corporation, a pioneer in flat-panel satellite antennas leveraging metamaterials for electronically steered beamforming. The United States, in particular, benefits from strong government and defense sector demand, as well as partnerships with major telecom operators.

Europe is also witnessing accelerated growth, with firms like Airbus integrating metamaterial antennas into next-generation aircraft and satellite platforms. The region’s focus on sustainable mobility and connected vehicles is expected to drive further adoption, especially as regulatory frameworks for connected and autonomous vehicles mature.

Asia-Pacific is emerging as a high-growth region, led by countries such as Japan, South Korea, and China. Japanese conglomerates including Murata Manufacturing Co., Ltd. are investing in metamaterial antenna R&D for consumer electronics and automotive radar systems. Meanwhile, Chinese manufacturers are scaling up production capacity to meet domestic and export demand, particularly for 5G infrastructure and smart city deployments.

Looking ahead, the market outlook remains robust as metamaterial antenna technology transitions from pilot projects to mass-market adoption. Key growth drivers include the proliferation of connected devices, the rollout of 6G networks, and the expansion of low-earth orbit (LEO) satellite constellations. As manufacturing costs decline and performance advantages become more widely recognized, metamaterial antennas are expected to capture a growing share of the global antenna market, with regional leaders shaping the competitive landscape through innovation and strategic partnerships.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for metamaterial antenna technology are rapidly evolving as the technology matures and finds increasing adoption in telecommunications, aerospace, defense, and consumer electronics. In 2025, regulatory bodies such as the Federal Communications Commission (FCC) in the United States and the European Telecommunications Standards Institute (ETSI) in Europe are actively monitoring the integration of metamaterial-based antennas, particularly as these devices enable novel functionalities like beam steering, miniaturization, and dynamic frequency reconfiguration.

Metamaterial antennas, by virtue of their unique electromagnetic properties, can operate across a wide range of frequencies and support advanced wireless protocols, including 5G and emerging 6G standards. This flexibility, however, presents new challenges for spectrum management and electromagnetic compatibility (EMC). Regulatory agencies are updating certification processes to ensure that metamaterial antennas comply with existing emission limits and do not cause harmful interference, especially as they are deployed in dense urban environments and critical infrastructure.

Industry standards are also being shaped by leading organizations and manufacturers. Companies such as Kyocera Corporation and Nokia are actively involved in standardization efforts, contributing to working groups within bodies like the IEEE and ETSI. These efforts focus on defining performance metrics, interoperability requirements, and safety guidelines for metamaterial antennas in commercial and industrial applications. For example, the IEEE is developing standards for next-generation antenna systems, which increasingly reference metamaterial-based designs for their efficiency and adaptability.

In the defense and aerospace sectors, compliance with military standards such as MIL-STD-461 for EMC and MIL-STD-810 for environmental testing remains essential. Companies like Northrop Grumman and Lockheed Martin are collaborating with regulatory authorities to ensure that metamaterial antennas meet stringent reliability and security requirements for mission-critical applications.

Looking ahead, the regulatory landscape is expected to become more harmonized globally, as international collaboration increases to support the deployment of advanced wireless networks and satellite communications. The ongoing work of organizations such as the International Telecommunication Union (ITU) will be pivotal in establishing unified standards and spectrum policies that accommodate the unique capabilities of metamaterial antennas. As adoption accelerates, industry stakeholders anticipate further updates to certification frameworks and the introduction of new guidelines tailored specifically to the performance and safety characteristics of metamaterial antenna technology.

Challenges and Barriers to Adoption

Metamaterial antenna technology, while promising significant advancements in wireless communication, faces several challenges and barriers to widespread adoption as of 2025 and in the near future. These obstacles span technical, manufacturing, economic, and regulatory domains, impacting the pace and scale at which metamaterial antennas can be integrated into mainstream applications.

One of the primary technical challenges is the complexity of design and simulation. Metamaterial antennas rely on engineered structures with sub-wavelength features, requiring advanced computational tools and expertise for accurate modeling and optimization. This complexity can slow down the development cycle and increase costs, particularly for companies without specialized knowledge in electromagnetic metamaterials. Additionally, ensuring consistent performance across wide frequency bands and in real-world environments remains a significant hurdle, as metamaterial properties can be sensitive to fabrication tolerances and environmental factors.

Manufacturing scalability is another major barrier. Producing metamaterial structures at scale with the required precision and repeatability is not trivial. While companies such as Kymeta Corporation and Meta Materials Inc. have demonstrated commercial products, the transition from laboratory prototypes to mass production involves overcoming challenges related to material selection, process control, and quality assurance. The cost of advanced materials and fabrication processes can also be prohibitive for some applications, particularly in cost-sensitive markets like consumer electronics.

Economic factors further complicate adoption. The initial investment in research, development, and retooling manufacturing lines for metamaterial antennas can be substantial. For many established manufacturers, the return on investment is uncertain, especially as traditional antenna technologies continue to improve and remain cost-competitive. The lack of standardized testing and certification procedures for metamaterial-based devices also introduces risk, as regulatory approval processes may be lengthy or ambiguous.

From a regulatory perspective, the novel electromagnetic properties of metamaterial antennas may not fit neatly within existing spectrum management and device certification frameworks. This can delay market entry and create uncertainty for manufacturers and end-users. Industry bodies such as the International Telecommunication Union and ETSI are beginning to address these issues, but harmonized standards and clear guidelines are still in development.

Looking ahead, overcoming these challenges will require coordinated efforts between technology developers, manufacturers, standards organizations, and regulators. Advances in materials science, manufacturing automation, and simulation tools are expected to gradually reduce barriers, but widespread adoption of metamaterial antenna technology is likely to be incremental over the next few years.

Future Outlook: Disruptive Potential and Long-Term Opportunities

Metamaterial antenna technology is poised to disrupt the wireless communications landscape in 2025 and the years immediately following, driven by its unique ability to manipulate electromagnetic waves in ways not possible with conventional materials. The technology’s promise lies in its potential to deliver smaller, lighter, and more efficient antennas, with applications spanning 5G/6G networks, satellite communications, IoT, automotive radar, and defense systems.

Several industry leaders are actively advancing metamaterial antenna solutions. Kymeta Corporation has commercialized electronically steered flat-panel antennas for satellite and mobile connectivity, leveraging metamaterials to enable low-profile, high-performance solutions for land, sea, and air platforms. Meta Materials Inc. is developing advanced radio frequency (RF) and electromagnetic interference (EMI) shielding products, as well as next-generation antenna designs for automotive and aerospace sectors. Fractal Antenna Systems is another notable player, focusing on fractal and metamaterial-based antennas for defense, public safety, and commercial wireless applications.

In 2025, the integration of metamaterial antennas into commercial products is expected to accelerate, particularly in the satellite communications and connected vehicle markets. The proliferation of low Earth orbit (LEO) satellite constellations is driving demand for flat, electronically steerable antennas that can maintain connectivity on moving platforms—an area where metamaterial designs excel. Automotive manufacturers are also exploring these antennas for advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communications, seeking to reduce form factor and improve reliability.

Looking ahead, the disruptive potential of metamaterial antennas extends to the rollout of 6G networks, where ultra-high frequencies and beamforming capabilities will be essential. The technology’s ability to support dynamic beam steering and multi-band operation could enable new paradigms in wireless connectivity, including holographic communications and ubiquitous IoT coverage. Defense and aerospace sectors are expected to benefit from enhanced stealth, jamming resistance, and multi-functionality.

Challenges remain, particularly in large-scale manufacturing, cost reduction, and standardization. However, ongoing investments and partnerships between technology developers, OEMs, and network operators are likely to address these hurdles. As the ecosystem matures, metamaterial antenna technology is positioned to become a foundational enabler of next-generation wireless infrastructure, with significant long-term opportunities across multiple industries.

Sources & References

- Metamagnetics

- Meta Materials Inc.

- Lockheed Martin

- Northrop Grumman

- Nokia

- Murata Manufacturing Co., Ltd.

- International Telecommunication Union

- Airbus

- IEEE