Table of Contents

- Executive Summary: Key Findings and Market Drivers

- Technology Overview: How Wavelength-Gated Lidar Works

- Competitive Landscape: Leading Innovators and Patents

- Current Market Size and 2025 Forecasts

- Emerging Applications: Automotive, Defense, Robotics, and More

- Regulatory Developments and Industry Standards (e.g. ieee.org, lidaralliance.org)

- Breakthroughs in Wavelength Selection and Signal Processing

- Case Studies: Real-World Deployments from Industry Leaders (e.g. velodynelidar.com, ouster.com)

- Challenges and Barriers to Adoption

- Future Outlook: Growth Projections and Next-Gen Innovations (2025–2030)

- Sources & References

Executive Summary: Key Findings and Market Drivers

Wavelength-gated lidar systems are emerging as a critical technology in the rapidly evolving landscape of advanced sensing solutions, particularly for automotive, industrial, and infrastructure monitoring applications. In 2025, the market is witnessing accelerated adoption of these systems, driven by their enhanced selectivity, resilience to ambient light interference, and improved detection range compared to conventional lidar approaches. Wavelength-gating leverages precise control over the emission and detection wavelengths, enabling robust performance in challenging environments such as fog, rain, and direct sunlight—key requirements for autonomous vehicles and smart city infrastructure.

One of the principal drivers of market growth is the automotive sector’s demand for higher fidelity perception systems. Major automotive OEMs and suppliers are collaborating with lidar manufacturers to integrate wavelength-gated architectures into advanced driver-assistance systems (ADAS) and fully autonomous platforms. For instance, companies such as Luminar Technologies and Aurora Innovation are investing in next-generation lidar that exploits wavelength-selective filtering and narrow-band detection to reduce interference and false positives, thereby supporting safer and more reliable vehicle navigation.

Industrial automation and infrastructure monitoring are also significant end-user segments. Wavelength-gated lidar is increasingly deployed for applications such as rail and power line inspection, where environmental clutter and variable lighting conditions have historically challenged traditional sensors. Suppliers like Hesai Technology and Ouster are actively expanding their portfolios to include systems optimized for spectral selectivity, meeting the stringent uptime and reliability requirements of these sectors.

From a technology standpoint, advancements in laser sources (including tunable and multi-wavelength emitters) and highly selective detector materials are enabling further miniaturization and cost reduction, opening the door to wider commercial deployment over the next few years. Industry consortia and standards bodies such as the ITEA are supporting collaborative efforts to standardize performance metrics and interoperability for wavelength-gated lidar, which is expected to further accelerate market penetration.

Looking forward, the outlook for wavelength-gated lidar systems remains strong through the mid-2020s. Key market drivers include the push for higher autonomy levels in mobility, the expansion of smart infrastructure projects, and ongoing innovation in photonic integration. As real-world deployment scales, industry leaders anticipate a rapid shift from pilot projects to mass production, with increased emphasis on system robustness and cost-effectiveness shaping the competitive landscape.

Technology Overview: How Wavelength-Gated Lidar Works

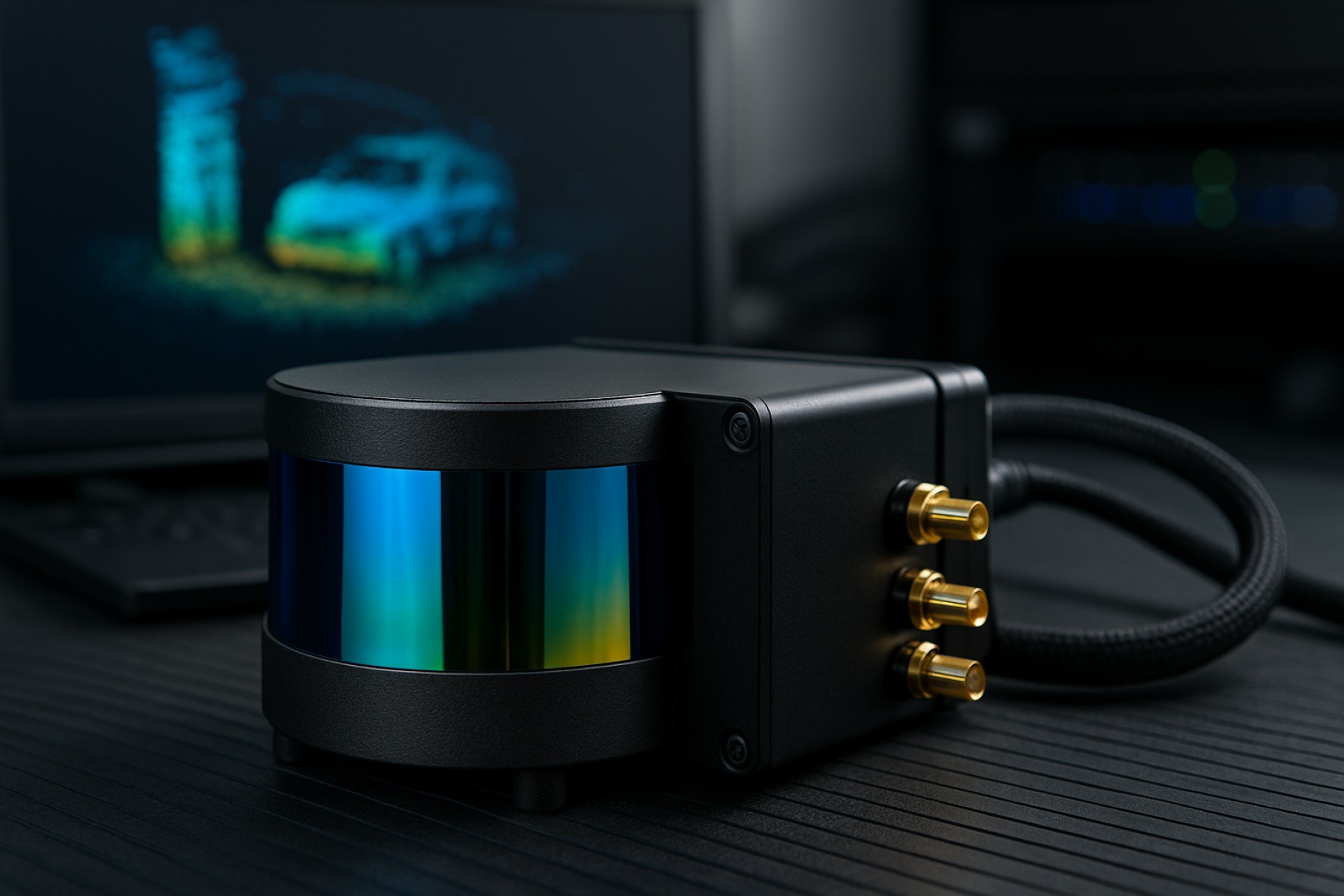

Wavelength-gated lidar systems represent a significant advancement in the field of light detection and ranging (lidar) technology. These systems leverage selective wavelength gating to enhance signal-to-noise ratios, suppress background interference, and improve detection capabilities, particularly in challenging environments. Unlike conventional lidar systems that primarily rely on time-of-flight or amplitude discrimination, wavelength-gated lidar utilizes tunable laser sources and narrowband optical filters to detect only specific return wavelengths, effectively filtering out ambient light and noise from other wavelengths.

At the core of a wavelength-gated lidar system is a laser source, often in the near-infrared (NIR) or short-wave infrared (SWIR) spectrum, paired with a highly selective optical filter on the receiver side. The transmitter emits laser pulses at a precise wavelength. The receiver, equipped with a bandpass filter or a tunable filter, only allows reflected photons matching the emitted wavelength to reach the photodetector. This approach greatly improves detection performance in scenarios with high ambient light, such as daylight operation or environments with significant background illumination.

By leveraging wavelength-selective detection, these systems are particularly well-suited for applications such as autonomous vehicles, robotics, and industrial automation—fields that demand high-accuracy sensing under variable lighting conditions. Major lidar manufacturers are advancing this technology. For example, Aeva Technologies has developed frequency-modulated continuous wave (FMCW) lidar platforms that inherently utilize wavelength selectivity, enabling simultaneous velocity and range measurement while suppressing interference from sunlight and other lidar sources. Similarly, Luminar Technologies integrates proprietary laser sources and precision filtering techniques in its Iris lidar platform, designed for automotive-grade performance in a broad range of lighting scenarios.

In 2025 and the immediate future, further improvements are expected in the integration of wavelength-gated lidar with advanced signal processing and machine learning algorithms for real-time object recognition and scene understanding. Innovations in photonic integration and the development of more compact, robust tunable filters are anticipated to reduce system size, cost, and power consumption, making wavelength-gated lidar more accessible for mass-market deployment. Companies like ams OSRAM are also investing in the development of high-efficiency semiconductor lasers and detectors tailored for precise wavelength gating, supporting growing demand across mobility, industrial, and smart infrastructure sectors.

Overall, wavelength-gated lidar systems are poised to play a crucial role in next-generation sensing platforms, offering enhanced reliability and performance as adoption accelerates in automotive and beyond.

Competitive Landscape: Leading Innovators and Patents

The competitive landscape for wavelength-gated lidar systems in 2025 is defined by a dynamic interplay between established lidar manufacturers, sensor technology firms, and automotive industry leaders. Wavelength-gated lidar, which leverages selective wavelength filtering to enhance signal-to-noise ratios and enable operation in challenging environments, is gaining prominence due to its potential in autonomous vehicles, robotics, and advanced mapping applications.

Key innovators in this segment include Velodyne Lidar and Luminar Technologies, both of which have publicly announced research and commercial projects focusing on advanced signal processing and wavelength-selective detection. Luminar Technologies, in particular, has invested heavily in developing lidar systems operating at longer near-infrared wavelengths (around 1550 nm), which allow for higher power operation while maintaining eye safety and improved atmospheric penetration—a critical attribute for wavelength-gated systems.

Another significant player is ADASENS, which has collaborated with automotive OEMs to integrate wavelength-gating techniques for enhanced detection in fog, rain, and low-light conditions. Additionally, Hesai Technology and Ibeo Automotive Systems are actively expanding their patent portfolios in spectrum-selective lidar approaches, reflecting the sector’s rapid innovation pace.

Patent activity in this domain has accelerated, with filings focusing on techniques for multi-wavelength emission, tunable filters, and advanced photodetector arrays. The United States Patent and Trademark Office and the European Patent Office have both recorded a steady increase in patents related to wavelength-gated lidar since 2022, signaling a race for intellectual property leadership among industry stakeholders.

Looking ahead, the competitive landscape is expected to intensify as automotive OEMs and Tier 1 suppliers—such as Continental AG and Robert Bosch GmbH—increase investments in proprietary wavelength-gated lidar modules tailored for next-generation driver assistance and autonomous systems. Cross-licensing of core patents and strategic partnerships are likely to shape market entry for new players, while established firms continue to refine their portfolios to address evolving regulatory and performance requirements.

Overall, 2025 marks a critical juncture for wavelength-gated lidar, with innovation hubs centered in North America, Europe, and East Asia. Continued patent activity and collaborative development between lidar specialists and automotive manufacturers are expected to drive advancements and diversification of applications in the next few years.

Current Market Size and 2025 Forecasts

Wavelength-gated lidar systems, which utilize selective wavelength filtering and gating to enhance signal-to-noise ratio and reduce interference, are gaining increasing traction across automotive, robotics, and infrastructure monitoring sectors. As of 2025, the global lidar market is experiencing robust growth, with wavelength-gated approaches representing a cutting-edge subset poised for significant expansion due to their ability to improve detection performance in challenging environments such as fog, rain, and crowded urban landscapes.

Leading lidar manufacturers are investing heavily in research and commercialization of wavelength-gated systems. For example, Velodyne Lidar has outlined ongoing developments in wavelength-selective detection technologies, aiming to enhance their product portfolio for automotive and smart infrastructure applications. Similarly, Luminar Technologies has announced continued integration of advanced optical filtering and gating technologies into its next-generation lidars, targeting OEMs and autonomous vehicle developers.

In terms of market size, industry sources and company reports indicate that the broader global lidar market is expected to surpass $3.5–4 billion by 2025, with wavelength-gated solutions comprising a growing portion of this total due to their adoption in premium automotive and industrial segments. Innoviz Technologies has specifically highlighted increased demand for their solid-state lidar sensors with wavelength-gating capabilities among Tier-1 automotive suppliers, contributing to multi-million dollar supply agreements through 2025.

The ongoing shift towards 1550 nm and other eye-safe wavelengths—enabling higher power levels and longer range—is accelerating the adoption of wavelength-gating, as companies such as Hesai Technology and Ouster refine their product lines to address stricter performance and safety requirements. Furthermore, the emerging trend of sensor fusion in the automotive sector is anticipated to drive further demand for wavelength-gated lidar, as OEMs seek robust, low-false-alarm solutions for advanced driver assistance systems (ADAS) and autonomous driving.

Looking ahead to the next few years, the wavelength-gated lidar segment is forecast to achieve above-average compound annual growth rates, as adoption extends from pilot projects to volume production in mobility, smart cities, and industrial automation. R&D collaboration and strategic partnerships—such as those announced by Velodyne Lidar and Luminar Technologies with major automotive OEMs—will likely accelerate commercialization and further expand the addressable market for wavelength-gated lidar systems through and beyond 2025.

Emerging Applications: Automotive, Defense, Robotics, and More

Wavelength-gated lidar systems are rapidly transforming multiple sectors by leveraging selective wavelength operation to enhance detection accuracy, target discrimination, and environmental robustness. In 2025 and the near future, significant momentum is observed across automotive, defense, robotics, and adjacent industries, driven by advancements in photonic integration, sensor miniaturization, and sophisticated signal processing.

In the automotive sector, wavelength-gated lidar is emerging as a critical enabler of next-generation advanced driver-assistance systems (ADAS) and autonomous driving platforms. By operating at eye-safe wavelengths (such as 1550 nm), these systems achieve higher peak powers and better penetration through adverse weather, compared to traditional 905 nm systems. Leading automotive suppliers are actively integrating wavelength agile and gated lidar modules into production vehicles to improve resolution and reduce cross-talk in dense urban environments. For example, Adasens and Continental are among those pursuing innovations in wavelength-selective lidar for real-time environmental mapping and pedestrian recognition.

Defense applications are also experiencing a surge in demand for wavelength-gated lidar, primarily due to the technology’s ability to provide high-fidelity imaging and object classification under low-visibility or camouflaged conditions. The use of gated imaging—where the lidar only detects signals within chosen wavelength and time windows—enables selective target identification and improved countermeasure resistance. Key defense contractors such as Lockheed Martin and Leonardo have publicly demonstrated research and prototype platforms incorporating multi-wavelength and gated lidar for reconnaissance, threat detection, and navigation in complex terrains.

In robotics and industrial automation, wavelength-gated lidar is facilitating safer human-robot collaboration and more precise navigation in dynamic and cluttered environments. The selective wavelength approach reduces susceptibility to interference from external light sources and improves the system’s ability to discern object material properties. Companies like SICK AG and Ouster are advancing lidar solutions with tunable wavelength and gating capabilities for integration into autonomous mobile robots, warehouse automation, and smart infrastructure.

Looking ahead, the convergence of wavelength-gated lidar with AI-powered perception engines is expected to unlock new applications in sectors such as urban mobility, unmanned aerial vehicles, and environmental monitoring. The market outlook for the next few years points to broader adoption, as costs decrease and regulatory frameworks evolve to accommodate the deployment of advanced sensing modalities.

Regulatory Developments and Industry Standards (e.g. ieee.org, lidaralliance.org)

Wavelength-gated lidar systems, which leverage the selective detection of specific wavelengths to enhance signal-to-noise ratios and reduce interference, are increasingly relevant as regulatory frameworks and industry standards evolve in 2025 and beyond. The surge in lidar adoption for autonomous vehicles, smart infrastructure, and industrial automation has prompted regulators and industry consortia to address the unique safety, interoperability, and performance concerns posed by multi-wavelength operation.

A key regulatory focus remains the eye safety classification of lidar systems, particularly those operating at wavelengths above 1400 nm. Recent updates to international safety standards, such as EN 60825-1 and IEC 60825-1, have provided clearer guidance on the use of longer infrared wavelengths, which are less hazardous to human eyes and thus allow for higher output powers. This regulatory clarity is accelerating the adoption of wavelength-gated approaches, as manufacturers seek to maximize lidar range and reliability while meeting legal requirements.

Industry alliances are also actively advancing interoperability and data quality standards for multi-wavelength and wavelength-gated lidar. The Lidar Alliance, a cross-sector consortium, has convened working groups that aim to develop technical specifications for wavelength management, crosstalk mitigation, and environmental robustness. These initiatives address practical challenges such as ensuring co-existence of lidars operating at different wavelengths in congested environments, and the standardization of test protocols for new system architectures.

The Institute of Electrical and Electronics Engineers (IEEE) has also expanded its standards portfolio to include guidelines pertinent to wavelength-gated and multi-wavelength lidar. Ongoing developments in the IEEE P2020 family, which focuses on automotive perception systems, include draft provisions for multi-spectral lidar calibration, environmental resilience, and wavelength-specific performance metrics. These collaborative efforts reflect increasing recognition of wavelength-gated lidar as a distinct class requiring tailored standards.

Looking ahead, regulatory authorities in the US, EU, and Asia-Pacific are anticipated to refine rules on electromagnetic compatibility and spectrum allocation, due to the proliferation of lidar in both mobility and infrastructure applications. Engagement with industry bodies such as the IEEE and Lidar Alliance will be critical in harmonizing global standards, facilitating cross-border interoperability, and ensuring safety as wavelength-gated lidar transitions from pilot deployments to mainstream adoption in the coming years.

Breakthroughs in Wavelength Selection and Signal Processing

Wavelength-gated lidar systems are at the forefront of next-generation optical sensing, leveraging precise control over emitted and detected wavelengths to enhance performance in complex environments. As of 2025, several key breakthroughs are reshaping the design and deployment of these systems, particularly in automotive, industrial, and environmental monitoring applications.

Recent advances in tunable laser diodes and narrowband optical filters have enabled lidar units to selectively operate at wavelengths less affected by atmospheric interference such as fog, dust, and sunlight. This wavelength agility is reducing false positives in object detection and improving range under challenging conditions. For instance, developers are increasingly employing 1550 nm lasers—supported by advancements in erbium-doped fiber amplifier (EDFA) technologies—due to their higher permissible power levels and superior eye safety compared to traditional 905 nm systems. Companies like Lumentum and OSRAM are driving this transition by introducing high-power, wavelength-stable laser sources specifically tailored for automotive lidar.

On the receiver side, the integration of high-rejection wavelength filters and advanced photodetectors has improved background light immunity, a critical factor for lidar deployed outdoors or in variable lighting. Hamamatsu Photonics and ams OSRAM have demonstrated photodetector arrays with tailored spectral responses, enabling more robust signal discrimination and reducing noise in multi-lidar environments.

Signal processing algorithms have also undergone significant evolution. Modern wavelength-gated systems now employ real-time digital signal processors (DSPs) and field-programmable gate arrays (FPGAs) to dynamically adapt gate windows in response to detected interference, maximizing detection probability while minimizing false alarms. Additionally, machine learning techniques are being incorporated to optimize wavelength selection based on environmental feedback, a trend being actively explored by lidar solution providers such as Velodyne Lidar and Ibeo Automotive Systems.

Looking ahead, the next few years are expected to see further miniaturization and integration of wavelength-gated lidar modules, driven by the push for scalable deployment in autonomous vehicles and smart city infrastructure. The anticipated evolution toward multi-wavelength and spectrally agile lidar will likely unlock new capabilities in material classification and target differentiation, expanding the utility of lidar across diverse sectors. The convergence of advances in laser sources, photodetectors, and intelligent signal processing is setting the stage for robust, high-performance wavelength-gated lidar systems well beyond 2025.

Case Studies: Real-World Deployments from Industry Leaders (e.g. velodynelidar.com, ouster.com)

Wavelength-gated lidar systems are increasingly being adopted in real-world applications, with industry leaders showcasing deployments that highlight the technology’s performance advantages in challenging environments. These systems use specific laser wavelengths—often in the near-infrared or short-wave infrared (SWIR) regions—to selectively gate returns, improving target detection while suppressing noise from adverse weather, sunlight, or interfering signals. The following case studies from leading lidar manufacturers illustrate the current state and future outlook of wavelength-gated lidar in 2025 and beyond.

-

Velodyne Lidar:

Velodyne Lidar has incorporated wavelength-gating techniques in its next-generation sensors aimed at automotive and industrial markets. Field trials conducted in 2024–2025 have demonstrated that their wavelength-gated solutions can significantly reduce false positives in rain and fog, a key requirement for autonomous vehicles and advanced driver-assistance systems (ADAS). Velodyne’s deployments with leading mobility partners in North America and Asia report a marked improvement in object classification and pedestrian detection under low-visibility conditions, accelerating commercial rollout in urban and logistics applications. -

Ouster:

Ouster has advanced the integration of multi-wavelength gating in its digital lidar architecture, with commercial deployments in 2025 focusing on smart infrastructure and robotics. Their systems leverage wavelength selectivity to filter out ambient noise, enabling reliable operation in high-glare or mixed-light environments such as airports and busy intersections. Ouster’s collaboration with city planners has led to several pilot installations that demonstrate improved detection of cyclists and vehicles, which is critical for traffic management and safety analytics. -

Innoviz Technologies:

Innoviz Technologies has begun delivering wavelength-gated lidar modules for automotive OEMs in Europe and Israel. These units are tailored for long-range, all-weather sensing in premium vehicle models slated for release in 2025–2026. Early fleet data indicate a substantial boost in lane-keeping and collision avoidance capabilities during night driving and heavy precipitation, aligning with the industry’s push towards higher levels of vehicle autonomy.

The industry outlook for wavelength-gated lidar systems is robust. As regulatory standards evolve and automotive OEMs intensify their autonomous driving programs, deployment volumes are expected to rise sharply. Manufacturers are investing in scalable production and further R&D to extend wavelength-gating benefits to additional markets such as drones and industrial automation. The next few years will likely see broader adoption across sectors that demand high reliability in variable lighting and weather, with ongoing refinements to reduce system cost and complexity.

Challenges and Barriers to Adoption

Wavelength-gated lidar systems, leveraging selective wavelength operation for enhanced object detection and interference mitigation, represent a promising direction in photonic sensing. However, several challenges and barriers are impeding their widespread adoption as of 2025 and for the upcoming years.

A primary technical challenge lies in the complexity of designing and manufacturing reliable tunable laser sources and wavelength-selective photodetectors. Unlike conventional lidar systems operating at fixed wavelengths (commonly 905 nm or 1550 nm), wavelength-gated architectures require dynamic wavelength control, adding to system cost and integration complexity. Industry leaders like Hamamatsu Photonics and TRIOPTICS are actively developing tunable photonic components, but mass-market solutions remain at a relatively early stage, affecting scalability and commercial viability for automotive and industrial customers.

Cost is another significant barrier. The addition of tunable elements and advanced optical filtering technologies increases the bill of materials compared to mature fixed-wavelength lidar systems. While companies such as Automotive Lidar and Lumentum are working to reduce component costs through integration and volume manufacturing, the price gap is expected to persist until at least the late 2020s, particularly for high-performance applications requiring long-range or high-resolution sensing.

Standardization and regulatory acceptance present further obstacles. As wavelength-gated lidar introduces new operational paradigms—especially for eye safety and electromagnetic compatibility—industry standards are still evolving. Organizations such as the International Electrotechnical Commission (IEC) are updating lidar-specific safety guidelines, but full harmonization for novel architectures may take several years, potentially slowing deployment in regulated sectors like automotive and aerospace.

Interoperability and ecosystem maturity are also in question. Wavelength-gated systems require end-to-end coordination between transmitters, receivers, and software for wavelength control and signal processing. The lack of universally compatible hardware and software platforms makes integration with existing perception stacks more challenging. While ecosystem players such as Velodyne Lidar and Ibeo Automotive Systems are exploring multi-wavelength and multi-modal sensing, comprehensive support for wavelength-gated operation is still nascent.

In summary, the adoption of wavelength-gated lidar systems in 2025 faces hurdles stemming from technical complexity, cost, standardization, and ecosystem readiness. Overcoming these barriers will require advances in photonic engineering, supply chain scaling, regulatory harmonization, and industry collaboration over the next several years.

Future Outlook: Growth Projections and Next-Gen Innovations (2025–2030)

From 2025 onward, wavelength-gated lidar systems are poised for significant growth and technological refinement, underpinned by advances in photonics, semiconductor lasers, and optical filtering technologies. Wavelength gating, which enables lidar units to selectively detect signals at specific wavelengths to reduce interference and enhance detection in challenging conditions, is gaining traction in automotive, industrial, and environmental monitoring sectors. The next several years are expected to witness accelerated deployment as key industry players transition from prototype demonstrations to commercial-scale solutions.

Automotive lidar manufacturers are at the forefront of integrating wavelength-gated systems to achieve robust object detection in scenarios plagued by sunlight glare, adverse weather, or multiple lidar-equipped vehicles operating in proximity. Companies such as Velodyne Lidar and Ibeo Automotive Systems have indicated ongoing R&D in spectral filtering and multi-wavelength operation to address interference and eye safety regulations. The anticipated adoption of multi-wavelength and wavelength-gated lidar in advanced driver assistance systems (ADAS) and fully autonomous vehicles is driven by the necessity for high-fidelity perception and the ability to operate seamlessly in congested environments.

Industrial and infrastructure monitoring applications are also projected to adopt wavelength-gated lidars at an increasing rate between 2025 and 2030. The technology’s ability to discriminate between signals and environmental noise is attractive for precision mapping, perimeter security, and robotics. Companies like SICK AG are actively developing next-generation lidar sensors optimized for industrial automation, with roadmap indications pointing toward enhanced spectral gating features to enable operation in multi-sensor environments and under variable lighting conditions.

On the component side, suppliers of laser diodes and optical filters, such as OSRAM, are ramping up manufacturing of multi-wavelength sources and high-performance interference filters, which are essential for scalable, cost-effective wavelength-gated lidar. The growing maturity of short-wave infrared (SWIR) sources and detectors is expected to further improve system performance, enabling higher resolutions and extended range.

Looking to 2030, the convergence of wavelength-gated lidar with AI-based signal processing and sensor fusion is anticipated to unlock new capabilities in real-time object classification and environmental adaptation. As standardization efforts mature and component prices decline, the proliferation of wavelength-gated solutions across mobility, smart cities, and environmental monitoring is expected to accelerate, supporting global trends toward automation and resilient infrastructure.