Table of Contents

- Executive Summary: Industry Outlook Through 2030

- Technology Primer: How Pigment-Treated Graphene is Revolutionizing Photonics

- Key Players & Industry Consortiums (2025 Industry Map)

- Current Market Size and 5-Year Forecasts (2025–2030)

- Emerging Applications: Displays, Sensors, and Optical Communications

- Competitive Landscape: Innovation Pipelines and Strategic Alliances

- Manufacturing Challenges & Solutions: Scaling Pigment-Treated Graphene

- Regulatory Landscape and Standardization Initiatives

- Regional Hotspots: Asia, Europe, and North America Market Dynamics

- Future Outlook: Disruptive Trends and Investment Opportunities

- Sources & References

Executive Summary: Industry Outlook Through 2030

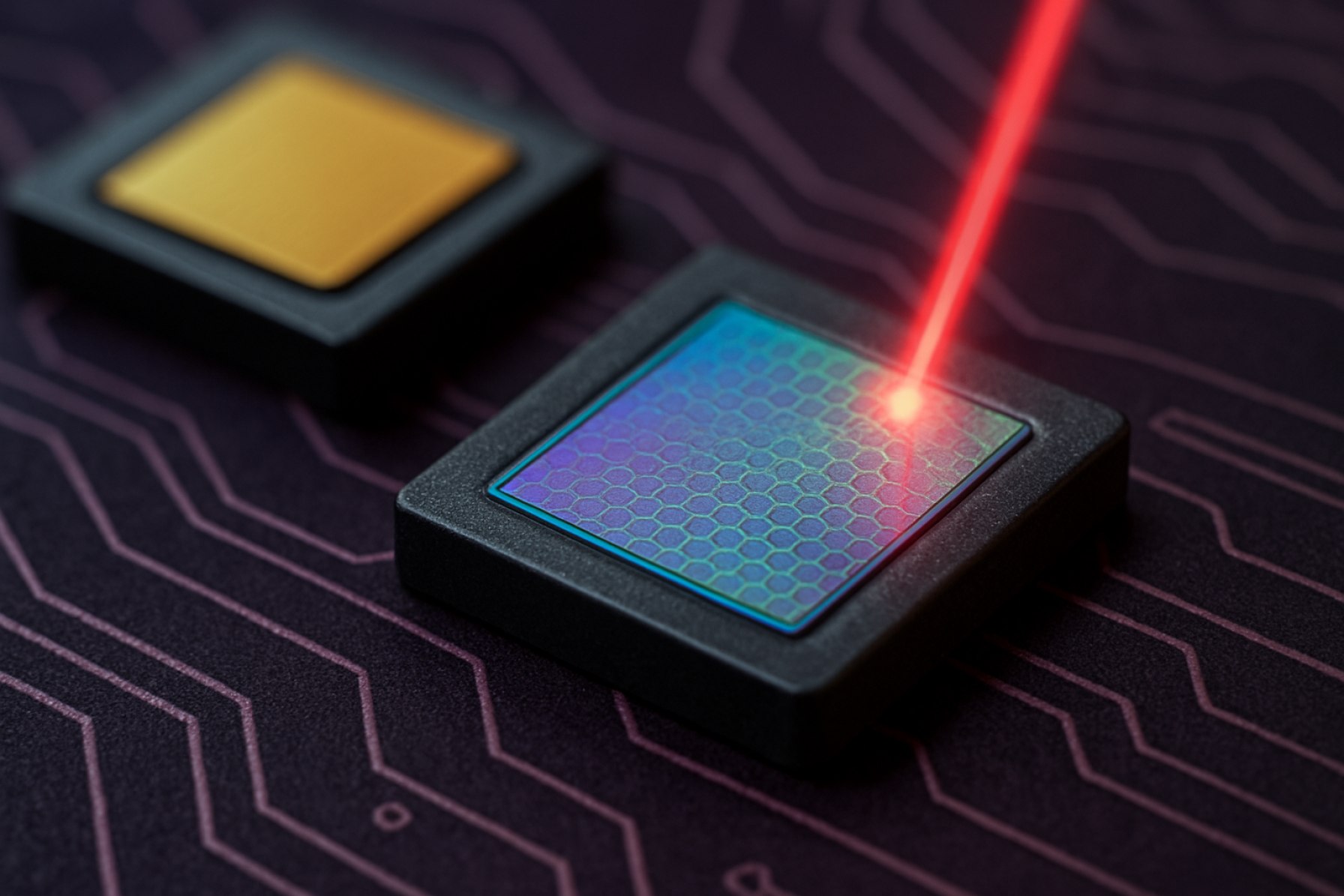

Pigment-treated graphene photonics is emerging as a dynamic frontier in the convergence of advanced materials science and optoelectronics, promising substantial impacts across telecommunications, sensing, imaging, and flexible electronics industries. As of 2025, the integration of pigment molecules—ranging from organic dyes to metal-oxide pigments—onto graphene sheets is enabling novel functionalities such as tunable optical absorption, enhanced nonlinear optical responses, and improved environmental stability of photonic devices.

Several leading companies are advancing pigment-treated graphene photonic components from laboratory proof-of-concept to pilot-scale manufacture. Versarien plc is leveraging functionalized graphene inks to develop coatings and substrates aimed at photodetector and sensor applications. Meanwhile, Graphenea is supplying high-quality graphene materials and supporting collaborative projects focused on pigment integration for enhanced photonic performance. The application of pigment-treated graphene films in flexible displays and smart windows is also being pursued by material innovators such as Universal Materials, who are integrating color-tunable pigments with graphene to achieve custom optical filtering and light modulation.

Recent demonstrations have shown that pigment-treated graphene can achieve broadband absorption and selective wavelength response, making it highly suitable for next-generation photodetectors and integrated optical circuits. For example, pilot devices using pigment-doped graphene have exhibited responsivities exceeding traditional graphene photodetectors, according to data released by Graphenea. Furthermore, the use of environmentally stable pigments has extended device lifetimes in ambient conditions, addressing a significant barrier to commercialization.

Looking ahead to the next few years, the industry is expected to prioritize scalability of fabrication techniques such as roll-to-roll coating and inkjet printing, in order to meet the demands of large-area optoelectronic and photonic system integration. Industry consortia and standardization efforts, led by organizations such as the Graphene Flagship, are fostering collaborations between material suppliers, device engineers, and end-users to accelerate the translation of pigment-treated graphene innovations into market-ready solutions.

By 2030, pigment-treated graphene photonics is projected to be a cornerstone technology for broadband optical communications, wearable sensors, and adaptive optics. The sector’s outlook is bolstered by ongoing investments in advanced material processing and the growing commitment of major players to sustainable, scalable manufacturing. As pigment-graphene hybrids continue to outperform conventional photonic materials in critical metrics, their adoption across industries is set for robust expansion through the decade.

Technology Primer: How Pigment-Treated Graphene is Revolutionizing Photonics

Pigment-treated graphene photonics represents a significant technological leap, leveraging the unique electronic and optical properties of graphene—further enhanced by the integration of functional pigments. As of 2025, this emerging field is gaining momentum, with research and commercialization efforts focusing on the development of advanced optical components, sensors, and communication devices.

Graphene’s atomic thinness and exceptional conductivity have long positioned it as a material of interest for photonics. The addition of pigments—organic or inorganic molecules with strong optical absorption or emission—enables precise tuning of graphene’s light-interaction properties. Pigment-treated graphene can achieve wavelength-selective absorption, improved nonlinear optical responses, and tailored photoluminescence, opening new avenues for device engineering.

Recent work by manufacturers and research institutes has highlighted several promising applications. For instance, Graphenea, a leading graphene producer, has collaborated with photonics companies to supply high-quality, customizable graphene films suitable for pigment integration. These films are being used in prototype photodetectors and modulators, where pigment functionalization enhances device sensitivity and selectivity in the visible and near-infrared spectrum.

On the device fabrication front, Thorlabs has explored the incorporation of pigment-treated graphene in their optical component platforms, particularly for ultrafast laser systems and broadband photodetectors. The company reports that pigment-functionalized graphene enables broadband operation from 400 nm to 2000 nm, while also improving device speed and lowering the noise floor.

In the telecommunications sector, Nokia has initiated programs to integrate pigment-treated graphene into next-generation optical transceivers. Their research suggests substantial improvements in modulation depth and energy efficiency, which are critical for high-speed, low-latency data links in fiber networks.

The outlook for pigment-treated graphene photonics in the coming years is robust. Key industry players anticipate that advances in scalable manufacturing—led by companies such as Versarien and Directa Plus—will lower costs and improve material consistency. This, in turn, will accelerate adoption in areas such as biomedical imaging, environmental sensing, and quantum photonics.

Overall, pigment-treated graphene is poised to redefine the performance and versatility of photonic devices through 2025 and beyond, with collaborative efforts between material suppliers, device manufacturers, and technology integrators continuing to drive innovation.

Key Players & Industry Consortiums (2025 Industry Map)

The pigment-treated graphene photonics sector is experiencing robust growth in 2025, with a diverse array of companies and industry consortiums driving innovation and commercialization. The convergence of pigment engineering and graphene’s exceptional optoelectronic properties has catalyzed new product lines in optical components, display technologies, and photonic sensors. Key players originate from graphene manufacturing, pigment synthesis, and advanced photonics, forming an integrated supply chain that spans material production to system integration.

- Graphene Flagship: This pan-European initiative continues to foster collaborative research and commercial scaling of graphene-based photonics. In 2025, the consortium’s innovation program supports pigment-engineered graphene films for tunable photonic devices, with active partnerships involving pigment specialists and component integrators.

- Directa Plus: Recognized for its scalable graphene production, Directa Plus is working with pigment formulators to produce graphene-enhanced coatings with tailored optical properties. Their 2025 portfolio includes photonic inks and films for smart window and sensor applications.

- Versarien: UK-based Versarien has expanded its nanomaterial offerings to include pigment-treated graphene dispersions. The company is collaborating with photonics manufacturers to develop next-generation optoelectronic substrates and flexible displays.

- Cambridge Graphene Centre: At the academic-industry interface, the Cambridge Graphene Centre is a hub for pigment-doped graphene photonic research and hosts pilot programs with global display and sensor firms, accelerating transfer from lab-scale innovation to industrial deployment.

- Fraunhofer Institute for Photonic Microsystems: The Fraunhofer IPMS leads a cluster of European SMEs and pigment suppliers to commercialize graphene-pigment hybrid photodetectors and modulators, with pilot lines operational in 2025.

- Graphene Council: As an industry association, the Graphene Council provides regulatory, standardization, and market intelligence support, with a 2025 focus group dedicated to pigment-treated graphene in photonic applications.

Looking ahead, the sector is expected to see further consolidation and the emergence of vertical alliances between pigment formulators, graphene producers, and end-device manufacturers. Collaborative R&D and pilot projects, often funded or supported by industry consortia, remain critical for scaling pigment-treated graphene photonic devices from prototypes to volume production, particularly in displays, photodetectors, and architectural optics.

Current Market Size and 5-Year Forecasts (2025–2030)

Pigment-treated graphene photonics is an emerging segment within the broader graphene-based photonics and optoelectronics market. As of 2025, the integration of pigment molecules with graphene is gaining traction for its ability to tailor optical absorption, tune emission wavelengths, and enhance the stability of photonic devices. These hybrid materials are being adopted for applications in tunable photodetectors, high-performance optical sensors, and flexible display technologies.

The current global market for graphene photonics—including pigment-treated variants—remains relatively nascent but is experiencing accelerated growth as industrial-scale production and application development mature. Market activity is concentrated in North America, Europe, and East Asia, with leading contributions from companies such as Graphenea, which supplies advanced graphene materials for optoelectronic research and prototype devices, and First Graphene, which collaborates with photonics developers to commercialize functionalized graphene products.

While quantitative segmentation of pigment-treated graphene photonics is not yet widely reported, the overall graphene-based photonics market is projected to surpass $1 billion USD globally by 2030, with pigment-enhanced derivatives expected to represent a significant share by enabling new device architectures and performance benchmarks. The market’s compound annual growth rate (CAGR) is anticipated to exceed 30% year-over-year from 2025 through 2030, fueled by ongoing commercialization of flexible wearable displays, broadband photodetectors, and bio-integrated optical sensors. Companies such as Versarien and Directa Plus are expanding their offerings to include pigment-functionalized graphene materials targeted at these high-growth applications.

Key drivers over the next five years include increased investment in pilot-scale manufacturing, collaborative R&D between material suppliers and photonic device integrators, and the development of standards for pigment-graphene composites by organizations like the Graphene Flagship. Market maturation is further supported by the adoption of pigment-treated graphene in commercial displays by Asian consumer electronics manufacturers and in sensor arrays for environmental monitoring and medical diagnostics.

Looking forward, the pigment-treated graphene photonics sector is expected to transition from research-driven innovation to early-stage commercial rollout by 2030, with supply chains and end-user adoption expanding rapidly in parallel with advances in scalable synthesis and device integration.

Emerging Applications: Displays, Sensors, and Optical Communications

Pigment-treated graphene photonics is gaining momentum in 2025 as a transformative technology for next-generation displays, sensors, and optical communications. The unique combination of graphene’s exceptional electrical and optical properties with pigment-based functionalization is unlocking new device architectures and performance benchmarks across several sectors.

In display technology, pigment-treated graphene offers enhanced color tunability and improved stability for flexible and transparent screens. Companies like Samsung Electronics are actively exploring graphene-based transparent electrodes and optical films for advanced OLED and QLED displays. The integration of pigment molecules allows for precise modulation of absorption and emission spectra, contributing to broader color gamuts and increased display lifespans—key requirements for foldable and wearable devices anticipated to reach commercial maturity in the next few years.

Sensor technologies are also benefiting from pigment-treated graphene’s tailored optical responses. For example, ams OSRAM is investigating graphene photodetectors enhanced with organic and inorganic pigments for hyperspectral and bio-sensing applications. These sensors leverage the pigment-induced selectivity and graphene’s ultrafast carrier dynamics to achieve high sensitivity and specificity, making them attractive for environmental monitoring and medical diagnostics. The next wave of commercial sensor modules is expected to offer real-time detection of gases, biomolecules, and pollutants with miniaturized footprints, in line with the global push for smart and connected devices.

In the realm of optical communications, pigment-treated graphene is opening pathways for ultra-broadband modulators and photonic switches. Organizations such as Huawei Technologies are investing in graphene-based photonic integrated circuits (PICs) where pigment functionalization enables wavelength-specific absorption and nonlinear optical effects. These properties are critical for meeting the escalating data transmission demands of 5G/6G networks and future quantum communication infrastructures. The next few years are projected to see pilot deployments of graphene-enhanced optical transceivers, with pigment treatments further optimizing bandwidth and energy efficiency.

Looking ahead, industry collaborations and standardization efforts—spearheaded by groups like Graphene Flagship—are expected to accelerate the adoption of pigment-treated graphene photonics. As fabrication processes mature and pigment integration becomes more controllable, the technology is set to underpin a range of commercial products, from ultra-high-resolution displays to compact, multi-analyte sensors and ultra-fast optical network components.

Competitive Landscape: Innovation Pipelines and Strategic Alliances

The competitive landscape for pigment-treated graphene photonics in 2025 is defined by rapid innovation, active patenting, and a surge in strategic alliances across the photonics, advanced materials, and display industries. Companies are leveraging novel pigment-functionalization techniques to address longstanding challenges in graphene photonic devices, such as spectral selectivity, color tunability, and stability. The sector is witnessing active collaborations between graphene manufacturers, pigment specialists, and end-users in optoelectronics and sensing.

-

Innovation Pipelines:

Several key players are investing in R&D pipelines focused on pigment-treated graphene. For instance, Vorbeck Materials has expanded its graphene platform to include pigment integration for photonic and display applications, targeting tunable color filters and flexible displays. Graphenea is advancing pigment-modified graphene inks suitable for printed photonic circuitry, aiming to achieve enhanced wavelength specificity and environmental robustness. -

Strategic Alliances:

Partnerships between pigment manufacturers and graphene producers are accelerating commercialization. First Graphene has announced joint development agreements with pigment specialists to co-develop graphene-pigment nanocomposites for anti-counterfeiting photonic tags and sensors. Similarly, Oxford Instruments is collaborating with photonics integrators to incorporate pigment-treated graphene layers into next-generation optical modulators and detectors. -

IP and Standardization:

Patent filings in pigment-functionalized graphene photonics have increased, with major filings focusing on pigment dispersion stability and interfacial engineering for enhanced optical response. Industry consortia, such as those coordinated by Graphene Flagship, are facilitating pre-competitive research and establishing standards to streamline material compatibility and device integration. -

Commercial Deployments:

In 2025, initial commercial deployments are emerging in flexible displays and smart packaging. Samsung Electronics has disclosed ongoing prototyping of pigment-treated graphene-based color filters for advanced OLED displays, aiming for superior energy efficiency and broader color gamut. Meanwhile, Nippon Paint Holdings is testing pigment-graphene coatings with photonic response for interactive packaging and security labeling. -

Outlook:

Over the next few years, the industry is expected to see further consolidation, with vertical integration of pigment and graphene supply chains. Strategic alliances with device OEMs and material suppliers will be vital to accelerate scale-up. Device-specific pigment-graphene formulations, enabled by joint R&D and IP pooling, are projected to enter mass production by the late 2020s.

Manufacturing Challenges & Solutions: Scaling Pigment-Treated Graphene

Scaling the manufacturing of pigment-treated graphene for photonics applications is a multifaceted challenge, centered on integrating pigment functionalization steps into established graphene production pipelines while maintaining the requisite material purity, uniformity, and optoelectronic performance. As of 2025, leading graphene material producers are investing in both process optimization and equipment upgrades to address these hurdles.

A primary challenge is the controlled, large-scale deposition or covalent bonding of pigment molecules onto graphene sheets without introducing defects that compromise photonic performance. Companies such as Graphenea have highlighted the need for in-line quality control systems, leveraging advanced Raman spectroscopy and in-situ optical monitoring, to ensure batch-to-batch consistency during pigment integration. Maintaining the monolayer or few-layer nature of graphene is also critical, as thicker films can dampen the unique light-matter interactions required for photonics devices.

Another bottleneck is the dispersion and stabilization of pigment-treated graphene in solution, which is crucial for scalable methods like inkjet printing and roll-to-roll coating. Efforts by Versarien plc and Directa Plus focus on surfactant engineering and post-processing annealing, which enhance both pigment adhesion and conductivity while minimizing aggregation. These companies report pilot-scale successes in producing printable graphene inks for optoelectronic device fabrication, suggesting that commercial volumes may be feasible by the late 2020s.

Supply chain management presents additional challenges, especially in sourcing high-purity pigments and ensuring their compatibility with graphene’s surface chemistry. To this end, First Graphene is collaborating with specialty pigment manufacturers to develop standardized pigment-graphene conjugates, aiming for plug-and-play materials suitable for diverse photonic device architectures.

Looking forward, automation and modularization of pigment treatment units are projected to play a significant role in scaling up. Oxford Instruments is developing modular CVD reactors equipped with integrated pigment delivery systems, allowing for rapid switching between pigment formulations and high-throughput production. Such innovations are expected to reduce costs and facilitate the customization required for next-generation photonic circuits and sensors.

In summary, while technical and supply chain challenges remain, intensive collaboration between graphene manufacturers, pigment suppliers, and equipment developers is accelerating progress toward scalable, high-quality production of pigment-treated graphene for photonics. With pilot-scale demonstrations underway and supply chain partnerships strengthening, commercial deployment in photonics could accelerate within the next few years.

Regulatory Landscape and Standardization Initiatives

The regulatory landscape for pigment-treated graphene photonics is rapidly evolving as the technology approaches broader commercial deployment in sectors such as optical communications, displays, and sensing. In 2025, regulatory frameworks focus on ensuring material safety, product reliability, and environmental compliance, while standardization initiatives are being spearheaded by several internationally recognized organizations to facilitate market adoption and interoperability.

At the materials level, pigment-treated graphene falls under the broader category of engineered nanomaterials. Regulatory agencies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are updating guidance on graphene and its composites, including pigmented variants. These agencies require manufacturers to submit detailed safety data concerning toxicity, occupational exposure, and end-of-life scenarios. In 2025, the EPA continues to revise its reporting requirements for new graphene-based materials under the Toxic Substances Control Act (TSCA), with additional emphasis on the influence of surface treatments, such as pigments, on material behavior and environmental impact.

From a photonics perspective, pigment-treated graphene must comply with standards related to optoelectronic device safety and performance. The International Organization for Standardization (ISO) Technical Committee 229 (Nanotechnologies) is collaborating with the International Electrotechnical Commission (IEC) TC 86 (Fibre optics) to develop harmonized standards for graphene-enabled photonics, covering characterization, labeling, and lifecycle assessment. In 2025, draft standards are under review that specifically address the optical and electrical properties of pigment-treated graphene films and their integration in photonic devices.

Industry-driven initiatives are also shaping the regulatory context. The Graphene Flagship continues to coordinate efforts among European stakeholders, issuing guidance on best practices for pigment integration, device qualification, and supply chain transparency. In Asia, the National Institute of Advanced Industrial Science and Technology (AIST) in Japan is collaborating with domestic manufacturers to align pigment-treated graphene standards with international benchmarks, ensuring global market compatibility.

Looking ahead, regulatory agencies are expected to increasingly require lifecycle assessments for pigment-treated graphene photonics, particularly regarding recyclability and safe disposal. Standardization bodies aim to finalize test protocols for optical performance and durability by 2026, supporting the transition of pigment-treated graphene photonics from pilot projects to mainstream commercial products. As the field matures, greater regulatory clarity and harmonized standards will be central to unlocking large-scale adoption and cross-border trade.

Regional Hotspots: Asia, Europe, and North America Market Dynamics

In 2025, the global market for pigment-treated graphene photonics is witnessing dynamic shifts, with Asia, Europe, and North America emerging as key regional hotspots. Each region features distinct drivers, investment patterns, and application focal points that shape the competitive landscape.

Asia—particularly China, South Korea, and Japan—remains at the forefront of graphene photonics commercialization. China’s national strategy for advanced materials, bolstered by significant funding and industrial policy, catalyzes rapid scaling of pigment-treated graphene for photonic devices including optical modulators and sensors. Companies such as China Electronics Technology Group Corporation and Huawei Technologies are investing in graphene-based optoelectronics to enhance datacenter and telecommunications infrastructure. South Korea’s Samsung SDI and LG Energy Solution are pursuing pigment-functionalized graphene for next-generation displays and energy-efficient smart windows, leveraging their expertise in materials science and flexible electronics.

Europe maintains momentum through collaborative research and early commercialization efforts. The Graphene Flagship, a pan-European initiative, continues to drive prototype developments for pigment-treated graphene in photonic applications, with pilot projects addressing broadband photodetectors and tunable lasers. Companies like Graphenea in Spain and AMS Technologies in Germany are supplying pigment-doped graphene sheets for photonic integration and providing custom solutions for European telecommunications and quantum technology sectors. This region benefits from strong public-private partnerships and regulatory support for sustainable, high-performance materials.

North America is marked by a robust innovation pipeline and venture-backed startups. The United States hosts a concentration of R&D in pigment-treated graphene, particularly for defense, aerospace, and medical photonics. Organizations such as Lockheed Martin and Raytheon Technologies are exploring these materials for lightweight sensing and secure optical communication. Meanwhile, Versarien (with US operations) and university spinouts are targeting pigment-enhanced graphene for integrated photonic chips and biosensors, aiming for commercial launches by 2026.

Across all three regions, 2025-2027 will likely see further scaling as fabrication challenges are addressed and application-driven partnerships form between material suppliers, device manufacturers, and end users. Despite different regulatory environments and commercial priorities, Asia, Europe, and North America are converging on pigment-treated graphene photonics as a cornerstone of next-generation technologies, with new pilot lines, supply agreements, and product launches expected throughout the next few years.

Future Outlook: Disruptive Trends and Investment Opportunities

Pigment-treated graphene photonics stands at the cusp of transformative growth, driven by surging investments in optoelectronics, advanced sensors, and display technologies. As we enter 2025, the convergence of pigment engineering and graphene nanomaterials is enabling new device architectures with enhanced optical tunability, color rendering, and energy efficiency. This synergy is particularly promising for applications in flexible displays, photodetectors, and next-generation communication systems.

Several industry leaders are expanding their material portfolios to include pigment-functionalized graphene. For example, Vorbeck Materials and Graphenax have reported ongoing research into pigment-treated graphene inks and films tailored for photonic and optoelectronic integration. These companies are targeting improved absorption spectra and tailored refractive indices, which are crucial for high-resolution imaging and tunable light modulation.

On the device side, Samsung Electronics continues to invest in graphene-based display technologies, exploring pigment treatment to enhance color vibrancy and reduce energy consumption in OLED and micro-LED panels. Similarly, Nokia is investigating the use of such materials within photonic integrated circuits, aiming to exploit graphene’s ultra-fast carrier mobility and the spectral selectivity imparted by pigment modification.

Emerging trends point to the integration of pigment-treated graphene in 2D material heterostructures, which can further boost nonlinear optical response and broaden the operational wavelength range. The European Union’s Graphene Flagship initiative is actively supporting collaborative projects focused on scalable manufacturing of these hybrid materials for photonic and optoelectronic markets.

Investment opportunities are expected to proliferate as the supply chain matures. Equipment suppliers such as Oxford Instruments are developing deposition and patterning systems compatible with pigment-graphene nanocomposites. Startups focusing on specialty inks, printable photonic circuits, and biosensing solutions are attracting early-stage funding, especially in Asia and Europe, where government-backed innovation programs are driving commercialization.

Looking ahead to the next several years, pigmented graphene photonics is projected to disrupt legacy markets and enable new business models. Key growth sectors include smart wearables, augmented reality optics, and secure optical communications. Market adoption will hinge on continued advances in scalable synthesis, pigment compatibility, and device reliability. Strategic alliances among material suppliers, device manufacturers, and end-users will be critical in moving from laboratory breakthroughs to real-world deployment.

Sources & References

- Versarien plc

- Thorlabs

- Nokia

- Directa Plus

- innovation program

- Cambridge Graphene Centre

- Fraunhofer IPMS

- ams OSRAM

- Huawei Technologies

- First Graphene

- Oxford Instruments

- Nippon Paint Holdings

- European Chemicals Agency (ECHA)

- International Organization for Standardization (ISO) Technical Committee 229

- National Institute of Advanced Industrial Science and Technology (AIST)

- China Electronics Technology Group Corporation

- AMS Technologies

- Lockheed Martin

- Raytheon Technologies

- Oxford Instruments