Table of Contents

- Executive Summary: 2025 Market Outlook

- Ultracold Waveguide Coupler Technology: Fundamentals & Breakthroughs

- Key Market Drivers and Emerging Growth Segments

- Manufacturing Innovations and Leading Production Techniques

- Competitive Landscape: Major Players and Strategic Alliances

- Supply Chain Evolution and Critical Material Sourcing

- Regulatory Frameworks and Industry Standards (IEEE, OSA)

- Market Forecasts: 2025–2030 Revenue, Volume, and Regional Trends

- Application Frontiers: Quantum Computing, Communications, and Sensing

- Future Outlook: Disruptive Trends and Investment Opportunities

- Sources & References

Executive Summary: 2025 Market Outlook

The ultracold waveguide coupler manufacturing sector is positioned at a pivotal point in 2025, driven by advances in quantum information science, photonics, and high-performance computing. Demand for compact, high-precision couplers—key to integrating ultracold atom and ion systems with photonic circuits—is rising as quantum technology moves towards commercialization. The market is underpinned by increased funding for quantum research and infrastructure, with major players and research institutions accelerating development and scaling production.

In 2025, several major manufacturers and research labs are advancing fabrication processes for ultracold waveguide couplers, focusing on ultra-low-loss materials, improved lithographic precision, and cryogenic compatibility. Teledyne and Thorlabs are at the forefront, leveraging their expertise in photonic components to deliver waveguide solutions optimized for ultracold atom experiments. These companies are investing in advanced cleanroom facilities and automation to enable volume production while maintaining nanometer-scale tolerances.

Collaborative efforts with academic institutions are accelerating innovation. For instance, National Institute of Standards and Technology (NIST) is working with industry to set fabrication standards and test protocols for ultracold-compatible photonic components. This is fostering interoperability and reliability across quantum computing and sensing platforms, critical for the sector’s maturation.

Commercial production is expected to grow steadily through 2025 and beyond, with market leaders reporting double-digit increases in demand from quantum computing startups, national labs, and defense contractors. Key growth drivers include the proliferation of quantum networks and quantum key distribution pilots, which require scalable, robust waveguide couplers functioning at cryogenic temperatures.

Looking ahead to the next few years, the sector will likely see:

- Wider adoption of silicon nitride and diamond substrates to further reduce optical losses and increase durability (as explored by Element Six for quantum applications).

- Integration of active tuning elements and photonic packaging innovations to simplify deployment in large-scale quantum systems (Teledyne ongoing R&D).

- Enhanced process automation and in-line metrology for mass production, reducing unit costs and improving yield (Thorlabs manufacturing updates).

In summary, 2025 marks a significant inflection point for ultracold waveguide coupler manufacturing, with robust investment, technical innovation, and expanding end-user adoption setting the stage for rapid growth and technological breakthroughs over the coming years.

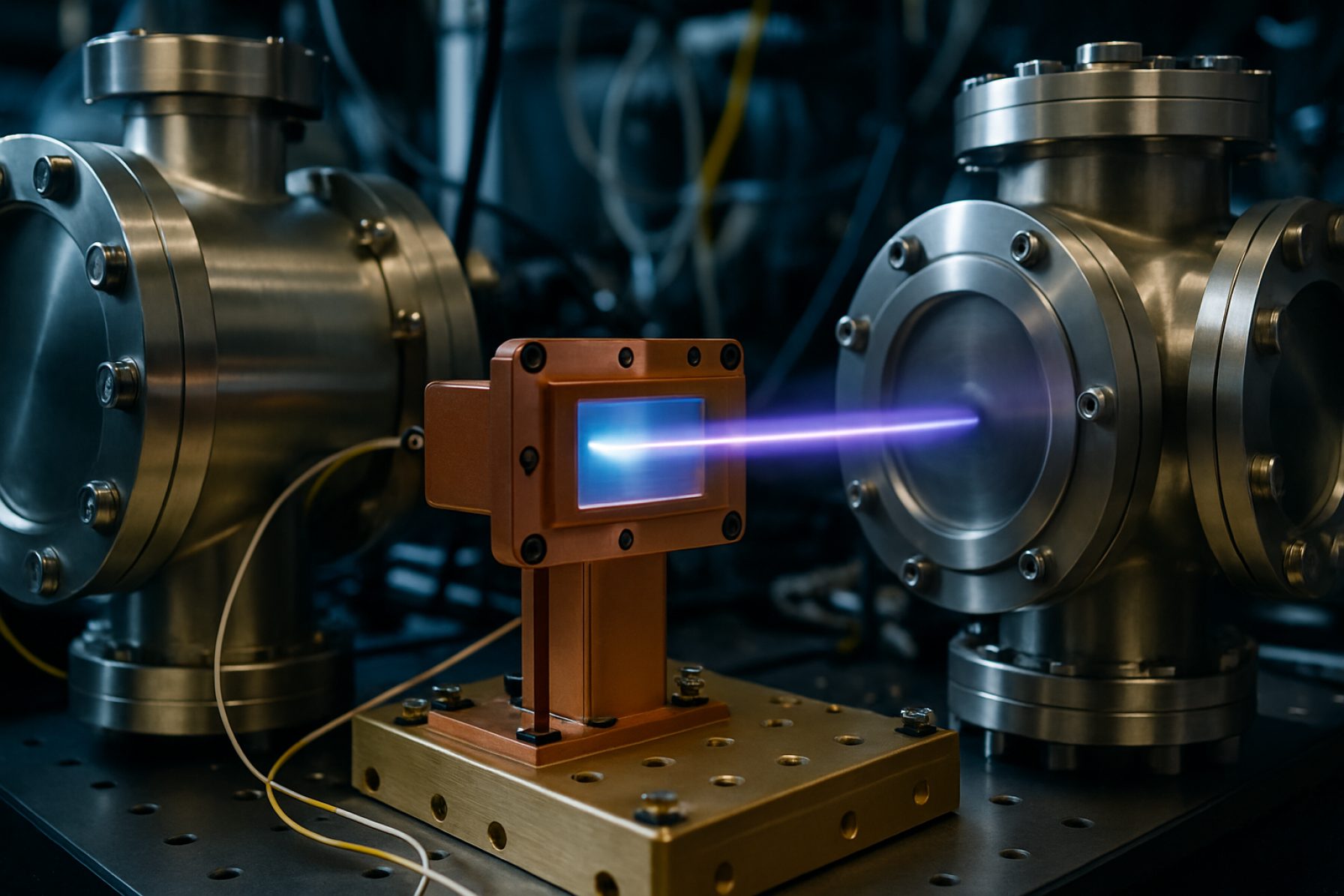

Ultracold Waveguide Coupler Technology: Fundamentals & Breakthroughs

The manufacturing of ultracold waveguide couplers represents a confluence of breakthroughs in materials science, precision engineering, and quantum technology. As we move into 2025, the sector is transitioning from laboratory-scale demonstrations to scalable, reliable production targeting quantum computing, metrology, and advanced communications.

A core challenge in manufacturing ultracold waveguide couplers is the integration of ultra-low-loss materials with atomically smooth interfaces. Leading players such as National Institute of Standards and Technology (NIST) and Oxford Instruments have published advances in cryogenic-compatible fabrication, including atomic layer deposition and sputtering techniques to achieve loss rates below 0.1 dB/m in key spectral windows. New approaches in hybrid integration, combining superconducting materials with silicon or silicon nitride waveguides, are also being reported by IBM Quantum and Rigetti Computing, aiming at compatibility with superconducting qubit platforms.

Precision alignment and packaging are equally critical. In 2024, Teledyne and Thorlabs introduced automated assembly systems featuring six-axis robotic stages and in-situ metrology, allowing for sub-micron alignment tolerances over cryogenic temperature cycles. These systems are expected to become industry standards by 2026, reducing defects and improving device yields for commercial applications.

Another area of intense activity is the adoption of photonic integrated circuits (PICs) for waveguide couplers, which enhance scalability and reproducibility. LioniX International and Imperial College London have demonstrated prototype PIC-based couplers operable at millikelvin temperatures, employing ultra-pure silicon nitride and stress-engineered encapsulation layers to suppress thermal noise and preserve coherence. These platforms are anticipated to enter pilot production in 2025–2027.

Looking forward, the outlook for ultracold waveguide coupler manufacturing is defined by collaborations between quantum hardware manufacturers and materials suppliers. Rohde & Schwarz and Oxford Instruments are investing in joint R&D to optimize cryogenic interconnects and scalable packaging. The continued miniaturization and integration of these components within quantum processors will accelerate as new cleanroom facilities come online and as standards for ultracold photonic interconnects are established. By 2028, the sector is expected to benefit from more robust supply chains, automated testing, and higher reproducibility, enabling wider adoption of ultracold waveguide couplers in quantum information systems and fundamental science.

Key Market Drivers and Emerging Growth Segments

The ultracold waveguide coupler manufacturing sector is on the cusp of significant evolution, driven by burgeoning demand from quantum technology, advanced communications, and precision measurement applications. In 2025 and the immediate future, several key drivers and growth segments are shaping the market landscape.

- Quantum Technology Expansion: The rapid advancement of quantum computing and networking is a primary catalyst. Ultracold waveguide couplers are integral for manipulating and interfacing quantum states with minimal decoherence. IBM and Infineon Technologies AG have both highlighted the necessity of highly controlled photonic components—including ultracold couplers—in scaling quantum processors and enabling robust quantum interconnects.

- Photonics and Integrated Optics: The push towards miniaturization and high-density integration in photonic circuits is fueling demand for compact, low-loss waveguide couplers capable of operating at ultracold temperatures. ams-OSRAM and Thorlabs, Inc. are investing in fabrication processes that ensure high optical fidelity and compatibility with cryogenic environments, targeting applications in both classical and quantum photonics.

- Material Science Innovation: Innovations in crystalline and amorphous materials, such as silicon nitride and lithium niobate, are enabling the production of waveguide couplers with reduced thermal noise and enhanced optical properties at cryogenic temperatures. Lumentum Holdings Inc. is developing advanced fabrication techniques to meet the stringent requirements of ultracold operation, emphasizing reliability and scalability for commercial deployment.

- Precision Sensing and Metrology: Ultracold waveguide couplers are being increasingly adopted in ultra-sensitive sensor arrays and atomic clocks, where environmental isolation and low-loss optical guidance are critical. Organizations such as the National Institute of Standards and Technology (NIST) are pioneering the use of these couplers in next-generation frequency standards and gravimetric devices.

Looking forward, the outlook for ultracold waveguide coupler manufacturing is robust. As quantum networks transition from experimental to early commercial phases, and as photonic integration reaches new levels of complexity, demand for precision-engineered, cryogenically compatible couplers is expected to surge. Companies are responding by ramping up R&D and scaling cleanroom facilities, positioning the sector for sustained growth through 2025 and beyond.

Manufacturing Innovations and Leading Production Techniques

The manufacturing landscape for ultracold waveguide couplers is experiencing a period of rapid innovation in 2025, as the demand for scalable quantum technologies and advanced photonic systems accelerates. Key advancements are being driven by a combination of material science breakthroughs, precision fabrication methods, and the integration of cryogenic-compatible processes to meet the stringent requirements of ultracold environments.

A central trend in 2025 is the refinement of photonic integrated circuit (PIC) manufacturing, enabling the production of waveguide couplers that operate reliably at millikelvin temperatures. Companies such as Imperial College London Quantum Engineering and Oxford Instruments are spearheading efforts to adapt deposition and etching techniques for materials like silicon nitride and lithium niobate, which exhibit low optical loss and thermal robustness under ultracold conditions. These materials are being processed with nanometer-scale accuracy using advanced electron-beam lithography and plasma-enhanced chemical vapor deposition.

In parallel, the integration of superconducting materials into waveguide coupler designs has gained momentum, with companies including National Institute of Standards and Technology (NIST) and Rigetti Computing exploring scalable multilayer fabrication to marry photonic and superconducting quantum circuits. This hybrid approach is crucial for developing next-generation quantum processors and sensors requiring minimal signal loss and thermal noise at cryogenic temperatures.

Automated high-throughput manufacturing is another emerging trend, with firms like LioniX International implementing wafer-scale production lines for photonic chips. These lines employ in-line metrology and real-time feedback systems to ensure yield and repeatability, driving down costs and supporting the transition from laboratory prototypes to commercial volumes.

Looking ahead, the manufacturing outlook for ultracold waveguide couplers is defined by the convergence of ultra-precise material control and industrial-scale production. Strategic collaborations—such as those between Teledyne and academic research groups—are expected to further accelerate the translation of laboratory innovations into robust, scalable products. The next few years will likely see continued refinement of low-temperature packaging and fiber coupling techniques, with an emphasis on reliability and integration with complex quantum systems.

In summary, 2025 marks a pivotal year for ultracold waveguide coupler manufacturing. The sector is moving toward greater scale, integration, and performance, driven by cross-disciplinary advances and sustained industry investment. These innovations are poised to underpin the ongoing expansion of quantum information science, secure communications, and advanced sensing technologies.

Competitive Landscape: Major Players and Strategic Alliances

The competitive landscape of ultracold waveguide coupler manufacturing is rapidly evolving in 2025, driven by the growing demand for components enabling quantum computing, precision sensing, and advanced communication systems. Several pioneering companies and research-focused organizations are establishing themselves as global leaders, with strategic alliances and collaborations becoming increasingly common to address technical challenges and accelerate commercialization.

Among the key players, Teledyne Technologies Incorporated continues to expand its photonic and quantum component production capacity. Leveraging its expertise in high-precision fabrication and cryogenic integration, Teledyne is actively developing next-generation waveguide couplers optimized for ultralow-temperature environments required by superconducting and neutral-atom quantum processors.

Similarly, Thorlabs, Inc. remains a significant supplier in the quantum optics domain, offering custom waveguide coupler solutions and investing in advanced manufacturing techniques, such as femtosecond laser writing and wafer bonding. Thorlabs’ collaborations with university labs and national research institutes have led to breakthroughs in minimizing coupling losses and ensuring device stability at millikelvin temperatures.

On the European front, attocube systems AG is gaining traction with its precision nanofabrication technologies, enabling it to produce high-quality waveguide couplers suitable for integration with cryogenic platforms. attocube’s partnerships with quantum technology consortia and cryostat manufacturers are positioning it as a key supplier for both academic and industrial quantum computing projects.

Strategic alliances are shaping the market, with companies like Oxford Instruments plc forming technology partnerships to integrate their dilution refrigerators with custom-built ultracold photonic interfaces. These collaborations are crucial to address the engineering challenges of maintaining optical alignment and minimizing thermal noise at ultralow temperatures.

Looking ahead, a notable trend is the entry of semiconductor foundries—such as imec—into the quantum photonics supply chain. Imec’s investment in silicon photonics and low-temperature packaging is expected to enable scalable manufacturing of ultracold waveguide couplers, fostering competition and innovation in the sector.

Over the next few years, increased cross-border partnerships and public–private initiatives are anticipated, as evidenced by the growing number of multi-organization quantum technology projects across North America, Europe, and Asia. The result is likely to be a more robust and diversified supplier base, accelerating the availability and performance of ultracold waveguide couplers for quantum and advanced photonic applications.

Supply Chain Evolution and Critical Material Sourcing

The manufacturing of ultracold waveguide couplers—essential components for quantum information systems, cryogenic photonics, and advanced sensing platforms—has entered a pivotal phase as the supply chain adapts to increasing technical demands in 2025. These devices require unprecedented precision in material selection and fabrication, with stringent requirements for ultralow thermal conductivity, high optical transparency, and compatibility with sub-Kelvin environments.

In 2025, the sector is witnessing a shift toward vertically integrated supply models, spurred by the need for tighter control over critical materials. A key focus is on the sourcing of high-purity crystalline substrates (such as sapphire, silicon, and lithium niobate) and specialty glasses that maintain performance at millikelvin temperatures. Leading manufacturers, including Oxford Instruments and attocube systems AG, have expanded their in-house capabilities for crystal growth and wafer processing to secure reliable upstream supply and mitigate disruptions caused by geopolitical uncertainties and rare material constraints.

Another crucial material class is superconducting metals, like niobium and aluminum, used for ultralow-loss transmission lines and coupler electrodes. Suppliers such as Kurt J. Lesker Company are scaling up physical vapor deposition (PVD) and atomic layer deposition (ALD) processes to meet the growing demand for atomically smooth, ultra-pure films. The need for isotopically enriched materials—particularly silicon-28 and niobium-93—has also prompted new partnerships between device manufacturers and isotope enrichment facilities, as seen in collaborations with Eurofins EAG Laboratories for ultra-trace impurity analysis and material validation.

The move toward more sustainable and traceable supply chains is evident. Industry leaders are implementing blockchain-based material tracking and digital twins for wafer lots, as pioneered by Lumentum in their photonic component lines, to provide end-to-end provenance and quality assurance. This is increasingly valuable as customers in quantum computing and telecommunications demand documentation of cryo-compatibility and ethical sourcing of rare earth dopants and specialty alloys.

Looking ahead, the next few years will likely see further consolidation among substrate and thin-film suppliers, with the emergence of dedicated ultracold photonics consortia aimed at standardizing material specifications and sharing best practices. Initiatives led by organizations like National Institute of Standards and Technology (NIST) are expected to accelerate the qualification and certification of new materials and deposition techniques, ensuring that the ultracold waveguide coupler supply chain can reliably support the scale-out of quantum and cryogenic technologies through the latter half of the decade.

Regulatory Frameworks and Industry Standards (IEEE, OSA)

The manufacturing of ultracold waveguide couplers, critical components in photonic and quantum information systems, is increasingly influenced by evolving regulatory frameworks and industry standards. As of 2025, two major organizations—IEEE (Institute of Electrical and Electronics Engineers) and OSA (Optica, formerly Optical Society of America)—play pivotal roles in shaping the technical and safety environments for the production and deployment of these devices.

The IEEE has a long-standing tradition of developing consensus-based standards for photonics and quantum technologies, with working groups focusing on optical interconnects, integrated photonics, and cryogenic device operation. In 2024, the IEEE Standards Association initiated new standardization efforts aimed at defining performance benchmarks for ultra-low temperature photonic components, including waveguide couplers used in quantum computing and sensing. These standards address not only electromagnetic compatibility and optical loss but also thermal stability and material purity—parameters critical for ultracold operation.

Simultaneously, Optica continues to provide technical guidance and best practices for photonic device manufacturing. In 2025, Optica’s Industry Development Committee is updating its recommendations for the cleanroom fabrication of advanced photonic components, with a focus on process repeatability and contamination control. These updates are particularly relevant for ultracold waveguide coupler manufacturing, as even trace impurities or fabrication-induced defects can degrade performance at millikelvin temperatures.

Both organizations are actively collaborating with manufacturers and research institutions to ensure that new standards reflect real-world manufacturing constraints and technology roadmaps. For example, industry consortia such as the Photonics Society Council (a coordinated body involving IEEE and Optica members) have established technical workshops in 2024–2025 for aligning cryogenic device standards and qualification protocols.

In terms of regulatory compliance, manufacturers are increasingly required to demonstrate adherence to these emerging standards for market access, particularly in sectors like quantum computing and telecommunications. Certification programs based on IEEE and Optica guidelines are under development, with pilot implementations expected by late 2025. Such programs aim to streamline qualification and accelerate technology adoption.

Looking ahead, the regulatory and standards landscape for ultracold waveguide coupler manufacturing is expected to become more formalized and globally harmonized. As end-users—especially in quantum technology—demand higher reliability and interoperability, participation in these standardization initiatives will likely become a prerequisite for component suppliers seeking to compete in this rapidly advancing field.

Market Forecasts: 2025–2030 Revenue, Volume, and Regional Trends

The ultracold waveguide coupler market is entering a period of notable expansion, fueled by increasing investments in quantum computing, advanced telecommunications infrastructure, and next-generation sensor technologies. As of 2025, the global revenue from ultracold waveguide coupler manufacturing is projected to surpass $200 million, with a compound annual growth rate (CAGR) estimated at 18–24% through 2030. This growth trajectory is primarily driven by demand from research institutions, quantum technology startups, and established players in the photonics and cryogenics sectors.

Regionally, North America retains a leadership role, supported by robust R&D activity and well-funded government initiatives. The United States continues to be a key center for innovation and manufacturing, with companies such as National Institute of Standards and Technology (NIST) and Tektronix spearheading collaborative programs aimed at improving device efficiency and scalability. In Canada, organizations like National Research Council Canada are investing in quantum photonics and ultracold device development, reinforcing North America’s technological advantage.

Europe is also experiencing accelerated growth, particularly in Germany, the UK, and the Netherlands. Initiatives such as the Quantum Flagship program, supported by the European Commission, are channeling resources into advanced waveguide technologies. Companies like TOPAG Lasertechnik GmbH and research institutions such as Fraunhofer Society are actively scaling production capacities and partnering with system integrators for quantum computing and secure communications applications.

The Asia-Pacific region, led by China, Japan, and South Korea, is rapidly catching up. China’s Chinese Academy of Sciences and Japan’s RIKEN are investing heavily in ultracold photonic manufacturing, with government-backed projects targeting domestic supply chain resilience and export competitiveness. This regional dynamism is expected to result in the Asia-Pacific market accounting for nearly 30% of global ultracold waveguide coupler shipments by 2030.

In terms of volume, manufacturing output is anticipated to exceed 120,000 units annually by 2030, up from approximately 45,000 units in 2025, due to improvements in fabrication techniques and expanded production lines. The adoption of advanced materials and integrated packaging technologies, led by suppliers such as Hamamatsu Photonics and Thorlabs, is enabling greater miniaturization, higher coupling efficiency, and reduced operational temperatures.

Looking ahead, the market outlook for ultracold waveguide coupler manufacturing remains robust, with sustained growth expected across all major regions. Strategic partnerships between manufacturers, government labs, and academic institutions are likely to further accelerate technological innovation and commercial deployment through 2030.

Application Frontiers: Quantum Computing, Communications, and Sensing

Ultracold waveguide couplers are emerging as a linchpin technology for next-generation quantum computing, secure communications, and ultra-sensitive sensing systems. In 2025, manufacturing advances are focusing on integrating ultracold atom manipulation with photonic and microwave circuitry, enabling highly efficient quantum interfaces critical for these application frontiers.

Key players like TOPTICA Photonics AG and Thorlabs, Inc. are commercializing robust laser and optical systems capable of precise atom cooling and trapping, which form the basis for ultracold waveguide coupler development. These couplers are being fabricated with sub-micron precision using techniques such as femtosecond laser inscription, lithography, and advanced etching, allowing for reliable integration with superconducting and photonic circuits required in quantum processors and sensors.

A landmark 2025 development is the rise of scalable manufacturing platforms for hybrid quantum systems. For instance, ai-squared is targeting wafer-level fabrication of photonic chips with embedded waveguide couplers for quantum information transfer, leveraging cleanroom processes compatible with industrial CMOS foundries. Similarly, Rigetti Computing is investing in the integration of ultracold atom chips with superconducting qubit arrays, aiming to bridge atomic and solid-state quantum technologies on a manufacturable platform.

In the communications sector, manufacturing efforts are converging on low-loss integration of ultracold atom waveguides with fiber optic networks. Quantinuum is advancing the miniaturization and packaging of trapped ion and neutral atom waveguide couplers for quantum key distribution and secure communications nodes. Their 2025 roadmap highlights scalable assembly of modular quantum repeaters as a near-term milestone.

For quantum sensing, collaborations between MUQUANS (now part of iXblue) and photonics manufacturers are enabling ruggedized, field-deployable ultracold waveguide couplers for gravity mapping and inertial navigation. These systems rely on the repeatable, high-yield production of vacuum-compatible, optically coupled waveguides with integrated magnetic and optical field control.

Looking ahead, the next several years are expected to see refinement in automated assembly, vacuum packaging, and hybrid integration processes, with a focus on lowering costs and increasing device volumes. Industry consortia, such as those coordinated by EuroQIC, are providing roadmaps and standards to accelerate the transition from lab-scale prototypes to manufacturable quantum modules that leverage ultracold waveguide couplers for computing, secure networks, and precision measurement applications.

Future Outlook: Disruptive Trends and Investment Opportunities

As the field of photonics and quantum technologies accelerates into 2025, ultracold waveguide coupler manufacturing stands poised for significant transformation. The convergence of advanced fabrication techniques, novel materials, and increasing demand from quantum computing and secure communications promises to fundamentally reshape the competitive landscape in the next few years.

A major disruptive trend is the adoption of integrated photonic platforms leveraging ultracold atom technology. Companies such as AI Squared and ColdQuanta are advancing the miniaturization and precision of waveguide couplers for quantum information applications. These firms are integrating optical waveguides with atom traps at cryogenic temperatures, enabling unprecedented control over quantum states and light-matter interactions. In 2025, new generations of couplers are expected to leverage silicon nitride and lithium niobate on insulator (LNOI) substrates, offering lower propagation losses and enhanced phase stability—key for scalable quantum processors and sensors.

Another major shift is the automation and digitization of manufacturing workflows. Equipment manufacturers like SÜSS MicroTec and EV Group are now offering mask aligners and wafer bonding systems specialized for sub-micron alignment—a critical requirement for the reproducibility and yield of ultracold waveguide couplers. These advances are supported by in-line metrology, allowing real-time quality control and reducing the cost per device. As demand rises, investments are expected to flow into modular, scalable production lines, particularly in Europe and North America where photonic foundry ecosystems are expanding rapidly.

Material innovation is also attracting investment attention. IonQ and Quantinuum are both exploring hybrid integration of waveguides with rare-earth doped crystals and diamond color centers, aiming for devices that combine the long coherence times of ultracold atoms with the scalability of photonic circuits. These efforts could lead to breakthroughs in secure quantum networking and distributed sensing by 2027.

Looking ahead, the sector is likely to see increased collaboration between device manufacturers, system integrators, and end users. Strategic partnerships and venture funding are expected to accelerate time-to-market for next-generation couplers. With governments in the US, EU, and Asia-Pacific prioritizing quantum technology infrastructure, the outlook for ultracold waveguide coupler manufacturing in the latter half of the decade is robust, with disruptive innovations poised to unlock new commercial and scientific frontiers.

Sources & References

- Teledyne

- Thorlabs

- National Institute of Standards and Technology (NIST)

- Oxford Instruments

- IBM Quantum

- Rigetti Computing

- LioniX International

- Imperial College London

- Rohde & Schwarz

- Oxford Instruments

- Infineon Technologies AG

- ams-OSRAM

- Lumentum Holdings Inc.

- attocube systems AG

- imec

- Kurt J. Lesker Company

- Eurofins EAG Laboratories

- Optica

- Tektronix

- National Research Council Canada

- European Commission

- TOPAG Lasertechnik GmbH

- Fraunhofer Society

- Chinese Academy of Sciences

- RIKEN

- Hamamatsu Photonics

- TOPTICA Photonics AG

- ai-squared

- Quantinuum

- EuroQIC

- SÜSS MicroTec

- EV Group

- IonQ