Table of Contents

- Executive Summary: Key Insights & Growth Catalysts

- Global Market Size & 2025–2030 Forecasts

- Emerging Applications in Medical, Space, and Security Sectors

- Technological Innovations: Detectors, Materials, and Imaging Algorithms

- Major Manufacturers and Supply Chain Developments

- Competitive Landscape: Partnerships, M&A, and New Entrants

- Regulatory Trends and Industry Standards

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges: Production Bottlenecks, Costs, and Scalability

- Future Outlook: Disruptive Trends and Investment Opportunities

- Sources & References

Executive Summary: Key Insights & Growth Catalysts

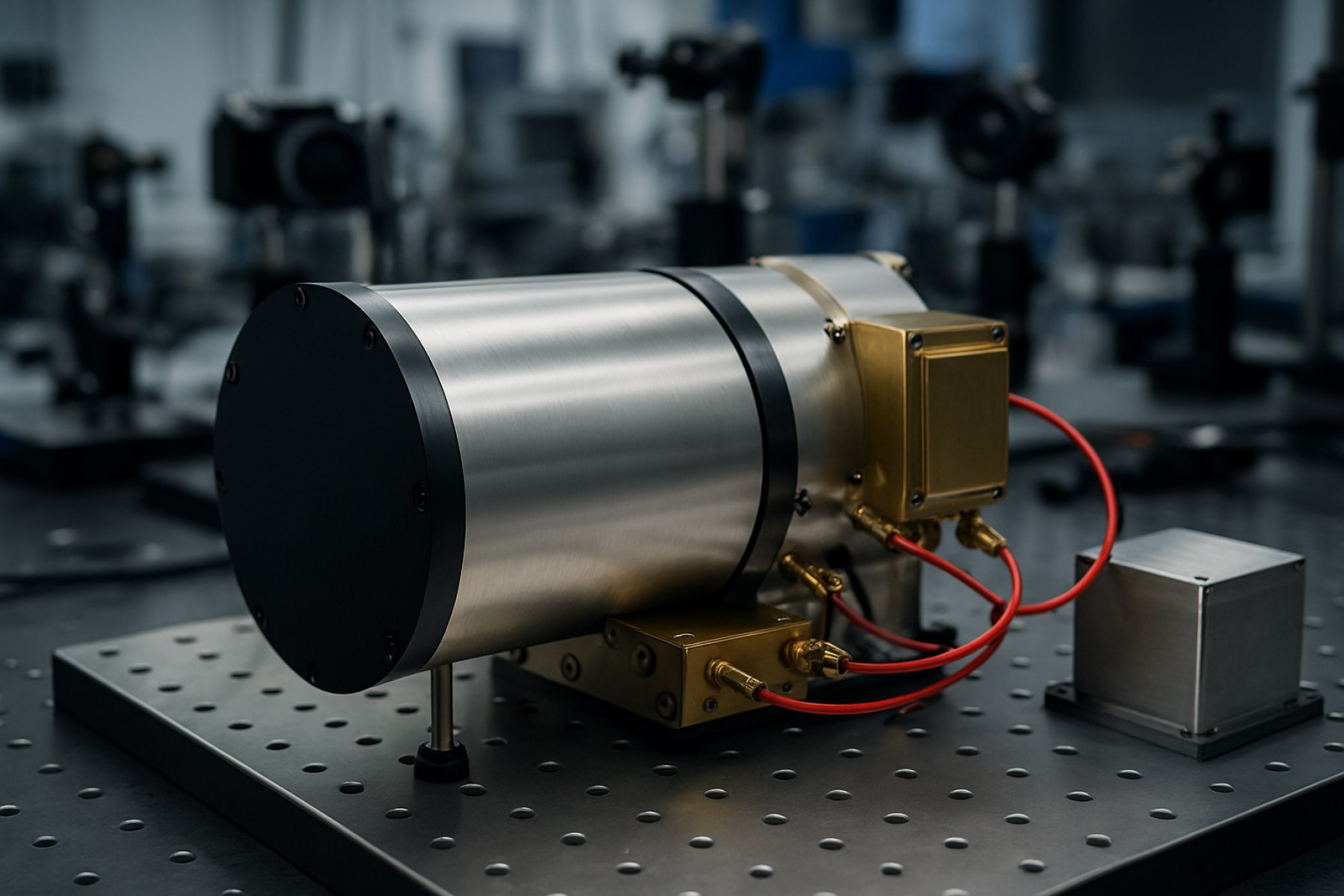

The global landscape of gamma-ray imaging spectrometers manufacturing is entering a dynamic phase in 2025, driven by advances in semiconductor detector materials, increased demand in medical diagnostics, nuclear safety, and astrophysical research, and the integration of digital electronics for enhanced imaging fidelity. Key manufacturers are accelerating innovation cycles to meet both performance and regulatory requirements, with particular momentum observed in Europe, North America, and East Asia.

One of the core growth catalysts is the transition towards cadmium zinc telluride (CZT) and high-purity germanium (HPGe) detectors, which offer superior resolution and efficiency compared to traditional scintillator-based systems. Companies such as Kromek Group plc and Amptek Inc. are actively expanding their CZT-based gamma spectrometer lines, targeting both portable and stationary applications for homeland security and medical imaging. In parallel, Mirion Technologies is leveraging proprietary HPGe crystal growth and packaging technologies to supply high-throughput spectrometers for nuclear facility monitoring and radiopharmaceutical quality control.

Automation and modularity are shaping manufacturing processes, enabling reduced production costs and faster customization. RITEC and Radiation Detection Technologies, Inc. have introduced modular detector architectures and scalable assembly lines, facilitating rapid adaptation to fluctuating project volumes and evolving end-user requirements.

Strategic collaborations between manufacturers and research institutions are further catalyzing innovation. For example, Hexagon Manufacturing Intelligence has partnered with academic consortia to integrate advanced digital signal processing in spectrometer modules, improving real-time imaging and analytics for environmental monitoring and nuclear decommissioning.

Looking ahead to the next few years, the sector is poised for robust growth, buoyed by expanding regulatory mandates for nuclear safety and the proliferation of precision medicine. The European Union’s continued investment in radiological monitoring infrastructure and the United States’ funding for advanced diagnostic devices are expected to stimulate procurement and R&D. Additionally, the miniaturization of gamma-ray imaging spectrometers—exemplified by recent prototypes from Kromek Group plc—will enable broader deployment in field operations and point-of-care diagnostics.

In summary, 2025 marks a pivotal year for gamma-ray imaging spectrometers manufacturing. The confluence of material science innovation, digital integration, and market-driven customization is set to propel both technological sophistication and commercial adoption, with leading manufacturers strategically positioned to capitalize on these trends.

Global Market Size & 2025–2030 Forecasts

The global market for gamma-ray imaging spectrometers is poised for significant growth between 2025 and 2030, driven by advancements in detector technology, expanding applications in medical imaging, nuclear security, and astrophysics, and increasing investments in high-energy physics research. In 2025, the market is characterized by a robust presence of established manufacturers and emerging players, with a focus on improving detection efficiency, energy resolution, and portability of spectrometer systems.

Currently, leading manufacturers such as Amptek, Inc., Mirion Technologies (Canberra), and HORIBA Scientific dominate the landscape, supplying advanced gamma-ray spectrometers for industrial, medical, and scientific use. These companies emphasize R&D into semiconductor materials, particularly Cadmium Zinc Telluride (CZT) and High Purity Germanium (HPGe), to enhance device performance while reducing cooling requirements and system size.

The demand from the healthcare sector, specifically in positron emission tomography (PET) and single-photon emission computed tomography (SPECT), continues to fuel growth. In parallel, heightened global security concerns are stimulating procurement of portable and high-sensitivity gamma spectrometers for homeland security and nuclear non-proliferation efforts. For instance, Thermo Fisher Scientific has expanded its product line to address field-deployable solutions for radiation detection, while Kromek Group plc has reported increased orders for its handheld spectrometers from government agencies.

Between 2025 and 2030, the sector is expected to witness an annual growth rate in the range of 6–8%, according to projections from major industry suppliers. This is underpinned by ongoing international collaborations in space missions and nuclear science, such as those supported by organizations like European Space Agency and NASA, which rely on custom spectrometer systems for cosmic gamma-ray detection.

Looking ahead, manufacturers are investing in automated assembly processes and digital signal processing, aiming to reduce production costs and shorten lead times. The integration of artificial intelligence for real-time spectral analysis and the development of modular, scalable spectrometer platforms are anticipated to open new market opportunities, especially in emerging economies and remote monitoring scenarios.

In summary, the gamma-ray imaging spectrometers manufacturing market is set for steady expansion through 2030, shaped by technological innovation, regulatory drivers, and the diversification of end-user applications across global regions.

Emerging Applications in Medical, Space, and Security Sectors

Gamma-ray imaging spectrometers have long been critical tools in advanced detection across medical diagnostics, space missions, and security screening. As of 2025, the manufacturing landscape is witnessing a pronounced shift driven by innovations in materials, miniaturization, and application-specific customizations. These trends are fueling the expansion of gamma-ray spectrometer deployment in emerging fields.

In the medical sector, manufacturers are advancing spectrometer technology to enable higher-resolution imaging and more precise isotopic identification for nuclear medicine and oncology. Companies such as Siemens Healthineers and GE HealthCare are integrating advanced gamma-ray detectors into SPECT (Single Photon Emission Computed Tomography) systems. These systems increasingly rely on new scintillator materials—such as cadmium zinc telluride (CZT)—that allow for direct conversion of gamma photons, enabling more compact devices and improved energy discrimination. This is particularly relevant in the development of mobile and point-of-care imaging solutions, which are expected to grow in adoption through 2025 and beyond.

In the space sector, the demand for lightweight, robust, and high-sensitivity gamma-ray spectrometers is driving manufacturers to explore novel semiconductor materials and modular designs. Teledyne DALSA and Raytheon Technologies are notable for their work on spectrometers tailored for planetary exploration, solar monitoring, and cosmic event detection. For instance, NASA’s Artemis program and ongoing Mars missions necessitate spectrometers that can withstand harsh environments while providing real-time elemental analysis—requirements that are shaping manufacturing standards and pushing for further miniaturization and radiation-hardening of detectors. Continued investment in this area is expected as space exploration missions proliferate through the late 2020s.

Security applications, particularly in border control and cargo screening, are benefiting from advances in rapid, high-throughput gamma-ray imaging spectrometers. Rapiscan Systems and Smiths Detection have introduced systems capable of discriminating between benign and illicit materials based on isotopic signatures. These innovations are increasingly necessary as global trade recovers and regulatory requirements become more stringent. Manufacturers are focusing on automating threat detection and integrating artificial intelligence into gamma-ray spectrometer systems, a trend that is expected to accelerate into the next few years.

Looking forward, the gamma-ray imaging spectrometer manufacturing sector is poised for continued growth into the late 2020s, driven by cross-sectoral demand and rapid material science advances. Strategic collaborations between device manufacturers and end-user industries are likely to further refine applications and accelerate the pace of innovation.

Technological Innovations: Detectors, Materials, and Imaging Algorithms

Gamma-ray imaging spectrometers are at the forefront of technological innovation, driven by advancements in detector materials, fabrication techniques, and computational algorithms. In 2025, manufacturers are accelerating the development of new semiconductor crystals and hybrid detection architectures to improve energy resolution, sensitivity, and compactness.

A key trend is the transition from traditional scintillator-photomultiplier tube (PMT) systems to solid-state detectors, such as cadmium zinc telluride (CZT) and high-purity germanium (HPGe). RITEC and Kromek Group plc are prominent in providing CZT-based devices, which operate at room temperature and allow for compact, portable spectrometers. These materials enable multi-pixel, pixelated detector arrays, facilitating high-resolution gamma-ray imaging crucial for medical diagnostics, nuclear security, and industrial non-destructive testing.

On the fabrication front, companies like Mirion Technologies (Canberra) have implemented advanced crystal growth and wafer processing techniques to increase detector yield and uniformity. These processes are essential as the demand for large-area, high-performance detectors grows for applications such as environmental monitoring and space exploration.

Algorithmic developments are another area of rapid innovation. Manufacturers are incorporating machine learning and advanced image reconstruction techniques to enhance the interpretability of gamma-ray data. Siemens Healthineers is integrating AI-driven algorithms into their SPECT (Single Photon Emission Computed Tomography) platforms, improving spatial resolution and reducing scan times for clinical workflows. Similarly, GE HealthCare is investing in real-time processing and deep learning for detector calibration and noise reduction, supporting more accurate and efficient imaging.

Looking forward, the industry is expected to see further improvements in detector miniaturization and integration. Efforts are underway to combine gamma-ray spectrometry with complementary modalities such as positron emission tomography (PET) and optical imaging, leading to hybrid imaging systems. Manufacturers are also working to develop cost-effective, scalable production methods for next-generation materials, including perovskites and compound semiconductors, which could further enhance detector performance and accessibility.

As these innovations mature, gamma-ray imaging spectrometers are poised to become more versatile, precise, and accessible, expanding their impact across healthcare, security, and scientific research throughout 2025 and beyond.

Major Manufacturers and Supply Chain Developments

The global manufacturing landscape for gamma-ray imaging spectrometers has been experiencing significant advancements as of 2025, driven by both escalating demand from medical diagnostics, security, and nuclear industries, and the rapid evolution of semiconductor and scintillator material technologies. Key manufacturers such as Mirion Technologies (including their Canberra brand), AMETEK ORTEC, Kromek Group plc, and Teledyne Technologies have been actively expanding their production capabilities to meet market needs for higher-resolution, more portable, and increasingly automated spectrometers.

A marked trend in 2025 is the growing adoption of advanced materials, particularly Cadmium Zinc Telluride (CZT) detectors, which offer room-temperature operation and compact form factors. Kromek Group plc continues to scale up CZT detector production at its Sedgefield facility, targeting increased output for homeland security and medical imaging applications. Similarly, AMETEK ORTEC has invested in modernizing its Oak Ridge, Tennessee, manufacturing site, integrating automated inspection and assembly systems to enhance throughput and consistency.

Supply chain developments have been a focal point for manufacturers in 2024–2025, following disruptions in semiconductor supply and rare earth materials during the earlier years of the decade. Companies like Mirion Technologies have diversified their supplier base for critical components such as high-purity germanium (HPGe) crystals, while also pursuing vertical integration to secure long-term access to key detector materials. Teledyne Technologies has announced partnerships with specialty electronics and crystal growth firms to ensure stability in its detector production lines.

- Mirion Technologies has launched new product lines in 2025 aimed at laboratory and field applications, emphasizing modular designs and plug-and-play electronics for easier scaling and maintenance.

- Kromek Group plc reports increased export activity to Asia and North America, reflecting both market expansion and the company’s ability to maintain robust supply despite global logistics challenges.

- AMETEK ORTEC is piloting next-generation automated calibration systems to reduce production bottlenecks and improve device reliability.

Looking ahead, the outlook for gamma-ray imaging spectrometer manufacturing in the next few years is strongly positive, with companies prioritizing supply chain resilience, smart manufacturing, and continued R&D investments to support the integration of AI-driven analytics and wireless connectivity in their next-generation products. As regulatory standards and end-user expectations rise, leading manufacturers are expected to further innovate in both materials engineering and production process automation, enhancing both the performance and accessibility of gamma-ray spectrometry solutions worldwide.

Competitive Landscape: Partnerships, M&A, and New Entrants

The competitive landscape for gamma-ray imaging spectrometers manufacturing in 2025 is characterized by intensified consolidation, heightened R&D partnerships, and the emergence of new entrants, spurred by rising demand from medical imaging, security screening, and space exploration sectors. Established market leaders are increasingly leveraging mergers and acquisitions (M&A) to broaden their technology portfolios and global reach. In 2023, for example, Mirion Technologies completed its acquisition of the French firm CIRS, strengthening its position in advanced radiation detection and imaging solutions. Such moves underscore a broader trend toward vertical integration and capability expansion, especially as end-users seek more comprehensive, turnkey solutions.

Strategic alliances and technology partnerships are also shaping the sector. RITEC, a longtime supplier of scintillation materials, expanded its collaboration with detector module manufacturers in 2024 to accelerate the development of compact, high-resolution gamma-ray imagers for industrial and homeland security applications. Meanwhile, Siemens Healthineers and Philips have both deepened their partnerships with academic institutions and start-ups to drive innovation in gamma-ray spectrometer technology, focusing on AI-driven image reconstruction and novel semiconductor detector materials.

The entry of new players, often spin-outs from research institutes and universities, is fueling competition and technological diversity. For instance, Kromek Group continues to strengthen its market position by commercializing advanced cadmium zinc telluride (CZT) gamma-ray spectrometers, with recent contracts awarded in 2024 for both medical diagnostics and nuclear security applications. Additionally, Advacam, leveraging its roots in CERN’s Medipix collaboration, has introduced new modular imaging spectrometers and expanded its European manufacturing capacity to meet growing demand.

Looking into the next few years, the sector is expected to witness further consolidation as companies seek scale and broader portfolios to address increasingly complex customer requirements. Simultaneously, cross-sector partnerships—particularly between traditional imaging giants and semiconductor innovators—will likely intensify, accelerating the adoption of next-generation materials such as perovskites and advanced readout electronics. As regulatory standards tighten and application domains diversify, the ability to rapidly integrate novel technologies through partnerships or acquisitions will be a key competitive differentiator for gamma-ray imaging spectrometer manufacturers.

Regulatory Trends and Industry Standards

Gamma-ray imaging spectrometers are subject to a dynamic regulatory landscape that reflects both advances in detector technology and evolving safety and quality demands. In 2025, regulatory trends are being shaped by the dual imperatives of tightening radiation safety requirements and harmonizing international standards for manufacturing and device performance. Authorities such as the International Electrotechnical Commission (IEC) and the International Atomic Energy Agency (IAEA) continue to update guidance on the production and use of gamma-ray spectrometers, emphasizing reliability, accuracy, and traceability in nuclear measurement systems.

Manufacturers like Mirion Technologies and ORTEC (Ametek) are actively aligning their manufacturing processes with new and anticipated standards. These include the IEC 62327 for Hand-Held Instruments for the Detection and Identification of Radionuclides and IEC 61577 for measuring equipment used in radon detection, both of which are increasingly referenced by regulatory bodies and procurement agencies in 2025. The focus is not only on device sensitivity and selectivity but also on the robustness of quality assurance protocols and data integrity, particularly as gamma-ray spectrometry expands into environmental monitoring, homeland security, and medical diagnostics.

A significant regulatory trend is the integration of cybersecurity requirements into device design and production. With spectrometers increasingly networked for remote monitoring and data transmission, manufacturers are required to implement secure data handling and transmission protocols, in line with recommendations from bodies such as the IAEA. This is especially pertinent in applications involving critical infrastructure and border security, where tamper resistance and auditability are paramount.

The adoption of RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directives, particularly in the European Union, is also influencing material choices and supply chain documentation. Companies like RITEC and Zecotek Photonics are highlighting their compliance with these environmental standards to ensure market access, especially as more countries implement similar frameworks.

Looking ahead, the regulatory outlook for 2025 and beyond suggests a continued push for international harmonization of standards, with greater emphasis on accreditation of calibration facilities, lifecycle traceability, and post-market surveillance of gamma-ray imaging systems. As regulatory authorities collaborate more closely to address emerging risks and technological convergence, manufacturers are expected to invest further in certification, documentation, and transparent manufacturing practices to maintain market competitiveness and regulatory compliance.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

Gamma-ray imaging spectrometers are critical tools in nuclear medicine, astrophysics, security screening, and industrial inspection. The manufacturing landscape for these devices is shaped by regional investments in advanced detector materials, electronics, and integration capabilities. As of 2025, North America, Europe, and Asia-Pacific represent the most dynamic markets, each exhibiting distinct drivers and trends, while the Rest of World displays growing, albeit more modest, participation.

- North America: The United States remains at the forefront, propelled by ongoing investments in nuclear research, homeland security, and medical diagnostics. Key manufacturers such as AdvanSiD and ORTEC (AMETEK) are expanding production capacities and developing next-generation high-purity germanium (HPGe) and cadmium zinc telluride (CZT) spectrometers. National labs and agencies continue to fund improvements in imaging resolution and compactness, supporting the region’s leadership in both R&D and manufacturing.

- Europe: European manufacturers benefit from substantial EU funding for security and healthcare innovation. Companies such as Mirion Technologies (Canberra) and Kromek Group plc lead in the production of modular gamma-ray imaging systems, with a particular focus on portable and field-deployable solutions. The region’s strong regulatory framework and collaboration between research institutions and industry are expected to drive new product introductions and expand manufacturing footprints through 2027.

- Asia-Pacific: The Asia-Pacific region, led by Japan, China, and South Korea, is witnessing robust growth, driven by increased demand in medical imaging and industrial inspection. Japanese firms like Hitachi High-Tech Corporation are advancing scintillator and semiconductor detector technologies. In China, investment in domestic manufacturing capacities is accelerating, with companies such as ECT (Beijing Eastimage Technology Co., Ltd.) scaling up production for both domestic and export markets. Collaborative government-industry initiatives are expected to further boost the region’s output and innovation pipeline.

- Rest of World: Other regions, including the Middle East and Latin America, are gradually entering the manufacturing space, often through technology transfer agreements and partnerships with established international firms. While local production remains limited, countries such as Brazil and the UAE are investing in infrastructure and skills development to support future participation in the gamma-ray spectrometer supply chain.

Looking ahead, manufacturers across all regions are focusing on miniaturization, improved spectroscopic performance, and cost reduction. The next few years are likely to witness further regional specialization, strategic partnerships, and increased automation in production lines to meet rising global demand for advanced gamma-ray imaging spectrometers.

Challenges: Production Bottlenecks, Costs, and Scalability

The manufacturing of gamma-ray imaging spectrometers in 2025 faces several critical challenges related to production bottlenecks, costs, and scalability. These instruments, essential for applications in nuclear medicine, astrophysics, and security, require highly specialized components and stringent quality control, contributing to persistent issues across the industry.

One significant bottleneck arises from the sourcing and fabrication of high-purity semiconductor materials, such as cadmium zinc telluride (CZT) and high-purity germanium (HPGe). Companies like Kromek Group plc and AMETEK ORTEC report ongoing difficulties in scaling up CZT and HPGe crystal growth without compromising detector performance. The process is time-consuming and sensitive to contamination, leading to low yields and supply chain delays. This directly impacts the availability and cost of finished spectrometers.

Cost remains a major hurdle, particularly for applications seeking to deploy large-area or high-resolution detector arrays. The intricate assembly of gamma-ray spectrometers—including pixelation, bonding, and encapsulation—demands precision automation and skilled labor. Canberra Industries (a Mirion company) and Cremat Inc. cite the high cost of raw materials and precision electronics as factors limiting widespread adoption, especially outside research or defense sectors.

Scalability is further constrained by the need for custom engineering in many deployments. Medical imaging, for example, often requires tailored detector geometries and integration with complex software. Siemens Healthineers and GE HealthCare continue to invest in production automation and modularity to meet global demand, but the transition from prototyping to large-scale manufacturing remains slow due to regulatory requirements and the criticality of device reliability.

- Shortages of qualified personnel for semiconductor processing and device assembly have also emerged, impacting throughput and increasing labor costs. This challenge is especially acute in regions where microelectronics expertise is limited.

- Supply chain disruptions, including those related to geopolitical events and export controls on strategic materials, further exacerbate production risks, as reported by organizations such as Kromek Group plc.

Looking forward, manufacturers are exploring automated crystal growth, advanced packaging, and modular detector architectures to address these challenges. However, for the next few years, production bottlenecks and high costs are likely to persist, potentially slowing the adoption of gamma-ray imaging spectrometers in emerging markets and high-volume clinical settings.

Future Outlook: Disruptive Trends and Investment Opportunities

The manufacturing landscape for gamma-ray imaging spectrometers is poised for significant evolution as the sector adapts to advances in materials science, data integration, and miniaturization. In 2025 and the following years, several disruptive trends are set to reshape both product innovation and investment activity.

A primary trend is the adoption of new detector materials, such as cadmium zinc telluride (CZT), which offer superior energy resolution and room-temperature operation compared to legacy scintillation detectors. Companies like Kromek Group plc and Advacam s.r.o. are at the forefront, actively scaling up production of advanced CZT-based devices for security, medical, and industrial markets. These next-generation detectors enable more compact, efficient, and precise gamma-ray imaging instruments, lowering barriers to adoption in emerging fields such as personalized medicine and portable security screening.

Integration of artificial intelligence (AI) and machine learning (ML) for real-time spectral analysis is another major disruptive force. Manufacturers are embedding advanced algorithms directly into hardware, facilitating faster data interpretation and automated anomaly detection. Thermo Fisher Scientific Inc. and Mirion Technologies are investing in software-hardware co-development to deliver spectrometers that streamline complex workflows in nuclear power, homeland security, and environmental monitoring applications.

The miniaturization of gamma-ray spectrometers, driven by innovations in microelectronics and 3D packaging, is expanding deployment scenarios. Portable and handheld systems, as developed by Kromek Group plc and Thermo Fisher Scientific Inc., are gaining traction in first-responder operations and field-based scientific research. These compact spectrometers are expected to see accelerated investment as users prioritize flexibility and rapid response capabilities.

Supply chain resilience and vertical integration are also becoming central to manufacturers’ strategies. The volatility of global semiconductor and specialty crystal markets—exacerbated by geopolitical tensions—has prompted companies such as Stellarray Inc. to invest in domestic production and advanced crystal growth technologies, ensuring greater control over key components.

Looking ahead, investment opportunities will concentrate on companies that can deliver scalable, high-resolution spectrometers incorporating both advanced materials and intelligent analytics. Cross-sector applications in medical diagnostics, nuclear waste management, and security will drive further growth. Public-private partnerships and government grant programs are anticipated to catalyze R&D, accelerating the commercialization of disruptive gamma-ray imaging technologies in the latter half of the decade.

Sources & References

- Kromek Group plc

- Amptek Inc.

- Mirion Technologies

- RITEC

- Hexagon Manufacturing Intelligence

- HORIBA Scientific

- Thermo Fisher Scientific

- European Space Agency

- NASA

- Siemens Healthineers

- GE HealthCare

- Teledyne DALSA

- Raytheon Technologies

- Rapiscan Systems

- Smiths Detection

- Teledyne Technologies

- Mirion Technologies

- Philips

- Advacam

- ORTEC

- IAEA

- Zecotek Photonics

- Hitachi High-Tech Corporation

- Cremat Inc.

- Stellarray Inc.