Table of Contents

- Executive Summary: Key Insights & 2025-2030 Market Outlook

- Electroencephalographic Microelectrode Coatings: Technology Primer

- Current Market Landscape: Leading Brands, Players, and Innovators

- Material Science Advances: From Biocompatibility to Signal Fidelity

- Emerging Application Areas and Unmet Clinical Needs

- Regulatory Landscape and Standardization Initiatives

- Competitive Strategies: Pricing, Patents, and Partnerships

- Market Forecasts: Revenue, Volume, and Regional Growth (2025–2030)

- R&D Pipelines and Next-Gen Coating Technologies

- Future Outlook: Disruption Risks, Opportunities, and Strategic Recommendations

- Sources & References

Executive Summary: Key Insights & 2025-2030 Market Outlook

The market for electroencephalographic (EEG) microelectrode coatings is poised for significant evolution between 2025 and 2030, driven by advances in neuroscience, neuromodulation therapies, and brain-computer interface (BCI) technologies. As demand for high-precision, chronic neural recording grows, coating technologies are becoming a pivotal differentiator in device performance, longevity, and patient safety.

Recent years have seen a transition from traditional metallic electrodes toward microelectrodes enhanced with advanced surface coatings. Materials such as poly(3,4-ethylenedioxythiophene) (PEDOT), iridium oxide, and carbon nanotubes are being increasingly adopted to reduce impedance, improve signal fidelity, and mitigate inflammatory tissue responses. In 2024, Blackrock Neurotech and Neuralink Corp. accelerated the clinical integration of custom-coated microelectrodes, demonstrating improved chronic recording performance in both research and early human trials.

Key industry players are investing in scalable manufacturing processes for advanced coatings, anticipating wider adoption as regulatory approvals broaden. For instance, NeuroPace, Inc. has reported ongoing development of proprietary coatings for seizure detection and response neurostimulators, targeting reduced device encapsulation and enhanced biocompatibility. Meanwhile, Microprobes for Life Science has expanded its portfolio to include platinum black and PEDOT-coated microelectrodes optimized for both acute and chronic EEG applications.

Emerging trends from 2025 onward include the integration of anti-fouling and drug-eluting coatings, which aim to further minimize glial scarring and electrode degradation. Collaborative projects between device manufacturers and materials science firms, such as those by Cortech Solutions, Inc., are expected to yield commercial products with tailored surface chemistries for specific neurophysiological applications. Additionally, as BCIs move closer to consumer markets, scalability and reproducibility of coating processes are becoming top priorities.

Looking ahead to 2030, the outlook is robust. Regulatory agencies are providing clearer pathways for innovative coated microelectrodes, particularly as clinical evidence for long-term safety accrues. The convergence of flexible electronics, nanomaterials, and bioactive coatings is expected to further elevate device functionality. Consequently, stakeholders anticipate a compound annual growth rate (CAGR) in the high single digits for this segment, underpinned by both the expansion of neurological disorder diagnostics and the emergence of consumer neurotechnology.

Electroencephalographic Microelectrode Coatings: Technology Primer

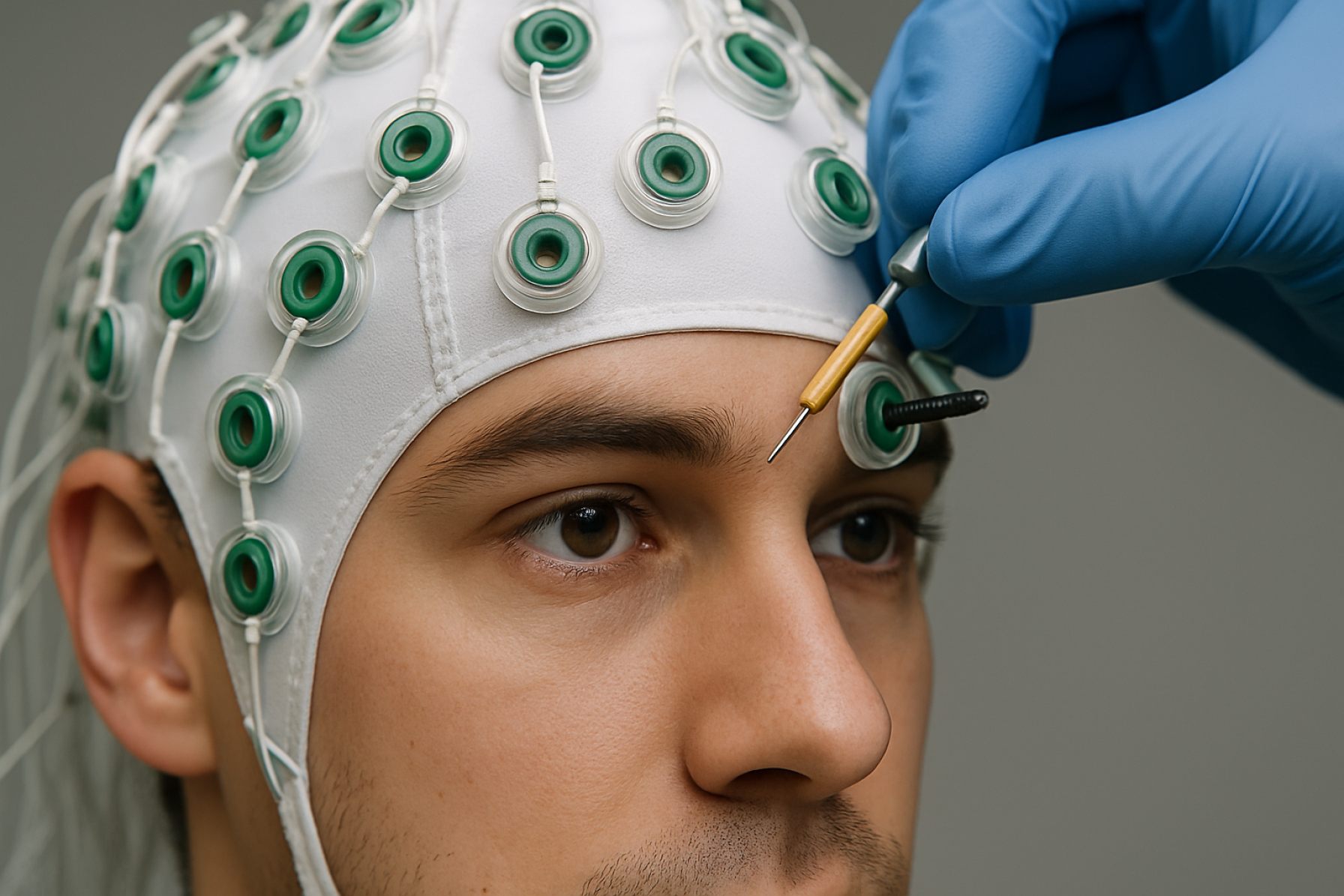

Electroencephalographic (EEG) microelectrode coatings are a critical component in advancing neural recording technologies, significantly influencing the reliability, biocompatibility, and longevity of both invasive and non-invasive EEG devices. As EEG systems become more miniaturized and are integrated into wearable or implantable platforms, the performance demands on microelectrode coatings have intensified. In 2025, the industry is seeing a convergence of new materials science and biomedical engineering approaches aimed at meeting these needs.

Current-generation EEG microelectrode coatings are designed to optimize three main parameters: electrical conductivity, biocompatibility, and resistance to biofouling. Gold and platinum, long-standing choices for their inertness and conductivity, are being enhanced with nanostructured surface modifications to increase surface area and signal-to-noise ratio. Companies such as ADInstruments and Blackrock Neurotech utilize these advanced coatings in their microelectrode arrays, reporting reduced impedance and improved signal fidelity in both research and clinical EEG applications.

Polymeric coatings—especially those based on PEDOT (poly(3,4-ethylenedioxythiophene))—are also gaining traction due to their flexibility and low impedance characteristics. For example, NeuroOne Medical Technologies has highlighted the role of PEDOT and similar polymers in improving electrode-tissue interfaces for chronic implantation, aiming to minimize inflammatory responses and signal degradation over time. These coatings are often combined with anti-biofouling agents such as polyethylene glycol (PEG) or zwitterionic compounds to further enhance stability in biological environments.

Emerging approaches in 2025 include the use of graphene and other 2D materials as ultra-thin coatings, offering a unique combination of conductivity, flexibility, and transparency. Neuralink Corp. and university-industry collaborations are actively exploring these materials for next-generation neural interfaces, citing their potential to enable high-density electrode arrays with minimal tissue disruption and increased recording resolution.

Looking forward, the outlook for EEG microelectrode coatings is centered on multifunctionality—integrating biosensing capabilities, drug delivery, or wireless communication directly into the coating layer. Research and industry players are also investigating self-healing materials and coatings with embedded microfluidic channels to further extend device lifespans and reduce maintenance. As regulatory pathways for implantable neurotechnologies become more defined, commercial adoption of these advanced coatings is expected to accelerate, supporting broader use in clinical diagnostics and brain-computer interface applications.

Current Market Landscape: Leading Brands, Players, and Innovators

The market for electroencephalographic (EEG) microelectrode coatings is evolving rapidly as demand grows for higher-resolution, longer-lasting, and biocompatible neural interfaces. As of 2025, the sector is characterized by a blend of established medical device manufacturers, specialized materials science firms, and university spin-offs, all contributing to advances in neural recording technologies through innovative electrode coating solutions.

Industry leaders such as ADInstruments and Neuroelectrics have maintained their positions by integrating advanced coatings into their EEG systems, aiming to improve signal quality and reduce impedance at the electrode–scalp interface. Meanwhile, manufacturers like Blackrock Neurotech are leveraging proprietary microelectrode coatings to enhance the recording fidelity and longevity of implantable neural devices, focusing on chronic applications and brain-computer interface (BCI) research.

A significant portion of innovation is driven by materials companies such as Parylene Coating Services, which supplies parylene—a biocompatible polymer widely adopted for insulating and protecting microelectrodes from biofouling and corrosion. Parylene’s conformal coating properties have helped expand its application in both surface and implantable EEG electrode arrays. Other companies, including NeuroMedex, are exploring conductive polymer coatings, such as PEDOT:PSS, to further reduce contact impedance and improve biocompatibility, with new product launches expected in the next two to three years.

Collaborations with academic institutions and research hospitals continue to shape the competitive landscape. For instance, Cortech Solutions partners with R&D centers to integrate the latest coating materials into commercial EEG arrays, facilitating translational research and early clinical adoption. Furthermore, The Bionics Institute is actively working with industry to validate novel nanostructured coatings that can promote neural tissue integration while minimizing inflammatory responses, with preclinical results anticipated by 2026.

Looking ahead, the market is expected to see continued fragmentation as new entrants introduce niche coating technologies targeting specialized clinical and research applications. Key trends include the adoption of multi-layer coatings for multifunctional electrodes (e.g., combining antimicrobial and anti-inflammatory properties) and the development of coatings compatible with flexible, wearable EEG systems. Regulatory pathways and material supply chain robustness will be critical factors influencing the pace of commercialization and broader adoption through 2027 and beyond.

Material Science Advances: From Biocompatibility to Signal Fidelity

Recent advancements in the material science of electroencephalographic (EEG) microelectrode coatings are redefining the standards for biocompatibility and signal fidelity as the field approaches 2025. Traditional metal-based electrodes, commonly gold or silver/silver-chloride, have long set the baseline for clinical and research EEG. However, contemporary challenges—including inflammatory response, long-term tissue integration, and impedance minimization—are driving the adoption of next-generation coatings.

A significant trend is the application of conductive polymers, such as poly(3,4-ethylenedioxythiophene) polystyrene sulfonate (PEDOT:PSS), which offer improved charge transfer and flexibility over classical metals. Academic and industry research coordinated with companies like NanoNeuro and Neuroelectrics is demonstrating that PEDOT:PSS coatings can reduce electrode-skin impedance and enhance patient comfort during prolonged recordings. Early clinical deployments by Neuroelectrics report lower noise floors and more stable signals over multi-hour sessions, supporting higher density arrays and more precise source localization.

Another avenue is the integration of nanostructured coatings, including carbon nanotubes (CNTs) and graphene derivatives. Companies such as NeuroOne Medical Technologies Corporation are exploring CNT-based solutions to increase effective surface area, thereby lowering impedance without enlarging electrode footprints. Preclinical prototypes have shown up to 50% impedance reduction compared to uncoated gold electrodes, while maintaining low cytotoxicity and mechanical stability.

Hydrogel-based coatings, incorporating biocompatible polymers with high water content, are also gaining traction. These coatings, as developed by GE HealthCare for next-generation EEG sensors, aim to minimize skin irritation and allow for dry or semi-dry application. Early market feedback suggests improved signal acquisition in ambulatory and pediatric populations, settings where traditional gel-based electrodes are suboptimal.

Looking forward, the outlook for EEG microelectrode coatings is driven by the convergence of flexible electronics and additive manufacturing. Industry stakeholders, including Natus Medical Incorporated, are investing in hybrid approaches—combining conductive polymers, nanomaterials, and anti-inflammatory agents—to deliver electrodes capable of chronic implantation and seamless integration with wearable systems. Regulatory pathways are steadily clarifying, and first-in-human trials for multifunctional coatings are anticipated by late 2025.

In summary, the next few years are set to witness a shift toward multi-material, biocompatible, and highly conductive coatings on EEG microelectrodes. These innovations promise to elevate both the clinical utility and user experience of EEG technology, supporting broader adoption in neurology, brain-computer interfaces, and remote monitoring.

Emerging Application Areas and Unmet Clinical Needs

The landscape for electroencephalographic (EEG) microelectrode coatings is undergoing significant transformation, with emerging application areas and persistent clinical needs shaping innovation through 2025 and the coming years. As EEG’s role expands from traditional diagnostics to therapeutic monitoring, brain-computer interfaces (BCIs), and closed-loop neuromodulation, the demand for advanced microelectrode coatings is intensifying.

One of the most prominent emerging application areas is in minimally invasive and high-density scalp EEG arrays, which require microelectrodes with enhanced biocompatibility and reduced impedance. Materials such as poly(3,4-ethylenedioxythiophene) (PEDOT), iridium oxide, and nanostructured carbon are being adopted to improve signal fidelity and longevity. Companies like Neuroelectrics are developing next-generation wearable EEG systems that leverage coated microelectrodes to increase comfort and maintain low electrode-skin impedance over extended sessions, crucial for ambulatory and at-home monitoring applications.

In the clinical sphere, a major unmet need is the reliable, long-term performance of microelectrodes in both acute and chronic settings. Traditional metal electrodes are prone to degradation and biofouling, leading to signal drift and reduced accuracy. Manufacturers such as ADInstruments are exploring coatings that resist protein adsorption and inflammatory responses, aiming to extend electrode lifespan, particularly for use in continuous ICU monitoring and epilepsy surgery planning.

For intracranial EEG and hybrid electrocorticography (ECoG) applications, coatings enabling ultra-low impedance and high charge-injection capacity are vital for both recording and stimulation. Companies like Blackrock Neurotech are integrating robust coatings to support the dual demands of high-resolution brain mapping and therapeutic stimulation, addressing the need for stable, safe, and efficient neural interfaces in epilepsy and brain mapping procedures.

Despite these advances, gaps remain. There is a continued need for coatings that ensure stable long-term performance in moist, variable biological environments, reduce the risk of infection, and enable integration with emerging flexible, stretchable substrates for next-generation EEG caps and subdermal arrays. Industry consortia such as IEEE are supporting standardization efforts around electrode materials and coatings to facilitate interoperability and safety across manufacturers.

Looking ahead, the outlook for EEG microelectrode coatings is shaped by collaboration between biomedical engineers, materials scientists, and device companies. With growing interest in non-invasive and minimally invasive neurotechnology, advancements in coating chemistries and surface engineering will be pivotal in meeting both current and future clinical demands, driving adoption in neurology, psychiatry, and emerging consumer neurotech markets.

Regulatory Landscape and Standardization Initiatives

The regulatory landscape for electroencephalographic (EEG) microelectrode coatings is undergoing significant evolution as the medical device sector responds to technological advancements and heightened safety expectations. In 2025 and the foreseeable future, national and international regulatory bodies are actively updating frameworks to address the unique characteristics and biocompatibility requirements of advanced electrode coatings used in neurodiagnostic applications.

One of the most influential organizations, the International Organization for Standardization (ISO), continues to refine standards such as ISO 10993 for the biological evaluation of medical devices, which is directly relevant to coating materials coming into contact with neural tissue. These standards are being further tailored to account for the long-term implantation and potential nano-scale properties of novel coatings, including conductive polymers and bioactive surfaces. By 2025, ISO technical committee 210 is also expected to progress on updates to ISO 13485, which governs quality management systems for medical devices, placing increased emphasis on traceability and risk management for device coatings.

In the United States, the U.S. Food and Drug Administration (FDA) has intensified scrutiny of microelectrode coatings, particularly regarding their durability, cytotoxicity, and potential for leachables. Recent guidance encourages manufacturers to provide comprehensive premarket data on coating adhesion, degradation profiles, and electrical performance stability. Additionally, the FDA’s Center for Devices and Radiological Health (CDRH) is engaging with industry stakeholders through the Medical Device Innovation Consortium to develop consensus standards for neural interface coatings, with the aim of expediting review times while ensuring patient safety.

The MedTech Europe association, representing the European medical technology sector, is advocating for harmonized approaches across EU member states under the evolving Medical Device Regulation (MDR 2017/745). This regulation, already impacting device certification processes, mandates detailed documentation of material composition, long-term safety data, and post-market surveillance—factors directly influencing the development and approval of novel microelectrode coatings. As of 2025, Notified Bodies in the EU are requiring more rigorous preclinical and clinical data specific to the interaction of coatings with neural tissue.

Looking ahead, regulatory harmonization and standardization initiatives are expected to further streamline market access for innovative EEG microelectrode coatings, but will also raise the bar for safety and performance evidence. Industry stakeholders are increasingly participating in pre-competitive consortia and public-private partnerships to establish verification protocols and reference materials, aiming to reduce regulatory uncertainty and accelerate the adoption of next-generation neurodiagnostic devices.

Competitive Strategies: Pricing, Patents, and Partnerships

The competitive landscape for electroencephalographic (EEG) microelectrode coatings in 2025 is defined by strategic pricing models, an active intellectual property environment, and a growing trend toward industry-academic partnerships. As technological advances drive demand for higher signal fidelity, durability, and biocompatibility in neurodiagnostic devices, companies are recalibrating their market approaches to secure and expand their positions.

Pricing Strategies:

- Leading manufacturers such as ADInstruments and Neuropixels are emphasizing value-based pricing, leveraging proprietary coating technologies (e.g., conductive polymers, nanostructured surfaces) that offer demonstrably improved signal-to-noise ratios and longevity. Bulk purchasing agreements and tiered pricing for research versus clinical-grade devices are becoming more prevalent, as institutions seek cost-effective solutions for large-scale studies and healthcare deployments.

- Emerging suppliers are differentiating through competitive introductory pricing and bundled solutions—including electrodes pre-coated with anti-inflammatory and anti-fouling agents—to accelerate adoption among early-stage brain-computer interface (BCI) developers and university labs.

Patent Activity:

- The patent landscape is intensifying, with companies such as Blackrock Neurotech and Neuralink actively filing for protection of novel micro/nanostructured coatings to inhibit glial scarring and improve chronic electrode performance. These filings reflect both composition-of-matter innovations (e.g., PEDOT:PSS blends, graphene derivatives) and methods of application (e.g., vapor deposition, layer-by-layer assembly).

- Defensive patenting and cross-licensing deals are surfacing, particularly as more players enter the field and as regulatory bodies scrutinize biocompatibility claims. The focus extends to coatings that facilitate wireless data transmission and reduce impedance over months of implantation.

Partnerships and Collaborations:

- Strategic collaborations are central to accelerating R&D and regulatory clearance. For instance, Cortech Solutions is working with materials science institutes to co-develop novel electrode coatings, while clinical partnerships with hospital networks foster real-world validation.

- Multinational device manufacturers are increasingly partnering with academic spin-offs and contract development organizations to access next-generation coating chemistries and to scale up manufacturing for global markets. These alliances are crucial for navigating variable regulatory environments and for tailoring products to application-specific needs (e.g., pediatric, long-term monitoring, or high-density arrays).

Looking ahead, the competitive strategies in electroencephalographic microelectrode coatings will likely center on rapid translation of lab-scale innovations to market-ready products, with a premium on cost-effectiveness, patent protection, and collaborative ecosystem building.

Market Forecasts: Revenue, Volume, and Regional Growth (2025–2030)

The market for electroencephalographic (EEG) microelectrode coatings is anticipated to experience robust growth from 2025 to 2030, propelled by advances in neurotechnology, the expanding application of brain-computer interfaces, and the increasing prevalence of neurological disorders. This segment, which focuses on enhancing electrode biocompatibility, signal fidelity, and device longevity, is becoming integral to next-generation EEG systems used in both clinical and research settings.

Revenue for the global EEG microelectrode coatings market is projected to grow at a compound annual growth rate (CAGR) exceeding 8% through 2030. The demand is driven primarily by the adoption of novel coatings such as iridium oxide, platinum black, and conductive polymers, which improve charge transfer and minimize inflammatory responses. Leading medical device manufacturers and neurotechnology firms are expanding their product portfolios to include coated electrodes specifically engineered for high-resolution, long-term monitoring applications. For instance, ADInstruments and Neuroelectrics have reported increased interest in coated microelectrode arrays for advanced EEG systems in both hospital and laboratory environments.

Volume-wise, shipment of coated microelectrodes is expected to rise sharply in North America and Europe, which together account for over 60% of global demand due to the presence of established healthcare infrastructure and high rates of adoption of advanced neurodiagnostic tools. Asia-Pacific is projected to exhibit the fastest regional growth, with countries such as China, Japan, and South Korea investing heavily in neurotechnology research and expanding their medical device manufacturing capabilities. Companies such as NeuroNexus Technologies have expanded their distribution and R&D presence in these regions to capitalize on regional growth opportunities.

Strategic collaborations between academic institutions and technology suppliers are further catalyzing innovation in electrode coatings, with a focus on reducing impedance, enhancing durability, and enabling miniaturization. Emerging materials such as carbon nanotube composites and graphene-based coatings are being piloted for market introduction by 2027, promising improvements in both signal stability and patient comfort. Blackrock Neurotech has announced ongoing development of next-generation coating technologies aimed at clinical and research EEG applications, signaling a competitive outlook with increased focus on proprietary materials and coating processes.

Overall, the next five years are set to witness significant expansion in both revenue and volume for EEG microelectrode coatings, with market leaders and new entrants alike investing in advanced materials, scalable manufacturing, and regionally tailored solutions to meet growing global demand.

R&D Pipelines and Next-Gen Coating Technologies

As the demand for high-fidelity electroencephalographic (EEG) recordings grows in both clinical and research settings, manufacturers and academic labs are intensifying efforts to optimize microelectrode coatings. The R&D pipelines for these coatings in 2025 reveal a focus on enhancing biocompatibility, reducing impedance, and prolonging functional lifespan, addressing challenges associated with chronic implantation and signal quality.

Current-generation coatings often use materials like platinum, gold, or iridium oxide due to their stability and conductivity. However, next-generation efforts are pivoting toward nanostructured coatings, conductive polymers, and bio-inspired surfaces. For example, NeuroPace and Neuraura are developing microelectrodes with proprietary low-impedance coatings that aim to minimize tissue response and maximize recording precision. These innovations are being tested in preclinical and early-stage clinical studies, with initial data showing improved signal-to-noise ratios and reduced inflammatory markers compared to legacy coatings.

A significant R&D trend involves conductive polymer coatings, such as poly(3,4-ethylenedioxythiophene) (PEDOT), which are designed to facilitate charge transfer while maintaining mechanical flexibility. Blackrock Neurotech has been actively exploring PEDOT and other organic coatings for their Utah array platforms, reporting lower impedance and enhanced chronic stability in their latest prototypes. These coatings are also being engineered for specific surface topographies that encourage neural cell adherence and reduce glial scarring.

Biofunctionalization is another frontier. Companies like CorTec are investigating coatings incorporating biomolecules (e.g., peptides, anti-inflammatory agents) to further suppress immune reactions and promote neural integration. Early-stage collaborations with university research groups have yielded promising in vitro results, with expectations to move toward animal testing in the next 1–2 years.

Looking ahead, industry-watchers anticipate that by 2027–2028, regulatory submissions for next-gen EEG electrode arrays featuring these advanced coatings will increase. The integration of nanomaterials and smart polymers is expected to set new benchmarks for chronic implantation safety and data quality. As the field moves closer to minimally invasive brain-computer interfaces, these R&D pipelines will be pivotal for enabling next-level neurophysiological monitoring and therapeutic interventions.

Future Outlook: Disruption Risks, Opportunities, and Strategic Recommendations

The future outlook for electroencephalographic (EEG) microelectrode coatings in 2025 and the upcoming years is shaped by a combination of disruptive technological advancements, evolving clinical and research needs, and an increasingly dynamic regulatory landscape. As the demand for higher signal fidelity, improved biocompatibility, and longer implant lifespans intensifies, both risks and opportunities emerge for established manufacturers and new entrants.

- Disruption Risks: One of the primary risks lies in rapid innovation cycles, as novel coating materials such as conductive polymers and nanostructured surfaces threaten to outpace conventional metal and carbon-based coatings. For example, companies like Neuroelectrics are exploring advanced polymer-based coatings to minimize impedance and inflammation. Regulatory requirements are also tightening, with agencies such as the U.S. Food and Drug Administration emphasizing rigorous biocompatibility testing for implantables. Delays in certification or unexpected toxicity findings could disrupt market entrants and incumbents alike.

- Opportunities: The rising adoption of brain-computer interfaces (BCIs) and neuroprosthetics is accelerating demand for highly reliable, chronic-use microelectrodes. Startups and established players, including Blackrock Neurotech and ADInstruments, are investing in coatings that reduce inflammatory responses and extend device lifespans. Graphene and carbon nanotube coatings, for example, show promise in enhancing electrical conductivity while maintaining tissue compatibility. For companies with robust R&D, there is significant potential to address unmet needs in minimally invasive, long-term neural monitoring.

- Strategic Recommendations: To capitalize on these opportunities, industry participants should prioritize cross-disciplinary collaboration, engaging with material scientists, neuroscientists, and clinicians. Early engagement with regulatory bodies such as the European Medicines Agency will help streamline approval processes. Companies should also consider open innovation platforms and partnerships with academic institutions to accelerate the translation of emerging materials into viable commercial products. Finally, implementing advanced in vitro and in vivo testing protocols will be essential to demonstrate long-term safety and efficacy, supporting both regulatory approval and market adoption.

In summary, the EEG microelectrode coating sector faces significant disruption risk from fast-moving materials science and tightening regulations in 2025 and beyond. However, strategic investment in R&D, regulatory foresight, and collaboration across the innovation ecosystem position stakeholders to seize emerging opportunities in both clinical and research applications.

Sources & References

- Blackrock Neurotech

- Neuralink Corp.

- Microprobes for Life Science

- Cortech Solutions, Inc.

- NeuroOne Medical Technologies

- Neuroelectrics

- NeuroMedex

- GE HealthCare

- Natus Medical Incorporated

- IEEE

- International Organization for Standardization (ISO)

- Neuropixels

- NeuroNexus Technologies

- Neuraura

- CorTec

- European Medicines Agency