Electrochemical Membrane Desalination Systems in 2025: Transforming Water Scarcity Solutions with Next-Gen Technology. Explore Market Growth, Innovation, and the Road Ahead.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Technology Overview: Principles of Electrochemical Membrane Desalination

- Major Players and Industry Initiatives (e.g., suez.com, dupont.com, toraywater.com)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts (CAGR: 12–15%)

- Recent Innovations and Patent Activity

- Cost Analysis and Competitive Positioning

- Regulatory Environment and Industry Standards (e.g., water.org, awwa.org)

- Deployment Case Studies: Municipal, Industrial, and Remote Applications

- Challenges, Risks, and Barriers to Adoption

- Future Outlook: Disruptive Trends and Strategic Opportunities Through 2030

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

Electrochemical membrane desalination systems are poised for significant growth in 2025, driven by escalating global water scarcity, tightening environmental regulations, and the need for energy-efficient desalination technologies. These systems, which include electrodialysis (ED), electrodialysis reversal (EDR), and capacitive deionization (CDI), leverage electrically driven ion-selective membranes to separate salts from water, offering advantages in operational flexibility and lower energy consumption for brackish and low-salinity feedwaters.

In 2025, the market landscape is shaped by both established water technology leaders and innovative startups. Veolia and SUEZ (now part of Veolia) continue to expand their portfolios of electrochemical desalination solutions, targeting municipal and industrial clients seeking to reduce operational costs and environmental footprints. DuPont, a major supplier of ion exchange membranes, is investing in next-generation materials to improve selectivity and durability, directly impacting system efficiency and lifespan. Evoqua Water Technologies (now part of Xylem) is also advancing modular EDR systems for decentralized and mobile water treatment applications.

Recent deployments highlight the sector’s momentum. In 2024, Veolia announced new contracts in the Middle East and Asia for large-scale brackish water desalination using EDR, citing up to 20% lower energy consumption compared to conventional reverse osmosis (RO) for similar feedwater salinities. DuPont has reported pilot projects in North America and Europe demonstrating improved membrane lifespans and reduced fouling, key factors for lowering total cost of ownership. Meanwhile, startups such as Aquaporin are commercializing biomimetic membranes that promise further efficiency gains in electrochemical desalination.

Key drivers for 2025 include the need for sustainable water management in water-stressed regions, stricter discharge regulations, and the electrification of industrial processes. Electrochemical systems are increasingly favored for their ability to recover valuable salts and minimize brine production, aligning with circular economy principles. The integration of renewable energy sources, such as solar and wind, is also accelerating, with several pilot projects underway to demonstrate off-grid or hybrid-powered desalination units.

Looking ahead, the sector is expected to see continued investment in R&D, particularly in advanced membrane materials and system automation. Partnerships between technology providers, utilities, and industrial end-users will be crucial for scaling up deployments. As water scarcity intensifies and sustainability targets become more ambitious, electrochemical membrane desalination systems are set to play a pivotal role in the global water treatment market through 2025 and beyond.

Technology Overview: Principles of Electrochemical Membrane Desalination

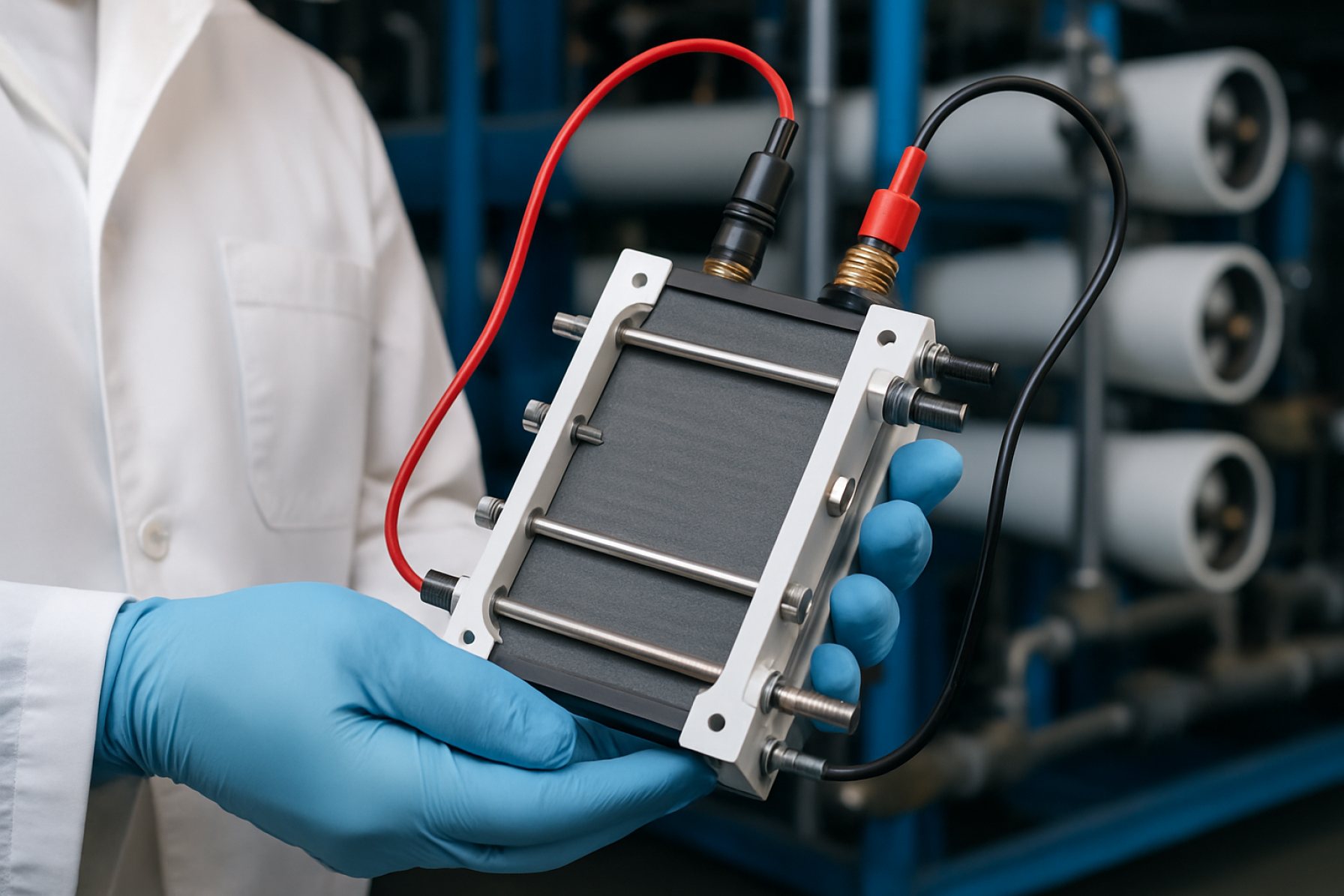

Electrochemical membrane desalination systems represent a rapidly advancing segment of water treatment technology, leveraging electrical potential and selective ion transport to remove salts and impurities from water. The core principle involves the use of ion-exchange membranes and an applied electric field to drive the migration of ions, effectively separating dissolved salts from water streams. The most prominent technologies in this category include electrodialysis (ED), electrodialysis reversal (EDR), and emerging variants such as capacitive deionization (CDI) and bipolar membrane electrodialysis (BMED).

In electrodialysis, alternating cation and anion exchange membranes are arranged between electrodes. When voltage is applied, cations migrate toward the cathode and anions toward the anode, each passing through their respective selective membranes. This process concentrates salts in one stream (the concentrate) and produces desalinated water in another (the diluate). Electrodialysis reversal periodically switches the polarity of the electrodes, mitigating membrane fouling and scaling, thus extending operational life and reducing maintenance.

Recent years have seen significant improvements in membrane materials, energy efficiency, and system integration. Companies such as Evoqua Water Technologies and SUEZ Water Technologies & Solutions (now part of Veolia) are at the forefront of commercial ED and EDR system deployment, offering modular, scalable solutions for brackish water desalination, industrial process water, and wastewater reuse. These systems are increasingly favored for applications where feedwater salinity is moderate and energy consumption is a critical concern.

Capacitive deionization (CDI) is gaining traction as a low-energy alternative for low-salinity water streams. In CDI, ions are removed from water by applying a voltage across porous electrodes, causing ions to adsorb onto the electrode surfaces. Companies like DuPont and Aker Carbon Capture (through its water division) are investing in advanced electrode materials and system designs to improve performance and reduce costs.

Looking ahead to 2025 and beyond, the outlook for electrochemical membrane desalination is promising. The integration of renewable energy sources, digital monitoring, and automation is expected to further enhance system efficiency and sustainability. Industry leaders are focusing on reducing capital and operational expenditures, expanding the range of treatable water sources, and minimizing environmental impact. As global water scarcity intensifies, electrochemical membrane desalination systems are poised to play a pivotal role in securing reliable, energy-efficient freshwater supplies for municipal, industrial, and agricultural sectors.

Major Players and Industry Initiatives (e.g., suez.com, dupont.com, toraywater.com)

The electrochemical membrane desalination sector is witnessing significant activity in 2025, with established water technology leaders and innovative startups advancing both research and commercialization. Major players are leveraging their expertise in membranes, system integration, and electrochemical processes to address the growing demand for energy-efficient and sustainable desalination solutions.

SUEZ, a global leader in water and wastewater treatment, continues to invest in electrochemical desalination technologies, building on its extensive portfolio of membrane-based solutions. The company is focusing on integrating electrochemical processes with its existing reverse osmosis (RO) and nanofiltration systems to enhance salt removal efficiency and reduce energy consumption. SUEZ’s R&D centers are collaborating with industrial partners and utilities to pilot hybrid systems that combine electrodialysis (ED) and capacitive deionization (CDI) for brackish water and industrial wastewater reuse applications. These initiatives align with SUEZ’s broader sustainability goals and its commitment to circular water management (SUEZ).

DuPont, a major supplier of advanced membrane materials, is actively developing next-generation ion exchange membranes and electrode assemblies tailored for electrochemical desalination. DuPont’s Seawater Reverse Osmosis (SWRO) and Electrodialysis Reversal (EDR) technologies are being adapted for modular, decentralized desalination units targeting off-grid and remote communities. In 2025, DuPont is expanding its partnerships with system integrators and local utilities to demonstrate the scalability and cost-effectiveness of electrochemical membrane systems, particularly in regions facing acute water scarcity (DuPont).

Toray Industries, renowned for its high-performance membrane products, is advancing the commercialization of electrochemical desalination through the development of durable, fouling-resistant membranes and stack designs. Toray’s research teams are optimizing membrane chemistry and system architecture to improve ion selectivity and operational stability, with pilot projects underway in Asia and the Middle East. The company is also exploring the integration of renewable energy sources, such as solar and wind, to power electrochemical desalination units, aiming to further reduce the carbon footprint of water treatment (Toray Industries).

Other notable industry initiatives include collaborative demonstration projects and technology validation programs led by regional utilities and public-private partnerships. These efforts are accelerating the adoption of electrochemical membrane desalination in municipal, industrial, and agricultural sectors. As regulatory frameworks and funding mechanisms evolve, the next few years are expected to see increased deployment of these systems, with major players driving innovation and standardization across the industry.

Market Size, Segmentation, and 2025–2030 Growth Forecasts (CAGR: 12–15%)

The global market for electrochemical membrane desalination systems is poised for robust expansion between 2025 and 2030, with compound annual growth rate (CAGR) projections ranging from 12% to 15%. This growth is driven by escalating water scarcity, increasing industrial demand for ultrapure water, and the need for energy-efficient desalination technologies. Electrochemical membrane systems, which include electrodialysis (ED), electrodialysis reversal (EDR), and capacitive deionization (CDI), are gaining traction as alternatives or complements to conventional reverse osmosis (RO) due to their lower energy requirements for brackish water and selective ion removal capabilities.

Market segmentation reveals that municipal water treatment and industrial process water are the leading application sectors. The municipal segment is expected to maintain the largest share, propelled by government investments in water infrastructure and the retrofitting of aging desalination plants. Industrial applications—particularly in power generation, pharmaceuticals, and microelectronics—are also expanding rapidly, as these sectors require high-purity water and seek to minimize environmental impact.

Geographically, the Asia-Pacific region is anticipated to witness the fastest growth, underpinned by large-scale desalination projects in China, India, and Southeast Asia, as well as increasing water stress in urban centers. The Middle East remains a significant market, with countries like Saudi Arabia and the United Arab Emirates investing in advanced desalination to secure water supplies for both municipal and industrial use. North America and Europe are seeing steady adoption, especially in regions facing groundwater salinization and stricter water quality regulations.

Key industry players are actively scaling up production and innovating in system design. SUEZ and Veolia are prominent in deploying large-scale electrodialysis and EDR systems, particularly for municipal and industrial clients. DuPont is a major supplier of ion exchange membranes, a critical component in these systems, and is investing in next-generation materials to improve efficiency and durability. Evoqua Water Technologies (now part of Xylem) is expanding its portfolio of electrochemical desalination solutions, targeting both brackish water and industrial reuse applications.

Looking ahead, the market outlook for 2025–2030 is characterized by continued technological advancements, cost reductions, and integration with renewable energy sources. The push for decentralized and modular desalination units is expected to open new opportunities in remote and off-grid locations. As regulatory frameworks tighten and water scarcity intensifies, electrochemical membrane desalination systems are set to play an increasingly vital role in global water management strategies.

Recent Innovations and Patent Activity

Electrochemical membrane desalination systems, including electrodialysis (ED), capacitive deionization (CDI), and their hybrid variants, have seen a surge in innovation and patent activity as the global demand for energy-efficient and sustainable water treatment intensifies. In 2025, the sector is characterized by a focus on advanced membrane materials, system integration, and process optimization, with several industry leaders and research-driven companies driving progress.

A notable trend is the development of ion-selective membranes with enhanced durability and selectivity, which directly impacts the efficiency and operational lifespan of desalination units. DuPont, a major supplier of ion exchange membranes, has continued to expand its product lines for electrodialysis and related applications, emphasizing improved chemical resistance and lower energy consumption. Similarly, SUEZ and Evoqua Water Technologies have reported ongoing R&D investments in membrane chemistry and module design, aiming to reduce fouling and maintenance requirements.

Patent filings in 2024–2025 reflect a shift toward hybrid systems that combine electrochemical desalination with renewable energy integration or advanced pre-treatment. For example, DuPont and SUEZ have both filed patents for systems that leverage solar or wind power to drive electrodialysis processes, targeting off-grid and remote applications. Additionally, startups such as Aquaporin are commercializing biomimetic membranes that utilize aquaporin proteins to achieve high water flux and selectivity, with several patents granted for their unique membrane fabrication techniques.

In the capacitive deionization (CDI) space, companies like Zydemy and ADAES are advancing electrode materials, including carbon aerogels and graphene composites, to boost salt adsorption capacity and regeneration efficiency. Patent activity in this area is robust, with filings covering novel electrode architectures, flow configurations, and system controls designed to minimize energy use and extend component life.

Looking ahead to the next few years, the outlook for electrochemical membrane desalination is shaped by the convergence of digital monitoring, modular system design, and circular economy principles. Industry leaders are expected to continue patenting innovations that enable real-time process optimization, remote diagnostics, and the recycling of spent membranes and electrodes. As regulatory and market pressures for sustainable water solutions mount, the pace of innovation and patenting in this sector is likely to accelerate, with established players and agile startups alike vying for technological leadership.

Cost Analysis and Competitive Positioning

Electrochemical membrane desalination systems, including electrodialysis (ED), electrodialysis reversal (EDR), and capacitive deionization (CDI), are gaining traction as alternatives to conventional reverse osmosis (RO) and thermal desalination, particularly for brackish water and low-to-moderate salinity sources. As of 2025, the cost competitiveness of these technologies is shaped by advances in membrane materials, system integration, and energy efficiency, as well as the evolving landscape of water scarcity and regulatory pressures.

The capital expenditure (CAPEX) for electrochemical membrane systems remains generally higher than for mature RO systems, primarily due to the specialized ion-exchange membranes and power supply units required. However, operational expenditure (OPEX) can be significantly lower, especially in applications where feedwater salinity is below 10,000 mg/L. For example, SUEZ and Veolia, both major global water technology providers, have reported that ED and EDR systems can achieve energy consumption as low as 0.4–1.5 kWh/m³ for brackish water desalination, compared to 1.5–3.0 kWh/m³ for RO in similar conditions. This energy advantage is particularly pronounced in partial desalination or selective ion removal scenarios, where only a fraction of ions need to be removed.

Membrane durability and fouling resistance are critical cost drivers. Recent product lines from DuPont (following its acquisition of Evoqua’s membrane business) and Ionics (now part of Siemens) have focused on advanced ion-exchange membranes with longer lifespans and lower maintenance requirements, reducing replacement frequency and downtime. These improvements are expected to further lower OPEX in the next few years.

In terms of competitive positioning, electrochemical membrane systems are increasingly favored for decentralized, modular installations and industrial applications requiring tailored water quality, such as in the food & beverage, pharmaceuticals, and microelectronics sectors. Companies like Gradiant and DuPont are actively marketing modular ED and CDI units for on-site water reuse and zero liquid discharge (ZLD) applications, where the flexibility and selectivity of electrochemical processes offer distinct advantages over RO.

Looking ahead to the next few years, the cost gap between electrochemical membrane desalination and RO is expected to narrow further as economies of scale improve and new membrane chemistries are commercialized. The integration of renewable energy sources and digital monitoring platforms—areas where SUEZ and Veolia are investing—will also enhance the economic and environmental profile of these systems. As water quality regulations tighten and the demand for resource-efficient solutions grows, electrochemical membrane desalination is poised to capture a larger share of the global desalination market, particularly in niche and high-value segments.

Regulatory Environment and Industry Standards (e.g., water.org, awwa.org)

The regulatory environment for electrochemical membrane desalination systems is evolving rapidly as these technologies gain traction in addressing global water scarcity. In 2025, regulatory frameworks are increasingly focused on ensuring water quality, energy efficiency, and environmental sustainability, while also supporting innovation in desalination technologies.

Key industry standards are set and updated by organizations such as the American Water Works Association (AWWA), which provides technical standards and guidance for water treatment processes, including desalination. The AWWA’s standards address aspects such as membrane material safety, system performance, and monitoring protocols, ensuring that electrochemical membrane systems meet stringent water quality and operational benchmarks. The International Organization for Standardization (ISO) also plays a significant role, with standards like ISO 24516 and ISO 24518, which cover infrastructure and crisis management for water utilities, indirectly impacting desalination system deployment and operation.

In the United States, the U.S. Environmental Protection Agency (EPA) regulates drinking water quality under the Safe Drinking Water Act (SDWA), setting maximum contaminant levels and treatment technique requirements that desalination systems must comply with. Electrochemical membrane desalination systems, such as those using electrodialysis or capacitive deionization, are subject to these regulations, particularly regarding the removal of salts, heavy metals, and emerging contaminants. The EPA is also piloting new regulatory approaches to encourage the adoption of energy-efficient and low-waste desalination technologies, reflecting a broader policy shift toward sustainable water management.

Globally, regulatory trends are converging on the need for harmonized standards to facilitate technology transfer and international projects. The International Water Association (IWA) is actively involved in developing best practice guidelines and fostering collaboration between regulators, technology providers, and utilities. This is particularly relevant as countries in the Middle East, Asia, and Africa accelerate investments in advanced desalination to meet growing water demand.

Industry players such as DuPont and Toray Industries are working closely with regulators and standards bodies to ensure their electrochemical membrane products comply with evolving requirements. These companies are also participating in pilot projects and demonstration plants to validate system performance under real-world regulatory conditions.

Looking ahead, the regulatory environment in 2025 and beyond is expected to emphasize lifecycle sustainability, including brine management, energy consumption, and integration with renewable energy sources. As electrochemical membrane desalination systems mature, ongoing collaboration between industry, regulators, and standards organizations will be critical to ensuring safe, efficient, and environmentally responsible deployment worldwide.

Deployment Case Studies: Municipal, Industrial, and Remote Applications

Electrochemical membrane desalination systems, particularly those based on electrodialysis (ED) and capacitive deionization (CDI), are gaining traction as viable alternatives to traditional reverse osmosis (RO) in diverse applications. Their deployment in municipal, industrial, and remote settings is accelerating in 2025, driven by the need for energy efficiency, modularity, and the ability to treat brackish or low-salinity waters.

In municipal contexts, several cities are piloting or scaling up electrochemical desalination to supplement or replace conventional systems. For example, Veolia, a global leader in water technologies, has integrated electrodialysis reversal (EDR) units into municipal water treatment plants in regions with brackish groundwater, such as parts of the Middle East and North America. These systems are valued for their lower energy consumption at moderate salinities and their resilience to fouling compared to RO. In 2025, Veolia is expanding its EDR deployments in arid U.S. states, targeting small-to-medium-sized communities where water scarcity and brackish sources are prevalent.

Industrial users are also adopting electrochemical membrane systems to address specific water quality requirements and sustainability goals. SUEZ has commercialized advanced ED and EDR solutions for industries such as power generation, food and beverage, and microelectronics. In 2025, SUEZ is collaborating with semiconductor manufacturers in East Asia to deploy high-recovery ED systems for ultrapure water production, reducing both water and energy footprints. Similarly, Evoqua Water Technologies is providing modular ED units for industrial clients in the United States and Europe, focusing on zero liquid discharge (ZLD) strategies and the reuse of process water.

Remote and decentralized applications represent a rapidly growing segment for electrochemical desalination. The modularity and relatively low maintenance of ED and CDI systems make them suitable for off-grid communities, disaster relief, and military operations. Grundfos, known for its water technology innovations, is piloting solar-powered ED units in remote African villages, aiming to provide reliable drinking water from brackish wells. In Australia, DuPont is supporting the deployment of compact CDI systems for remote mining camps, where water logistics are challenging and on-site treatment is essential.

Looking ahead, the outlook for electrochemical membrane desalination is positive. Ongoing improvements in membrane materials, system automation, and hybridization with renewable energy are expected to further reduce costs and expand applicability. As regulatory and sustainability pressures mount, especially in water-stressed regions, the adoption of these systems in municipal, industrial, and remote settings is projected to accelerate through the late 2020s.

Challenges, Risks, and Barriers to Adoption

Electrochemical membrane desalination systems, such as electrodialysis (ED) and capacitive deionization (CDI), are gaining attention as alternatives to conventional reverse osmosis (RO) for water treatment. However, several challenges, risks, and barriers continue to impede their widespread adoption as of 2025 and are likely to persist in the near future.

A primary challenge is the relatively high capital and operational costs compared to established RO systems. Electrochemical systems require specialized ion-exchange membranes and electrodes, which are often more expensive and less durable than RO membranes. Membrane fouling and scaling remain significant operational risks, leading to increased maintenance and replacement costs. Companies such as Evoqua Water Technologies and SUEZ Water Technologies & Solutions—both active in membrane and electrochemical water treatment—have highlighted the need for more robust, fouling-resistant materials to improve system longevity and reduce lifecycle costs.

Energy consumption is another critical barrier. While electrochemical systems can be more energy-efficient for brackish water desalination or selective ion removal, their energy requirements for seawater desalination remain higher than those of advanced RO systems. This limits their competitiveness in large-scale municipal or industrial applications, where energy costs are a decisive factor. DuPont, a major supplier of ion-exchange membranes, continues to invest in research to lower energy demands, but breakthroughs are still needed for parity with RO in high-salinity contexts.

Technical complexity and system integration also pose risks. Electrochemical desalination systems require precise control of voltage, current, and flow rates, as well as sophisticated monitoring to prevent membrane degradation and ensure water quality. This complexity can deter adoption, especially in regions lacking skilled operators or robust technical support infrastructure. Companies like Grundfos and Xylem, which provide integrated water treatment solutions, are working to simplify system interfaces and automate operations, but widespread deployment will require further advances in user-friendly design.

Regulatory and market acceptance barriers also persist. Electrochemical desalination is less familiar to regulators and end-users than RO, leading to slower permitting processes and hesitancy in procurement. Demonstration projects and third-party validation are needed to build confidence in system reliability and water quality outcomes. Industry organizations such as the International Desalination Association are promoting knowledge exchange and standardization, but broader acceptance will take time.

In summary, while electrochemical membrane desalination systems offer promising advantages for specific applications, overcoming cost, energy, technical, and regulatory barriers will be essential for broader adoption in the coming years.

Future Outlook: Disruptive Trends and Strategic Opportunities Through 2030

Electrochemical membrane desalination systems are poised for significant advancements and market expansion through 2030, driven by the urgent need for sustainable water solutions and the limitations of conventional reverse osmosis (RO) technologies. These systems, which include electrodialysis (ED), capacitive deionization (CDI), and emerging hybrid platforms, leverage electric fields and selective membranes to remove ions from saline water with potentially lower energy consumption and greater selectivity for specific contaminants.

As of 2025, several industry leaders and technology developers are accelerating the commercialization of next-generation electrochemical desalination. Evoqua Water Technologies, a major player in water treatment, continues to expand its electrodialysis offerings, targeting industrial and municipal applications where brackish water desalination and water reuse are critical. SUEZ and Veolia are also investing in advanced membrane materials and modular system designs, aiming to improve energy efficiency and operational flexibility. These companies are increasingly integrating digital monitoring and automation to optimize system performance and reduce maintenance costs.

A disruptive trend is the rapid development of novel ion-exchange membranes and electrode materials, which are expected to significantly lower the energy footprint of electrochemical desalination. Companies such as DuPont are at the forefront of membrane innovation, focusing on enhanced selectivity, fouling resistance, and durability. The integration of renewable energy sources, such as solar and wind, with electrochemical desalination units is also gaining traction, particularly in off-grid and remote settings where conventional RO is less viable.

Strategically, the sector is witnessing increased collaboration between technology developers, utilities, and industrial end-users to pilot and scale up electrochemical systems. For example, ElectroScan Inc. is working on advanced monitoring solutions to ensure membrane integrity and system reliability, which is crucial for large-scale deployment. The Middle East, North America, and parts of Asia are emerging as key markets, driven by water scarcity, regulatory pressures, and the need for decentralized water treatment solutions.

Looking ahead to 2030, the outlook for electrochemical membrane desalination is robust. Continued improvements in membrane chemistry, system integration, and digitalization are expected to drive down costs and expand the addressable market. Strategic opportunities exist in industrial water reuse, zero-liquid discharge (ZLD) applications, and the treatment of challenging feedwaters, such as produced water from oil and gas operations. As governments and industries seek resilient and sustainable water infrastructure, electrochemical membrane desalination systems are well-positioned to play a transformative role in the global water sector.

Sources & References

- Veolia

- SUEZ

- DuPont

- Aquaporin

- Aker Carbon Capture

- Toray Industries

- Zydemy

- ADAES

- Siemens

- American Water Works Association

- International Organization for Standardization

- International Water Association

- International Desalination Association

- ElectroScan Inc.