Revolutionizing Analysis: High-Speed Terahertz Spectroscopy Technologies in 2025 and Beyond. Explore Market Growth, Disruptive Innovations, and the Future of Ultra-Fast Sensing.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Technology Overview: Principles of High-Speed Terahertz Spectroscopy

- Major Players and Industry Ecosystem (e.g., thzsystems.com, menlosystems.com, teraview.com)

- Current Applications: Materials Science, Security, and Biomedical Sectors

- Emerging Innovations: Next-Gen Sources, Detectors, and Integration

- Market Size and Growth Forecast (2025–2030): CAGR Analysis and Projections

- Regional Trends: North America, Europe, Asia-Pacific, and Global Hotspots

- Challenges: Technical Barriers, Standardization, and Cost Factors

- Future Outlook: Disruptive Use Cases and Commercialization Pathways

- Conclusion and Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

High-speed terahertz (THz) spectroscopy technologies are poised for significant growth and innovation in 2025, driven by advances in photonics, electronics, and materials science. The global market is witnessing increased adoption of THz systems across sectors such as semiconductor inspection, pharmaceutical quality control, security screening, and advanced materials research. The demand for faster, more sensitive, and compact THz spectrometers is accelerating, with industry leaders and emerging players investing in next-generation solutions.

Key drivers for the 2025 market include the miniaturization of THz components, integration with artificial intelligence for real-time data analysis, and the expansion of industrial and biomedical applications. The development of high-speed, broadband THz sources and detectors—such as quantum cascade lasers and photoconductive antennas—has enabled rapid, non-destructive testing and imaging at unprecedented resolutions. Companies like TOPTICA Photonics and Menlo Systems are at the forefront, offering turnkey THz time-domain and frequency-domain spectrometers with sub-picosecond temporal resolution and high dynamic range, targeting both research and industrial markets.

In 2025, the semiconductor industry remains a major adopter, leveraging high-speed THz spectroscopy for wafer inspection, defect analysis, and process control. The ability of THz waves to penetrate non-conductive materials without causing damage is particularly valuable for inline quality assurance. Advantest Corporation, a global leader in semiconductor test equipment, has expanded its THz-based inspection solutions, reflecting the sector’s growing reliance on these technologies.

Pharmaceutical and biomedical applications are also expanding, with THz spectroscopy enabling rapid, label-free analysis of drug formulations, polymorph detection, and even early disease diagnostics. Companies such as TOPTICA Photonics and Menlo Systems are collaborating with research institutions to develop portable, high-throughput THz systems for clinical and laboratory use.

Looking ahead, the market outlook for high-speed THz spectroscopy technologies in 2025 and beyond is robust. Ongoing R&D is expected to yield more affordable, user-friendly systems, further lowering barriers to adoption. The convergence of THz spectroscopy with machine learning and automation will drive new use cases in smart manufacturing, security, and life sciences. As standardization efforts progress and component costs decline, the sector is set for sustained double-digit growth, with established players and innovative startups alike shaping the future landscape.

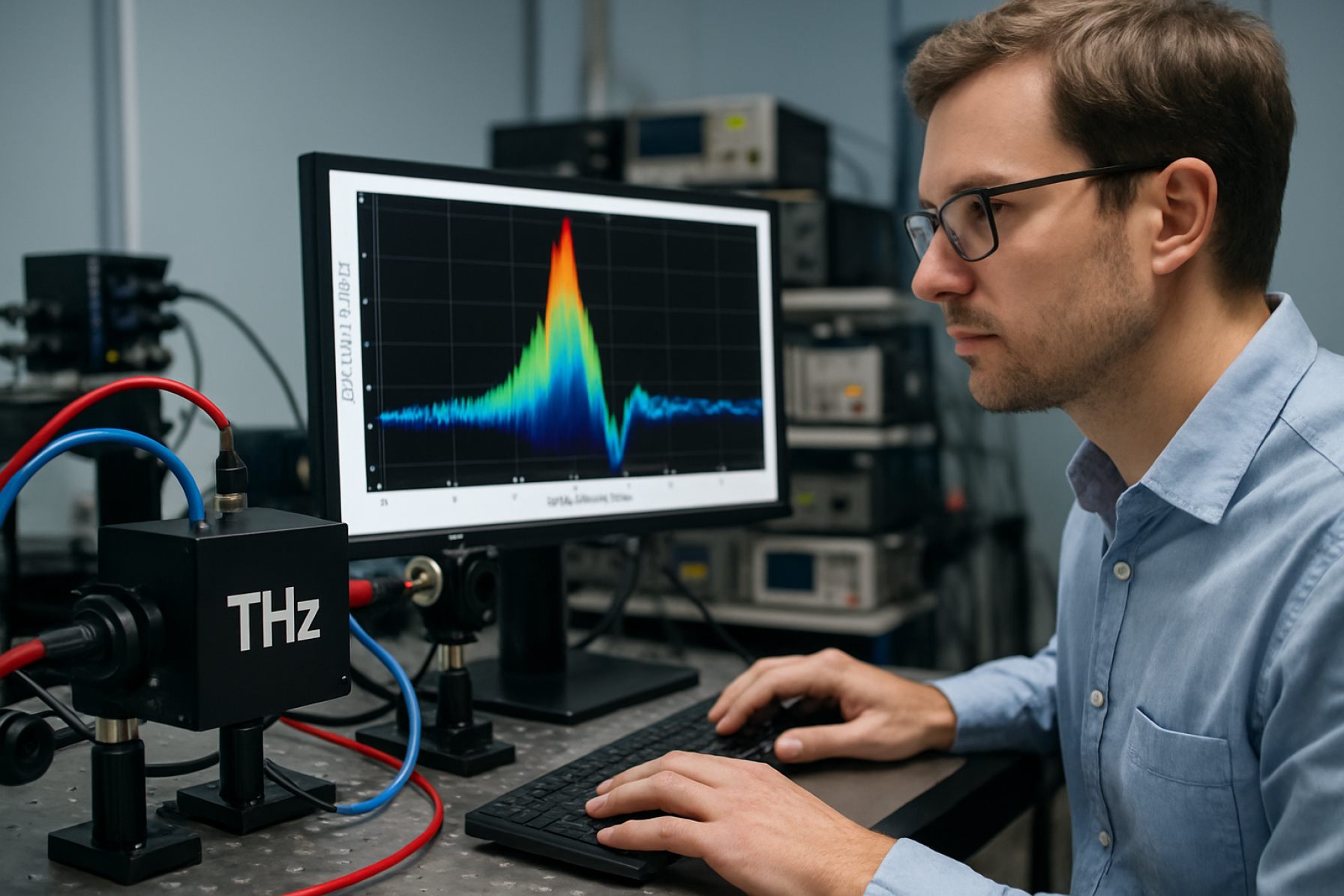

Technology Overview: Principles of High-Speed Terahertz Spectroscopy

High-speed terahertz (THz) spectroscopy technologies are rapidly advancing, driven by the demand for ultrafast, non-destructive analysis in fields such as materials science, semiconductor inspection, and biomedical diagnostics. Terahertz radiation, occupying the frequency range between microwave and infrared (0.1–10 THz), enables unique spectroscopic capabilities due to its sensitivity to molecular vibrations, rotational transitions, and carrier dynamics in solids. The core principle of high-speed THz spectroscopy involves generating, manipulating, and detecting short pulses or continuous waves of THz radiation, then analyzing their interaction with materials to extract spectral information at unprecedented speeds.

Recent years have seen significant progress in both time-domain and frequency-domain THz spectroscopy systems. Time-domain THz spectroscopy (THz-TDS) remains the dominant approach for high-speed applications, leveraging femtosecond lasers to generate and detect broadband THz pulses. Innovations in photoconductive antennas, such as those developed by TOPTICA Photonics and Menlo Systems, have enabled higher repetition rates and improved signal-to-noise ratios, supporting real-time measurements and rapid data acquisition. These advances are complemented by the integration of fiber-coupled components and compact, turnkey systems, making THz-TDS more accessible for industrial and laboratory environments.

On the frequency-domain front, continuous-wave (CW) THz spectroscopy technologies are gaining traction for high-speed, high-resolution applications. Companies like TOPTICA Photonics and TeraView are pioneering dual-laser photomixing techniques, which allow for rapid frequency sweeps and precise spectral measurements. These systems are particularly valuable for applications requiring fine spectral resolution, such as gas sensing and thin-film characterization.

A key trend in 2025 is the push toward higher acquisition speeds and real-time imaging. Emerging systems now achieve measurement rates exceeding several kilohertz, enabling dynamic studies of fast processes and in-line quality control in manufacturing. For example, TeraView and Menlo Systems have introduced platforms capable of high-throughput, non-contact inspection of electronic components and pharmaceutical products. These advances are underpinned by improvements in data processing algorithms, leveraging machine learning and advanced signal processing to extract meaningful information from large, rapidly acquired datasets.

Looking ahead, the outlook for high-speed THz spectroscopy technologies is robust. Ongoing research focuses on further miniaturization, integration with automated systems, and the development of new THz sources and detectors with broader bandwidths and higher sensitivities. As the ecosystem matures, collaborations between technology providers, such as TOPTICA Photonics, Menlo Systems, and TeraView, and end-users in semiconductor, pharmaceutical, and security sectors are expected to accelerate the adoption of high-speed THz spectroscopy as a standard analytical tool.

Major Players and Industry Ecosystem (e.g., thzsystems.com, menlosystems.com, teraview.com)

The high-speed terahertz (THz) spectroscopy sector is characterized by a dynamic ecosystem of specialized manufacturers, system integrators, and component suppliers, each contributing to the rapid evolution of this advanced technology. As of 2025, the industry is witnessing accelerated innovation, driven by increasing demand for faster, more sensitive, and robust THz systems across applications such as semiconductor inspection, pharmaceutical quality control, and security screening.

Among the most prominent players, Menlo Systems stands out for its pioneering work in femtosecond laser-based THz time-domain spectroscopy (THz-TDS) systems. The company’s solutions are widely adopted in both academic and industrial research, offering high-speed data acquisition and precise material characterization. Menlo Systems’ continuous investment in compact, turnkey THz platforms has positioned it as a leader in enabling real-time, high-throughput measurements.

Another key innovator is TeraView, recognized for its proprietary terahertz imaging and spectroscopy technologies. TeraView’s systems are deployed globally for non-destructive testing and quality assurance, particularly in the electronics and pharmaceutical sectors. The company’s focus on high-speed, automated THz inspection aligns with the growing need for rapid, inline process control in manufacturing environments.

Emerging companies such as THz Systems are also making significant contributions, particularly in the development of modular, scalable THz platforms tailored for industrial integration. Their emphasis on user-friendly interfaces and compatibility with existing automation infrastructure is helping to lower the barrier for THz adoption in production lines.

The industry ecosystem is further supported by component specialists like TOPTICA Photonics, which supplies ultrafast lasers and photonic components essential for high-speed THz generation and detection. Their collaborations with system integrators and research institutions are accelerating the commercialization of next-generation THz solutions.

Looking ahead, the sector is expected to see intensified collaboration between hardware manufacturers, software developers, and end-users to address challenges such as data processing speed, system miniaturization, and cost reduction. The integration of artificial intelligence and machine learning for real-time spectral analysis is anticipated to further enhance the capabilities of high-speed THz spectroscopy systems. As these technologies mature, the ecosystem will likely expand to include more cross-industry partnerships, driving broader adoption and new application domains through 2025 and beyond.

Current Applications: Materials Science, Security, and Biomedical Sectors

High-speed terahertz (THz) spectroscopy technologies are rapidly advancing, with significant applications emerging across materials science, security, and biomedical sectors as of 2025. These systems leverage the unique properties of THz radiation—such as non-ionizing energy and sensitivity to molecular vibrations—to enable non-destructive, high-resolution analysis at unprecedented speeds.

In materials science, high-speed THz spectroscopy is increasingly used for real-time quality control and characterization of polymers, semiconductors, and composite materials. The ability to probe sub-surface features and detect defects without damaging samples is particularly valuable in electronics and advanced manufacturing. Companies like TOPTICA Photonics and Menlo Systems are at the forefront, offering ultrafast THz time-domain spectrometers capable of rapid data acquisition and integration into automated production lines. These systems are being adopted by manufacturers for inline inspection, thickness measurement, and detection of delamination or voids in multilayer structures.

Security applications are also benefiting from the maturation of high-speed THz spectroscopy. The technology’s ability to penetrate clothing and packaging, while distinguishing between different chemical substances, makes it ideal for detecting explosives, narcotics, and concealed weapons at security checkpoints. Terasense Group and BAE Systems are developing portable and fixed THz imaging and spectroscopy solutions for airports, border control, and critical infrastructure protection. These systems are designed for rapid screening, with acquisition times reduced to fractions of a second, enabling high-throughput operation without compromising safety or privacy.

In the biomedical sector, high-speed THz spectroscopy is opening new avenues for non-invasive diagnostics and real-time tissue analysis. The technology’s sensitivity to water content and molecular composition allows for early detection of cancerous tissues, monitoring of wound healing, and analysis of pharmaceutical compounds. TOPTICA Photonics and Menlo Systems are collaborating with research hospitals and pharmaceutical companies to develop compact, user-friendly THz systems for clinical and laboratory environments. These efforts are expected to accelerate in the next few years, with ongoing clinical trials and regulatory evaluations.

Looking ahead, the outlook for high-speed THz spectroscopy technologies is robust. Continued improvements in source power, detector sensitivity, and data processing algorithms are expected to further reduce acquisition times and expand the range of detectable materials. As costs decrease and system integration improves, adoption across materials science, security, and biomedical sectors is projected to accelerate, making THz spectroscopy a cornerstone of next-generation analytical and diagnostic platforms.

Emerging Innovations: Next-Gen Sources, Detectors, and Integration

The landscape of high-speed terahertz (THz) spectroscopy is undergoing rapid transformation, driven by advances in source generation, detector sensitivity, and system integration. As of 2025, the push for higher data acquisition rates, broader bandwidths, and compact, robust platforms is shaping the next generation of THz spectroscopy technologies.

A key area of innovation is the development of high-power, broadband THz sources. Quantum cascade lasers (QCLs) have emerged as leading candidates for compact, electrically pumped THz emitters, with companies such as Menlo Systems and TOPTICA Photonics advancing commercial QCL modules that operate at higher temperatures and with improved output power. These sources are enabling real-time, high-resolution spectroscopy in both laboratory and industrial environments. Meanwhile, photoconductive antennas and nonlinear optical crystals remain central to time-domain THz systems, with ongoing improvements in materials and fabrication techniques enhancing their efficiency and bandwidth.

On the detection front, innovations in ultrafast photodetectors and electro-optic sampling are pushing the limits of sensitivity and speed. Hamamatsu Photonics and Laser Components are notable for their work in developing low-noise, high-speed detectors tailored for THz frequencies. These advances are critical for applications requiring rapid, high-fidelity spectral acquisition, such as quality control in manufacturing and real-time biomedical diagnostics.

Integration and miniaturization are also at the forefront, with a growing emphasis on turnkey, user-friendly THz spectroscopy systems. Companies like TOPTICA Photonics and Menlo Systems are offering modular platforms that combine sources, detectors, and control electronics in compact footprints, facilitating deployment outside specialized research labs. The integration of fiber-coupled components and advanced digital signal processing is further enhancing system robustness and ease of use.

Looking ahead, the next few years are expected to see the commercialization of chip-scale THz spectrometers, leveraging advances in silicon photonics and microfabrication. Collaborative efforts between industry and academia are accelerating the translation of laboratory breakthroughs into practical devices. The outlook for 2025 and beyond points to broader adoption of high-speed THz spectroscopy across sectors such as pharmaceuticals, security screening, and wireless communications, driven by ongoing innovation from established players and emerging startups alike.

Market Size and Growth Forecast (2025–2030): CAGR Analysis and Projections

The global market for high-speed terahertz (THz) spectroscopy technologies is poised for robust growth between 2025 and 2030, driven by expanding applications in pharmaceuticals, security screening, materials characterization, and semiconductor inspection. As of 2025, the market is characterized by increasing adoption of advanced THz systems capable of rapid, non-destructive analysis, with leading manufacturers and research institutions accelerating commercialization efforts.

Key industry players such as TOPTICA Photonics AG, Menlo Systems GmbH, and Baker Hughes (through its Panametrics division) are actively developing and supplying high-speed THz spectroscopy solutions. These companies are investing in innovations that enhance spectral resolution, acquisition speed, and system integration, targeting both laboratory and industrial environments. For instance, TOPTICA Photonics AG has introduced compact, turnkey THz platforms designed for real-time quality control and process monitoring, while Menlo Systems GmbH continues to advance fiber-based THz time-domain spectrometers for high-throughput applications.

The compound annual growth rate (CAGR) for the high-speed THz spectroscopy market is projected to range between 18% and 24% from 2025 to 2030, according to industry consensus and company forecasts. This acceleration is underpinned by the increasing demand for rapid, contactless inspection in semiconductor manufacturing, where THz systems are used for wafer analysis and defect detection. Additionally, pharmaceutical companies are adopting THz spectroscopy for polymorph identification and tablet coating inspection, further expanding the addressable market.

Geographically, North America and Europe are expected to maintain leadership in both technology development and market adoption, supported by strong R&D ecosystems and government funding initiatives. However, significant growth is anticipated in Asia-Pacific, particularly in Japan, South Korea, and China, where investments in advanced manufacturing and quality assurance are driving demand for high-speed THz solutions. Companies such as Hamamatsu Photonics K.K. are notable for their contributions to THz component and system development in the region.

Looking ahead, the market outlook for 2025–2030 is shaped by ongoing improvements in source power, detector sensitivity, and system miniaturization. As THz spectroscopy technologies become more accessible and cost-effective, adoption is expected to accelerate across new verticals, including food safety, aerospace, and biomedical diagnostics. Strategic partnerships between equipment manufacturers, end-users, and research institutions will likely play a pivotal role in scaling deployment and unlocking new applications for high-speed THz spectroscopy worldwide.

Regional Trends: North America, Europe, Asia-Pacific, and Global Hotspots

High-speed terahertz (THz) spectroscopy technologies are experiencing rapid regional development, with North America, Europe, and Asia-Pacific emerging as key innovation and commercialization hubs. In 2025, these regions are characterized by robust research ecosystems, government-backed initiatives, and a growing presence of specialized companies driving the adoption of THz solutions for applications in materials analysis, security screening, and biomedical diagnostics.

North America remains a global leader, propelled by a strong base of academic research and industrial partnerships. The United States, in particular, is home to pioneering firms such as Tydex (with US distribution), which supplies THz optics and components, and TeraView, a UK-based company with significant North American operations, offering high-speed THz imaging and spectroscopy systems. The region benefits from federal funding for advanced photonics and quantum technologies, with agencies like the National Science Foundation and Department of Energy supporting THz research infrastructure. In Canada, universities and startups are increasingly collaborating to translate THz innovations into commercial products, especially for non-destructive testing and pharmaceutical quality control.

Europe is distinguished by its coordinated research frameworks and cross-border collaborations. Germany, the UK, and France are at the forefront, with companies such as Menlo Systems (Germany) and TOPTICA Photonics (Germany) delivering high-speed THz time-domain and frequency-domain spectrometers. The European Union’s Horizon Europe program continues to fund large-scale projects focused on THz communications and sensing, fostering a vibrant ecosystem of startups and established players. The region is also seeing increased deployment of THz systems in industrial quality assurance and cultural heritage conservation.

Asia-Pacific is rapidly expanding its THz capabilities, led by Japan, China, and South Korea. Japanese firms such as Hamamatsu Photonics are advancing THz detector and source technologies, while China’s investment in photonics and semiconductor manufacturing is accelerating the development of cost-effective, high-speed THz modules. South Korea’s focus on 6G wireless research is driving demand for THz spectroscopy in communications and device testing. Regional governments are supporting THz research through dedicated funding and the establishment of national laboratories.

Globally, hotspots are emerging in regions with strong semiconductor and photonics industries, such as Taiwan and Israel, where local companies are beginning to enter the THz market. The outlook for 2025 and beyond points to increased standardization, broader adoption in industrial and medical sectors, and ongoing competition to achieve higher speeds, greater sensitivity, and more compact THz spectroscopy systems.

Challenges: Technical Barriers, Standardization, and Cost Factors

High-speed terahertz (THz) spectroscopy technologies are advancing rapidly, but several significant challenges remain as the sector moves through 2025 and into the following years. These challenges span technical barriers, standardization issues, and cost factors, all of which impact the broader adoption and commercialization of THz systems.

Technical Barriers: One of the primary technical hurdles is the generation and detection of high-power, broadband THz signals with sufficient signal-to-noise ratio for real-world applications. While photoconductive antennas and nonlinear optical crystals have improved, their efficiency and operational bandwidth are still limited. Leading manufacturers such as TOPTICA Photonics and Menlo Systems are actively developing more robust femtosecond laser sources and compact THz emitters, but challenges remain in scaling these solutions for industrial environments. Additionally, the integration of THz components into compact, user-friendly systems is hindered by the sensitivity of THz waves to environmental factors such as humidity and temperature, which can degrade measurement accuracy.

Standardization: The lack of universally accepted standards for THz spectroscopy systems is another barrier. Without standardized measurement protocols, calibration procedures, and data formats, interoperability between devices from different manufacturers is limited. Industry groups and consortia, including the IEEE, are beginning to address these gaps, but as of 2025, comprehensive standards for high-speed THz spectroscopy are still in development. This lack of standardization complicates regulatory approval and slows the adoption of THz technologies in sectors such as pharmaceuticals, security screening, and semiconductor inspection.

Cost Factors: The high cost of key components—such as ultrafast lasers, sensitive detectors, and precision optics—remains a significant barrier to widespread deployment. Companies like TOPTICA Photonics and Menlo Systems have made progress in reducing costs through system integration and volume manufacturing, but THz spectroscopy systems are still priced beyond the reach of many potential users, especially in academic and small industrial settings. The need for highly skilled personnel to operate and maintain these systems further adds to the total cost of ownership.

Outlook: Looking ahead, ongoing research and collaboration between industry leaders, component suppliers, and standardization bodies are expected to gradually address these challenges. Advances in semiconductor-based THz sources and detectors, as pursued by companies like Hamamatsu Photonics, may help lower costs and improve system robustness. However, significant technical and economic barriers are likely to persist through the next few years, shaping the pace and direction of high-speed THz spectroscopy adoption.

Future Outlook: Disruptive Use Cases and Commercialization Pathways

High-speed terahertz (THz) spectroscopy technologies are poised for significant breakthroughs and commercialization in 2025 and the following years, driven by advances in photonics, electronics, and materials science. The unique ability of THz waves to probe molecular structures, non-destructively inspect materials, and enable ultra-fast data acquisition is catalyzing disruptive use cases across multiple industries.

In the semiconductor and electronics sector, THz spectroscopy is rapidly gaining traction for non-contact, high-resolution inspection of integrated circuits and advanced packaging. Companies such as TOPTICA Photonics and Menlo Systems are at the forefront, offering high-speed THz time-domain spectroscopy (TDS) systems capable of sub-picosecond temporal resolution. These systems are being adopted for inline quality control and failure analysis, with expectations that by 2025, integration into semiconductor fabs will become more widespread as throughput and automation improve.

In pharmaceuticals and chemical manufacturing, THz spectroscopy is emerging as a disruptive tool for real-time process monitoring and polymorph detection. TOPTICA Photonics and University of Bristol spinouts are developing compact, high-speed THz systems for deployment in production environments, enabling rapid, non-destructive analysis of solid-state formulations and coatings. The ability to monitor crystallinity and hydration states in real time is expected to streamline quality assurance and regulatory compliance, with pilot deployments anticipated in 2025.

Security and defense applications are also set to benefit from high-speed THz spectroscopy. Terahertz Systems and TOPTICA Photonics are advancing portable THz imaging and spectroscopy platforms for concealed threat detection and material identification at security checkpoints. The high acquisition speed and spectral specificity of these systems are expected to enable rapid, non-invasive screening of people and parcels, with field trials and early commercial rollouts projected in the next few years.

Looking ahead, the commercialization pathway for high-speed THz spectroscopy will be shaped by continued miniaturization, cost reduction, and integration with AI-driven data analytics. Industry leaders such as TOPTICA Photonics, Menlo Systems, and Terahertz Systems are investing in scalable manufacturing and software ecosystems to support broader adoption. As regulatory frameworks evolve and end-user awareness grows, high-speed THz spectroscopy is expected to transition from niche research applications to mainstream industrial, medical, and security solutions by the late 2020s.

Conclusion and Strategic Recommendations for Stakeholders

High-speed terahertz (THz) spectroscopy technologies are poised to play a transformative role across multiple industries in 2025 and the coming years. The rapid evolution of THz sources, detectors, and system integration is enabling unprecedented measurement speeds, higher sensitivity, and broader application scopes. As the market matures, stakeholders—including manufacturers, research institutions, end-users, and policymakers—must strategically position themselves to leverage these advancements.

Key industry leaders such as TOPTICA Photonics, Menlo Systems, and TeraView are driving innovation by commercializing compact, robust, and high-speed THz spectroscopy platforms. These companies are focusing on improving system bandwidth, real-time data acquisition, and user-friendly interfaces, which are critical for adoption in sectors like semiconductor inspection, pharmaceutical quality control, and security screening. For example, TOPTICA Photonics has introduced turnkey THz time-domain systems with sub-picosecond resolution, while Menlo Systems is advancing fiber-based THz sources for industrial integration.

Strategically, stakeholders should prioritize the following recommendations:

- Investment in R&D: Continued investment in THz component miniaturization, faster electronics, and advanced data processing algorithms will be essential. Collaborations with technology providers like TOPTICA Photonics and Menlo Systems can accelerate innovation cycles.

- Standardization and Interoperability: Active participation in industry consortia and standards bodies will help ensure interoperability and facilitate regulatory acceptance, especially as THz systems move from research labs to industrial environments.

- Application-Driven Development: Engaging closely with end-users in pharmaceuticals, electronics, and security will help tailor THz solutions to real-world challenges, driving faster adoption and return on investment.

- Workforce Training: Upskilling technical staff to operate and interpret high-speed THz systems is crucial. Partnerships with academic and training organizations can bridge the skills gap.

- Global Collaboration: International cooperation, including joint ventures and knowledge exchange, will be vital for overcoming technical barriers and expanding market reach.

Looking ahead, the outlook for high-speed THz spectroscopy is robust. As system costs decrease and performance improves, broader deployment in quality assurance, non-destructive testing, and biomedical diagnostics is expected. Stakeholders who proactively invest in technology, partnerships, and workforce development will be best positioned to capitalize on the expanding opportunities in this dynamic field.

Sources & References

- TOPTICA Photonics

- Menlo Systems

- Advantest Corporation

- TeraView

- Terasense Group

- Hamamatsu Photonics

- Laser Components

- Baker Hughes

- Tydex

- IEEE

- University of Bristol

- TeraView