How Flexible X-ray Fluorescence Spectroscopy Equipment Will Redefine Materials Analysis in 2025—And What’s Next for This Fast-Evolving Industry. Uncover Market Dynamics, Tech Shifts, and Key Players Shaping the Future.

- Executive Summary: 2025 Outlook and Key Takeaways

- Market Size & Growth Forecast: 2025–2030

- Key Drivers: Demand, Applications, and Industry Trends

- Technological Innovations in Flexible XRF Systems

- Competitive Landscape: Leading Manufacturers and New Entrants

- Supply Chain & Manufacturing Challenges

- End-User Segments: Emerging Markets and Use Cases

- Regulatory Environment and Standards (e.g., ISO, ASTM)

- Investment, M&A, and Partnership Trends

- Future Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Outlook and Key Takeaways

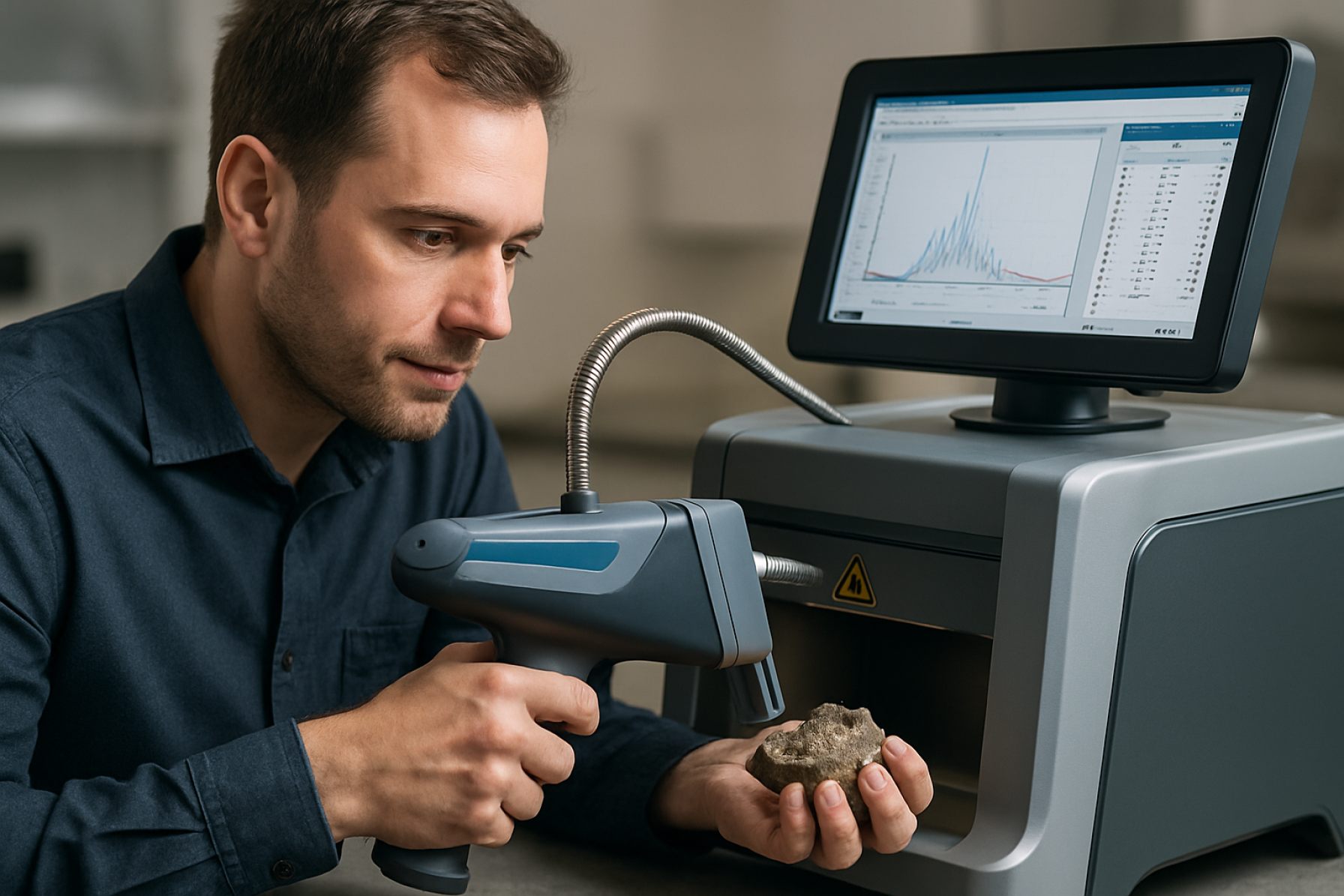

The manufacturing landscape for flexible X-ray fluorescence (XRF) spectroscopy equipment is undergoing significant transformation in 2025, shaped by technological advancements, evolving end-user demands, and intensifying global competition. XRF, a non-destructive analytical technique used to determine elemental composition, has traditionally relied on benchtop or laboratory-based systems. However, 2025 marks a pivotal year as leading manufacturers accelerate the production and commercialization of flexible, portable, and even handheld XRF devices, broadening market reach across mining, environmental science, energy, and recycling sectors.

Key industry players such as Olympus Corporation, known for its Vanta series, and Bruker Corporation, with its S1 TITAN and TRACER models, have reported increased investments in miniaturization and ruggedization technologies. These innovations respond directly to industry demands for real-time, in-field analysis capabilities, especially in mining exploration and industrial quality control. In parallel, Thermo Fisher Scientific continues to expand its Niton series, focusing on enhanced user interfaces and cloud connectivity to improve data management and remote diagnostics.

Recent years have seen a shift from purely stationary systems toward highly adaptable formats. Flexible XRF solutions now integrate wireless communication, advanced battery technology, and ergonomic design, enabling deployment in challenging environments and remote locations. The ongoing improvements in detector technology, such as silicon drift detectors (SDDs), have further increased sensitivity and speed, making portable XRF a viable alternative for many routine laboratory applications.

Strategic partnerships and cross-industry collaborations are emerging as a hallmark of the sector in 2025. Manufacturers are working closely with raw material suppliers and software developers to co-create bespoke solutions for sector-specific analytical needs. For instance, Hitachi High-Tech Corporation is leveraging its expertise in precision instrumentation to develop compact, highly sensitive XRF analyzers tailored for electronics recycling and environmental monitoring.

Looking ahead, the outlook for flexible XRF spectroscopy equipment manufacturing remains robust. Demand is forecasted to rise as regulatory pressures on waste management and resource efficiency tighten globally. Additionally, advancements in machine learning and data analytics are expected to be increasingly integrated into next-generation XRF devices, enhancing predictive maintenance and providing deeper insights into elemental analyses.

- Rapid expansion in portable and flexible XRF device offerings by leading manufacturers.

- Technological focus on miniaturization, sensitivity, wireless communication, and cloud integration.

- Increased cross-industry partnerships to develop application-specific solutions.

- Positive growth outlook driven by regulatory trends and digital transformation within core end-user industries.

Market Size & Growth Forecast: 2025–2030

The market for flexible X-ray fluorescence (XRF) spectroscopy equipment is positioned for accelerated growth from 2025 through 2030, driven by ongoing advancements in material science, miniaturization of analytical technologies, and increased demand across diverse end-use sectors. Flexible XRF devices, distinct for their portability and adaptable form factors, are enabling real-time, nondestructive elemental analysis in settings that previously relied on stationary laboratory instruments.

Key manufacturers such as Olympus IMS, Bruker Corporation, and Hitachi High-Tech Corporation are investing in the development of lightweight, battery-powered XRF analyzers optimized for on-site applications. The competitive landscape is further characterized by innovation in detector technologies, enhanced software capabilities, and integration with wireless data platforms, all aimed at improving accuracy and ease of use.

Several factors are expected to propel market expansion during this period:

- Industrial and Environmental Applications: Expanding regulatory oversight in mining, metal recycling, environmental monitoring, and food safety sectors is fueling adoption of flexible XRF solutions. These instruments provide rapid, in-field elemental analysis, meeting compliance standards and supporting traceability.

- Technological Miniaturization: Companies such as Thermo Fisher Scientific and SPECTRO Analytical Instruments are focusing on shrinking detector and source components, making handheld and wearable XRF units more accessible and affordable for small and medium-sized enterprises.

- Emerging Markets: Growth in Asia-Pacific and Latin America is notable, with infrastructure development and manufacturing expansion creating new opportunities for deployment of flexible XRF equipment. Localized manufacturing and distribution strategies by firms like Oxford Instruments are supporting this trend.

Although the market size for flexible XRF equipment is a subset of the broader XRF instrumentation sector, industry consensus points to a robust compound annual growth rate (CAGR), potentially in the high single digits, through 2030. The continuous influx of new portable models and enhanced analytical capabilities are anticipated to widen the addressable market. By 2030, flexible XRF systems are expected to account for a significantly larger share of total XRF equipment sales, as end-users prioritize mobility, safety, and efficiency in analytical workflows.

Key Drivers: Demand, Applications, and Industry Trends

The manufacturing landscape for flexible X-ray fluorescence (XRF) spectroscopy equipment is evolving rapidly in 2025, influenced by a convergence of technological innovation, expanding application fields, and shifting industrial demands. Key drivers propelling this sector include the increasing requirement for portable and adaptable analytical solutions across varied industries such as mining, environmental monitoring, recycling, and advanced materials research.

Demand is particularly strong in sectors seeking in-situ and on-the-go elemental analysis. Industries like mining and metals have adopted flexible XRF equipment to enable rapid ore grading and process control, minimizing downtime and reducing reliance on laboratory-based analysis. Environmental monitoring agencies are also leveraging the portability and sensitivity of flexible XRF devices for soil, water, and air quality assessments, responding to heightened regulatory demands and sustainability goals.

Flexible XRF manufacturing is further catalyzed by the ongoing miniaturization of X-ray sources and detectors, coupled with advancements in battery technology and wireless connectivity. These innovations are enabling manufacturers to produce lighter, more ergonomic, and increasingly rugged systems. Industry leaders such as Olympus Corporation and Bruker Corporation are actively developing handheld and portable XRF devices that combine high analytical performance with user-friendly interfaces and robust data management features. Thermo Fisher Scientific has similarly expanded its portfolio with flexible solutions tailored for field applications and harsh environments.

A notable trend in 2025 is the integration of XRF systems with digital platforms and cloud-based data analytics, allowing for real-time sharing and interpretation of results. This is particularly advantageous for multinational operations and distributed research teams, as it supports central oversight and rapid decision-making. Another emerging application is in the recycling sector, where flexible XRF equipment is increasingly employed for rapid sorting and verification of scrap materials, supporting circular economy initiatives and compliance with environmental regulations.

Looking ahead, the outlook for flexible XRF equipment manufacturing remains robust, with anticipated growth driven by demand for sustainability, efficiency, and precision analytics. Companies are expected to invest further in R&D, with a focus on improving detection limits, expanding the range of analyzable elements, and enhancing connectivity. As ESG (Environmental, Social, Governance) considerations become more central to industrial operations, flexible XRF solutions are poised to play a vital role in enabling compliance and innovation across a broad spectrum of industries.

Technological Innovations in Flexible XRF Systems

The landscape of flexible X-ray fluorescence (XRF) spectroscopy equipment manufacturing is undergoing rapid technological evolution in 2025, driven by the demand for portable, adaptable, and high-precision material analysis tools. Major manufacturers are focusing on the miniaturization and ruggedization of XRF analyzers, enabling their deployment across a broader range of environments, including fieldwork in mining, recycling, environmental monitoring, and industrial process control.

A central innovation is the integration of advanced silicon drift detectors (SDDs) and digital signal processing, which yield faster acquisition times and improved sensitivity for trace elements. Leading firms such as Olympus Corporation and Hitachi High-Tech Corporation are scaling up their production of handheld and portable XRF devices that maintain laboratory-grade precision while withstanding variable field conditions. These systems are being equipped with cloud connectivity and smart data management, allowing seamless results transfer, remote diagnostics, and integration into larger digital ecosystems for real-time decision-making.

Flexible form factors are another area of active development. Companies like Bruker Corporation are pioneering benchtop and portable XRF instruments with modular sample stages and interchangeable collimators or detectors, supporting analysis of irregular, large, or in-situ samples. In parallel, Thermo Fisher Scientific is advancing wireless and battery-operated XRF platforms, expanding the usability of XRF technology in locations with challenging logistics or limited infrastructure.

Recent years have also seen the emergence of flexible XRF components, including bendable thin-film windows and flexible printed circuit boards, which contribute to lighter and more adaptable equipment. These advances are anticipated to be particularly beneficial in sectors such as aerospace and electronics, where non-destructive analysis of complex-shaped components is crucial.

- In 2025, manufacturers are incorporating artificial intelligence and machine learning algorithms to automate calibration, enhance spectral interpretation, and reduce operator error, thus further democratizing XRF usage.

- Green manufacturing practices—such as the use of recyclable materials and energy-efficient production lines—are gaining traction as sustainability becomes a strategic objective for XRF equipment makers.

- Global supply chain resilience is a continued focus, with firms diversifying component sourcing and establishing regional assembly hubs to mitigate disruptions.

Looking forward, the flexible XRF equipment sector is expected to benefit from cross-industry partnerships and co-development with sensor, software, and materials innovators. As regulatory standards for material traceability and environmental compliance tighten worldwide, the demand for flexible, robust, and precise XRF systems is projected to grow steadily through the latter half of the decade.

Competitive Landscape: Leading Manufacturers and New Entrants

The competitive landscape of flexible X-ray fluorescence (XRF) spectroscopy equipment manufacturing in 2025 is characterized by both established global leaders and dynamic new entrants driving innovation in miniaturization, portability, and material flexibility. The sector is evolving rapidly, fueled by demand from industries such as environmental monitoring, mining, materials science, and advanced manufacturing, all of which benefit from the ability to conduct non-destructive, in situ elemental analysis on irregular or flexible surfaces.

Historically, dominant players in XRF technology—such as Olympus Corporation, Bruker Corporation, Thermo Fisher Scientific, and Malvern Panalytical—have set industry standards with benchtop and handheld XRF analyzers. These companies continue to invest in R&D to enhance detector sensitivity, device ruggedness, and software capabilities. Bruker Corporation, for example, has expanded its S1 TITAN series with models optimized for field use, reflecting a broader shift toward greater portability and user-friendly interfaces.

However, the move toward flexible XRF—where analyzers incorporate bendable substrates or conformal geometries—has opened the door for both established firms and innovative startups. Notably, Oxford Instruments has demonstrated interest in integrating flexible detector components to improve performance on curved or uneven surfaces, a key requirement for next-generation manufacturing and recycling applications.

In parallel, new entrants and university spin-offs are leveraging advances in flexible electronics and microfabrication. Several startups in North America, Europe, and East Asia are actively prototyping flexible XRF sensors that utilize thin-film semiconductor materials and printable circuitry. While many of these technologies are still in pilot or pre-commercial stages, their emergence is attracting partnership interest from larger OEMs seeking to diversify their product portfolios.

The competitive intensity is further heightened by efforts from established electronics manufacturers in Asia, such as Hitachi High-Tech Corporation, which has a longstanding presence in XRF and is investing in miniaturization and flexible form factors for industrial inspection. Similarly, Rigaku Corporation continues to introduce compact XRF solutions targeted at both laboratory and field applications, often emphasizing adaptability and ease of integration.

Looking ahead, the next few years are expected to see increased collaboration between traditional XRF companies and flexible electronics innovators. The race to commercialize robust, high-sensitivity flexible XRF analyzers will likely intensify, with strategic alliances, joint ventures, and targeted acquisitions shaping the competitive landscape. As regulatory standards call for more precise and versatile materials characterization, the sector’s leading manufacturers and agile newcomers alike are poised to capitalize on the growing demand for flexible, deployable XRF solutions.

Supply Chain & Manufacturing Challenges

The manufacturing of flexible X-ray fluorescence (XRF) spectroscopy equipment in 2025 is shaped by a complex global supply chain, featuring both significant opportunities and persistent challenges. As demand for more portable, adaptable analytical tools grows across sectors such as mining, environmental monitoring, and materials science, manufacturers are under increasing pressure to deliver next-generation systems that combine high sensitivity with mechanical flexibility.

One of the primary manufacturing challenges is the sourcing and integration of advanced detector materials. Flexible XRF devices often require thin-film detectors based on materials like silicon drift detectors (SDDs) or cadmium telluride (CdTe), which must be produced with stringent purity and structural requirements. The supply chain for such semiconductors remains vulnerable to disruptions, particularly due to global fluctuations in raw material availability and geopolitical tensions impacting semiconductor supply. Key manufacturers such as Oxford Instruments and Bruker Corporation continue to invest in developing more robust supplier networks and in-house fabrication capabilities to mitigate these risks.

Another critical challenge involves precision microfabrication and assembly. Flexible XRF units demand the miniaturization of traditional components—X-ray tubes, collimators, and detectors—without sacrificing analytical performance. This requires specialized manufacturing environments and advanced automation, which can be capital intensive. Companies like Hitachi High-Tech Corporation and Evident Corporation (formerly Olympus Scientific Solutions) are actively expanding their R&D and production facilities to support such advanced manufacturing processes, with a focus on automation and quality control.

Logistics and cross-border regulatory compliance also play a significant role. The movement of sensitive X-ray components is subject to international safety regulations, customs scrutiny, and, in some cases, export controls. This has led manufacturers to explore regional production hubs and strategic partnerships, aiming to localize supply chains and reduce lead times. For example, Thermo Fisher Scientific has been involved in expanding its regional service and assembly centers to better serve local markets and bypass some of the logistical challenges posed by global shipping constraints.

Looking ahead to the next few years, the outlook for flexible XRF equipment manufacturing is cautiously optimistic. Continued investment in material science, automation, and supply chain resilience is expected. However, manufacturers must remain vigilant regarding potential disruptions to semiconductor and specialty material supplies. Industry leaders are likely to further integrate vertically and pursue strategic collaborations to ensure both innovation and stability in this evolving sector.

End-User Segments: Emerging Markets and Use Cases

Flexible X-ray fluorescence (XRF) spectroscopy equipment is rapidly gaining traction across diverse end-user segments, fueled by demand for portable, adaptable, and high-precision elemental analysis tools. As of 2025, advancements in flexible XRF devices—characterized by lightweight form factors, bendable detectors, and wireless connectivity—are enabling new applications beyond traditional laboratory settings. This trend is reshaping the landscape for manufacturers, who are increasingly tailoring solutions to the evolving needs of both established and emerging markets.

In the mining and minerals sector, flexible XRF analyzers are being deployed for on-site elemental analysis, reducing reliance on fixed lab infrastructure and accelerating decision-making in exploration and ore grading. Major equipment producers such as Thermo Fisher Scientific and Olympus Corporation are expanding their portfolios with robust, field-ready XRF solutions, addressing growing demand in regions undergoing resource development in Africa, South America, and Southeast Asia.

Environmental monitoring is another burgeoning end-user segment, with flexible XRF systems being adopted for in situ soil, water, and air quality assessments. These applications are critical for regulatory compliance and pollution control, especially in rapidly industrializing countries. Bruker Corporation and Hitachi High-Tech Corporation are notable for introducing compact, battery-powered analyzers that can be easily transported and operated in the field, supporting environmental agencies and NGOs in emerging markets.

A notable emerging use case is in electronic waste (e-waste) recycling. Flexible XRF devices enable rapid, non-destructive identification of hazardous substances and valuable metals in discarded electronics, facilitating compliance with international directives and improving recycling efficiency. Companies like Oxford Instruments are responding by developing ruggedized, user-friendly XRF solutions for recyclers and urban mining operators.

In the advanced manufacturing and quality assurance sector, flexible XRF technologies are being integrated into automated production lines for real-time material verification. The automotive, aerospace, and electronics industries are particularly active adopters, seeking to enhance traceability and product safety. As manufacturing shifts to regions such as India and ASEAN countries, demand for localized, flexible inspection solutions is expected to grow.

Looking ahead to the next few years, the outlook for flexible XRF spectroscopy equipment manufacturing is robust, with continued innovation expected in sensor miniaturization, wireless integration, and user interface design. Manufacturers are likely to focus on expanding applications in battery recycling, pharmaceuticals, and food safety, leveraging partnerships with local distributors and research institutions to penetrate emerging markets.

Regulatory Environment and Standards (e.g., ISO, ASTM)

The regulatory environment for flexible X-ray fluorescence (XRF) spectroscopy equipment manufacturing is evolving rapidly in 2025, reflecting both the technological innovation in portable and adaptable XRF devices and the increased scrutiny on safety and product standardization. The sector is influenced by international standards such as ISO and ASTM, which set benchmarks for performance, safety, and interoperability. ISO 3497 and ISO 18113 series, for example, specify general requirements for XRF analysis and instrument performance, while ASTM standards like E1621 and E2119 provide guidelines for the quantitative analysis of metals and alloys using XRF techniques.

Manufacturers must also comply with radiation safety regulations set forth by national and international bodies. The International Electrotechnical Commission (IEC) issues key standards for the electrical safety and electromagnetic compatibility of XRF instruments, including IEC 61010 for laboratory equipment safety. Compliance with these standards is essential for market access in major economies such as the EU and USA. In the United States, equipment must adhere to the safety and labeling requirements of the Food and Drug Administration’s Center for Devices and Radiological Health (CDRH), while European manufacturers follow the CE marking process, referencing directives like the Low Voltage Directive and the Machinery Directive.

Major industry players such as Bruker, Olympus Corporation, and Thermo Fisher Scientific are actively involved in standards development and ensure their flexible XRF products are certified accordingly. These companies also participate in working groups for standards revision, especially as flexible and handheld XRF devices present new challenges in terms of user safety and calibration requirements compared to benchtop systems. The International Organization for Standardization (ISO) and ASTM International continuously update their standards to address advances in detector technology, miniaturization, and wireless connectivity, which are increasingly prevalent in flexible XRF equipment.

Looking ahead to the remainder of 2025 and the subsequent years, regulatory bodies are expected to address emerging topics such as cybersecurity for connected instruments, harmonization of global standards, and enhanced operator training requirements. With the proliferation of flexible XRF systems in sectors like environmental monitoring, mining, and recycling, regulators are placing greater emphasis on traceability, environmental impact (such as RoHS compliance), and safe disposal of devices. As a result, manufacturers are investing in compliance infrastructure and cross-functional teams to monitor regulatory changes and participate in shaping new standards, ensuring continued global market access and user safety.

Investment, M&A, and Partnership Trends

The landscape for investment, mergers and acquisitions (M&A), and partnership activity in the flexible X-ray fluorescence (XRF) spectroscopy equipment manufacturing sector is experiencing dynamic developments as of 2025. This momentum is primarily driven by the growing demand for portable and adaptable analytical instruments in fields such as mining, recycling, environmental monitoring, and advanced manufacturing. Flexible XRF systems—encompassing lightweight, handheld, and modular designs—are increasingly valued for their in-field utility and rapid analytical turnaround, spurring a new wave of corporate strategies and capital flows.

Major industry players are actively pursuing both organic and inorganic growth avenues. For example, Olympus Corporation—a leader in analytical instrumentation—continues to invest in R&D and strategic collaborations to expand its portfolio of portable XRF analyzers. The company’s increasing focus on ruggedized, application-specific systems reflects broader industry efforts to address emerging end-user needs. Similarly, Bruker Corporation has prioritized technological innovation and partnerships, emphasizing modularity and integration with digital platforms to enhance real-time, on-site data analysis.

Recent years have also seen heightened M&A activity as firms seek to consolidate expertise and expand market reach. Notably, Thermo Fisher Scientific has historically expanded its analytical instruments division through targeted acquisitions, and its ongoing pursuit of novel XRF technologies is expected to continue through 2025. Such moves are intended to capture growing market segments, particularly in areas where flexibility and portability of equipment are decisive purchasing factors.

Strategic partnerships between manufacturers and materials science organizations or industrial end-users are also reshaping the sector. For instance, Hitachi High-Tech Corporation frequently collaborates with mining and recycling companies to tailor its XRF units for specific operational environments. This trend toward co-development is fostering more application-driven innovation and accelerating the adoption of flexible XRF solutions.

Venture investment in XRF startups—particularly those developing miniaturized or IoT-enabled devices—continues to grow, with several firms announcing funding rounds aimed at scaling production and advancing sensor technology. Established companies are increasingly exploring joint ventures with start-ups to access novel intellectual property and agile development approaches.

Looking ahead, the next few years are expected to bring continued consolidation among established manufacturers, increased cross-sector partnerships, and sustained venture capital interest, especially as regulatory requirements and sustainability imperatives drive demand for rapid, flexible material analysis solutions across industries.

Future Opportunities and Strategic Recommendations

The landscape for flexible X-ray fluorescence (XRF) spectroscopy equipment manufacturing is poised for dynamic evolution in 2025 and beyond, driven by technological advances, growing end-user demands, and global emphasis on portable analytical solutions. Key opportunities are emerging as new materials and design paradigms—such as bendable substrates, miniaturized detectors, and wireless connectivity—transform traditional XRF devices into flexible, lightweight, and field-deployable instruments. Strategic recommendations for equipment manufacturers are grounded in current industry events, partnerships, and projected market trajectories.

Leading manufacturers, such as Olympus Corporation and Bruker Corporation, are actively investing in research and development focused on miniaturization, improved energy efficiency, and enhanced data processing capabilities. These investments aim to meet the rising demand from industries such as mining, recycling, environmental monitoring, and quality assurance, which increasingly require on-site, non-destructive analysis. The trend toward flexible electronics, including flexible printed circuits and advanced thin-film detectors, has opened avenues for developing truly bendable XRF devices, which can conform to curved or irregular surfaces—a crucial feature for automotive, aerospace, and cultural heritage applications.

In 2025, collaborative projects between equipment manufacturers and research institutions are expected to accelerate the commercialization of flexible XRF technologies. For example, Hitachi High-Tech Corporation continues to expand its portfolio of portable and benchtop XRF systems, with R&D efforts geared towards integrating flexible sensor components and cloud-based data management platforms. Furthermore, standardization bodies such as the American National Standards Institute and sector-specific consortia are anticipated to issue new guidelines to ensure interoperability and data integrity as flexible XRF tools proliferate.

Strategic recommendations for manufacturers include:

- Prioritize partnerships with advanced materials suppliers and electronics fabricators to secure proprietary access to next-generation flexible substrates and detector technologies.

- Invest in modular product architectures that allow for rapid customization and upgrading, enabling adaptation to diverse field conditions and analytical requirements.

- Expand after-sales service networks and remote diagnostics capabilities, leveraging IoT and cloud connectivity, to reduce downtime and improve customer retention.

- Engage with regulatory agencies and standards organizations early in the product development cycle to anticipate compliance needs and facilitate market entry.

- Encourage open innovation through university-industry collaboration, fostering the rapid translation of laboratory breakthroughs into commercially viable products.

Looking ahead, the convergence of flexible electronics, smart sensors, and digital connectivity is set to define the next generation of XRF equipment. Manufacturers that embrace innovation, cultivate strategic alliances, and proactively address regulatory and market shifts will be best positioned to capitalize on the expanding opportunities within flexible XRF spectroscopy equipment manufacturing in 2025 and beyond.

Sources & References

- Olympus Corporation

- Bruker Corporation

- Thermo Fisher Scientific

- Hitachi High-Tech Corporation

- Olympus IMS

- SPECTRO Analytical Instruments

- Oxford Instruments

- Malvern Panalytical

- Oxford Instruments

- Hitachi High-Tech Corporation

- Rigaku Corporation

- American National Standards Institute