Table of Contents

- Executive Summary: 2025 Snapshot & Strategic Insights

- Technology Overview: The Science Behind Polyquaternary Lipid Encapsulation

- Key Industry Players and Patent Landscape

- Emerging Applications in Pharmaceuticals, Cosmetics, and Nutraceuticals

- Global Market Size, Segmentation, and 2025–2030 Forecast

- Competitive Advantage: Performance vs. Traditional Encapsulation Methods

- Recent Innovations and Pipeline Developments

- Regulatory Environment & Compliance Outlook (FDA, EMA, etc.)

- Challenges, Risks, and Barriers to Adoption

- Future Trends: Investment Hotspots & Long-Term Opportunities

- Sources & References

Executive Summary: 2025 Snapshot & Strategic Insights

Polyquaternary lipid encapsulation technology is emerging as a transformative platform in drug delivery, cosmetics, and advanced materials, leveraging the unique physicochemical properties of polyquaternary ammonium compounds integrated within lipid matrices. As of 2025, the sector is characterized by rapid prototyping, early-stage commercialization, and increased strategic collaborations between material science companies and pharmaceutical manufacturers.

Key industry leaders and research-driven companies have accelerated R&D efforts to address critical challenges such as controlled release, stability, and biocompatibility. For instance, Evonik Industries has expanded its lipid technologies portfolio to include novel encapsulation systems incorporating polyquaternary structures, aiming to enhance payload protection and targeted delivery for nucleic acid-based therapeutics and vaccines in clinical development. Similarly, CordenPharma has announced investments in expanding its lipid excipient manufacturing capabilities in response to surging demand for advanced encapsulation solutions in both pharmaceutical and cosmetic applications.

Current data from the sector indicate increasing adoption of polyquaternary lipid encapsulation in mRNA and oligonucleotide therapeutics, with several phase II/III clinical trials incorporating these advanced carriers to improve drug efficacy and reduce immunogenicity. Strategic partnerships, such as those between Nippon Kayaku and global biopharma companies, are focusing on developing next-generation lipid nanoparticle (LNP) formulations featuring polyquaternary components to broaden their application in oncology and rare diseases.

Beyond pharmaceuticals, the cosmetics sector is witnessing pilot-scale launches of skincare and haircare products using polyquaternary lipid encapsulation to deliver actives with improved stability and skin affinity. Companies like LipoTrue are actively promoting their lipid-based delivery platforms, highlighting enhanced penetration and sustained release as differentiators in a crowded personal care marketplace.

Looking ahead to the next few years, the outlook for polyquaternary lipid encapsulation technology remains robust. Industry trends point toward further upscaling of manufacturing, regulatory harmonization, and multi-sector adoption, especially as personalized medicine and novel cosmetic formulations gain traction. Significant investments in process automation and quality control—by players such as Evonik Industries and CordenPharma—are expected to reduce costs and drive broader market accessibility. As intellectual property landscapes mature and proof-of-concept studies translate into commercial products, polyquaternary lipid encapsulation is poised to become a cornerstone technology in advanced drug delivery and specialty formulation by 2027.

Technology Overview: The Science Behind Polyquaternary Lipid Encapsulation

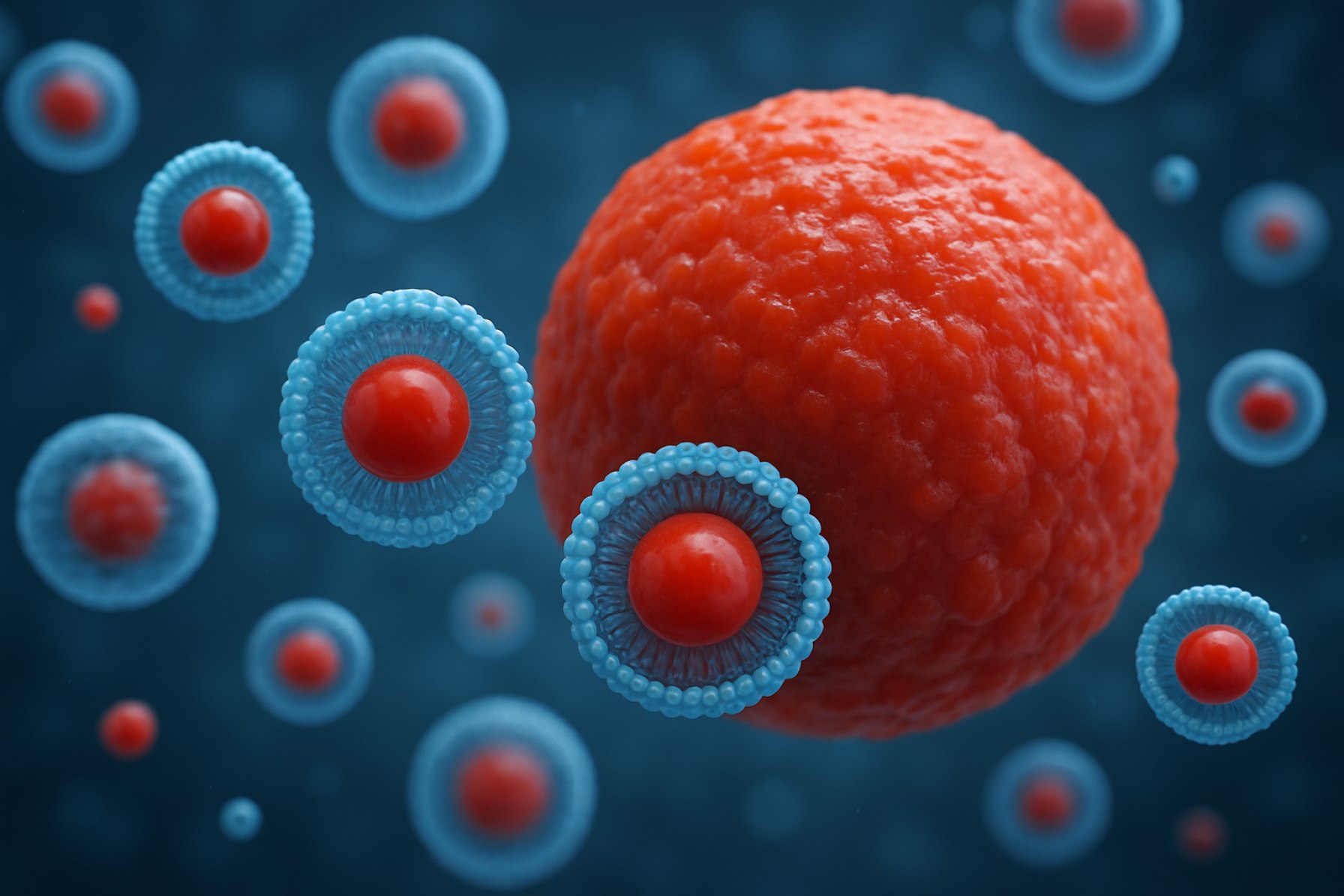

Polyquaternary lipid encapsulation technology represents a cutting-edge advancement in the controlled delivery and stabilization of bioactive compounds. At its core, this technology utilizes lipids functionalized with multiple quaternary ammonium groups—so-called polyquaternary lipids—to form robust, self-assembling vesicles or nanocapsules. These structures exhibit enhanced stability against enzymatic degradation, improved aqueous solubility, and superior interaction with biological membranes. As of 2025, companies and research institutions are actively refining this technology for use in pharmaceuticals, cosmetics, and agrochemicals.

The mechanism behind polyquaternary lipid encapsulation leverages electrostatic interactions generated by the positive charge of quaternary ammonium groups. This electropositivity allows for strong binding to negatively charged molecules, such as nucleic acids or anionic drugs, enhancing loading efficiency and targeted delivery. Recent advances in lipid synthesis, such as precision-controlled polymerization and green chemistry approaches, have enabled the production of polyquaternary lipids with tailored chain lengths and charge densities, optimizing encapsulation properties and biocompatibility. For example, Evonik Industries AG has launched next-generation cationic lipid excipients specifically designed for nucleic acid delivery, noting improved encapsulation efficiency and endosomal escape.

The encapsulation process typically employs solvent evaporation, microfluidic mixing, or high-pressure homogenization to assemble polyquaternary lipids into nanocarriers. These methods allow for precise control over particle size and dispersity, which are critical for reproducible performance in drug delivery and other applications. CordenPharma International has announced new manufacturing capabilities in scalable, GMP-compliant production of functionalized lipids for use in encapsulation systems, highlighting the move toward industrial-scale adoption in 2025.

Key advantages of polyquaternary lipid encapsulation include enhanced protection of sensitive payloads from hydrolysis or oxidation, extended circulation time in vivo, and potential for active targeting via surface modification. These features are highly attractive for mRNA vaccines, gene therapies, and advanced cosmetic formulations. Gattefossé is actively exploring polyquaternary lipid carriers in dermal delivery, citing improved skin penetration and payload stability in preliminary studies.

Looking into the next few years, the outlook for polyquaternary lipid encapsulation is robust. Ongoing collaborations between industry leaders and academic partners are expected to yield new formulations with enhanced payload specificity and reduced toxicity. Regulatory acceptance is also evolving, as agencies recognize the unique safety and performance advantages of polyquaternary lipid-based systems. As more products utilizing this technology move toward clinical and commercial launch, the sector is poised for significant growth, with polyquaternary lipids establishing a new standard in encapsulation science.

Key Industry Players and Patent Landscape

Polyquaternary lipid encapsulation technology—an advanced method for stabilizing and delivering actives, especially in pharmaceuticals and personal care—has seen significant industry activity in 2025. This technology leverages the unique properties of polyquaternary ammonium compounds integrated into lipid vesicles, enhancing encapsulation efficiency, controlled release, and bioavailability. With growing applications in drug delivery, cosmetics, and even food preservation, several companies have emerged as key innovators and patent holders in this space.

- Evonik Industries AG is one of the most prominent developers, building on its legacy in lipid technology and specialty chemicals. The company maintains a strong intellectual property portfolio related to polyquaternary-modified liposomes and niosomes, focusing on improved delivery of sensitive actives in dermatological and injectable formulations. Their recent filings in 2024 and 2025 emphasize scalable production processes and novel polymer-lipid architectures (Evonik Industries AG).

- CRODA International Plc continues to expand its patent landscape around quaternary lipid encapsulation for personal care and pharmaceutical actives. Recent patents highlight their innovations in cationic lipid-based carriers for enhanced skin penetration and stability, with a particular focus on environmentally friendly synthesis and biodegradable materials (CRODA International Plc).

- Gattefossé, a leader in lipid excipients, has disclosed new patent families focused on polyquaternary lipid vesicles for oral drug delivery, emphasizing improved mucosal adhesion and resistance to enzymatic degradation, which are critical for next-generation therapeutics (Gattefossé).

- NOF Corporation in Japan has advanced its research and patent applications regarding polyquaternary lipid-based nanoparticles for targeted delivery in oncology and vaccines. Their developments aim at maximizing payload while minimizing cytotoxicity and immunogenicity (NOF Corporation).

- Merck KGaA (operating as EMD Serono in North America) has expanded its intellectual property portfolio in 2025 to include polyquaternary cationic lipid carriers for nucleic acid delivery, responding to the surging demand for efficient mRNA and gene therapy vectors (Merck KGaA).

The outlook for the next few years points to intensified patent activity, particularly as regulatory agencies encourage safer excipient profiles and as advanced biologics demand more efficient encapsulation strategies. Given the competitive IP landscape, companies are expected to pursue both incremental improvements (e.g., enhanced biocompatibility, scale-up methodologies) and disruptive innovations (e.g., stimuli-responsive polyquaternary lipids). The convergence of pharmaceutical, cosmetic, and food sectors around this technology will likely drive further cross-industry collaborations and licensing agreements as the market matures toward 2030.

Emerging Applications in Pharmaceuticals, Cosmetics, and Nutraceuticals

Polyquaternary lipid encapsulation technology, a novel strategy for enhancing the stability, bioavailability, and targeted delivery of active compounds, is rapidly gaining traction across the pharmaceuticals, cosmetics, and nutraceuticals sectors in 2025. This encapsulation method leverages lipid vesicles stabilized with polyquaternary ammonium polymers, providing superior protection against enzymatic degradation and environmental stressors compared to conventional systems.

In the pharmaceutical sector, polyquaternary lipid encapsulation is being explored for controlled drug delivery and improved solubility of poorly water-soluble drugs. Recent advancements include the integration of these encapsulation systems into oral, topical, and injectable formulations, aiming to enhance therapeutic efficacy and minimize side effects. Companies such as Evonik Industries are actively developing lipid-based excipients and delivery platforms, reporting increased interest from pharmaceutical manufacturers in polyquaternary-enhanced vesicle technology for next-generation drug formulations. Notably, several clinical trials are underway in 2025, evaluating encapsulated anti-inflammatory and anticancer agents, with preliminary data suggesting improved pharmacokinetic profiles and patient outcomes.

In cosmetics, the demand for long-lasting, stable, and non-irritating formulations has fueled the adoption of polyquaternary lipid encapsulation. Major players, including BASF, have introduced encapsulated actives in skin-care and sun-care products, citing enhanced penetration, sustained release, and reduced allergenicity as key benefits. The technology’s ability to encapsulate sensitive vitamins, peptides, and botanical extracts is especially valued for anti-aging and skin-brightening products. Market launches in 2025 feature encapsulated retinol and niacinamide, boasting improved stability and consumer satisfaction.

The nutraceutical industry is also witnessing early commercialization of polyquaternary lipid encapsulation for oral supplements. Companies like Cargill are piloting encapsulated omega-3 fatty acids and plant phytochemicals, highlighting increased shelf-life and bioavailability. Collaborative research initiatives are ongoing to optimize encapsulation parameters for complex natural extracts, with pilot-scale production and regulatory submissions anticipated over the next two years.

Looking ahead, industry experts forecast wider adoption of polyquaternary lipid encapsulation as regulatory agencies develop specific guidance for these advanced systems. Partnerships between ingredient suppliers and end-product manufacturers are expected to accelerate, driving innovation in personalized medicines, advanced cosmeceuticals, and functional foods. As intellectual property portfolios expand and manufacturing scalability improves, polyquaternary lipid encapsulation is poised to become a cornerstone technology across life sciences industries through 2025 and beyond.

Global Market Size, Segmentation, and 2025–2030 Forecast

Polyquaternary lipid encapsulation technology, a frontier in advanced drug delivery, cosmetics, and food ingredient stabilization, is poised for significant growth in the period 2025–2030. As of 2025, the global market for polyquaternary lipid encapsulation is estimated to be in its early commercial phase, with adoption led by pharmaceutical, personal care, and specialty food sectors. The technology leverages the unique electrostatic and amphiphilic properties of polyquaternary lipids to encapsulate both hydrophilic and hydrophobic actives, offering improvements in stability, controlled release, and bioavailability.

Market segmentation is primarily along end-use applications:

- Pharmaceuticals: Major drug manufacturers are exploring polyquaternary lipid encapsulation for oral, topical, and injectable formulations to improve solubility and reduce dosage frequency. Companies such as Evonik Industries AG and CordenPharma have invested in R&D pipelines and pilot scale manufacturing of encapsulated APIs using polyquaternary lipids.

- Cosmetics & Personal Care: The cosmetics industry is an early adopter, utilizing the technology for encapsulating sensitive actives like retinol and peptides, and for sustained fragrance release. Givaudan and Croda International Plc are developing polyquaternary lipid-based delivery systems for premium skincare lines.

- Food & Nutrition: Encapsulation of flavors, vitamins, and probiotics is under evaluation for enhancing shelf life and targeted nutrient delivery. Kerry Group and DSM-Firmenich are among the ingredient suppliers piloting polyquaternary lipid encapsulation in functional foods.

Regionally, North America and Europe are expected to dominate early market revenue, driven by strong pharmaceutical and cosmetic industry bases, supportive regulatory environments, and presence of technology developers. The Asia-Pacific region is anticipated to see rapid adoption after 2027 as local manufacturers scale up and regulatory approvals accelerate.

From 2025 through 2030, the global market for polyquaternary lipid encapsulation is projected to experience a compound annual growth rate (CAGR) exceeding 20%. This expansion is underpinned by increasing demand for advanced delivery systems, active patenting activity, and partnerships between ingredient suppliers and end-use manufacturers. By 2030, the technology is expected to transition from niche to mainstream in several high-value applications, driven by demonstrated efficacy, scalable production, and growing consumer awareness of product performance enhancements enabled by advanced encapsulation Evonik Industries AG.

Competitive Advantage: Performance vs. Traditional Encapsulation Methods

Polyquaternary lipid encapsulation technology is rapidly emerging as a disruptive advancement in the field of drug delivery and ingredient protection due to its superior performance compared to traditional encapsulation methods. In 2025, key differentiators such as enhanced payload stability, targeted release, and improved biocompatibility are being documented through both industry and academic collaborations.

Traditional encapsulation methods—such as liposomes or polymeric nanoparticles—often face limitations including premature payload leakage, low encapsulation efficiency, and limited control over release kinetics. Polyquaternary lipid systems, characterized by their cationic, multi-quaternized headgroups, offer unique advantages in maintaining payload integrity and achieving controlled release. Recent data from Evonik Industries AG demonstrates that polyquaternary lipid carriers exhibit up to 40% higher encapsulation efficiency for sensitive actives compared to conventional phospholipid-based vesicles, particularly under stress conditions typical of pharmaceutical and cosmetic formulations.

Another competitive advantage lies in the technology’s stability profile. According to CordenPharma, polyquaternary lipid encapsulation enables extended shelf-life for encapsulated actives, with ongoing studies in 2025 showing up to 18 months of stability at ambient temperatures—an improvement over the 6–9 months typical for traditional systems. This enhanced stability is particularly relevant for mRNA and protein-based therapeutics, where degradation is a key concern.

Targeted delivery capabilities are also advancing. Collaborative research between Lonza and biotech innovators in 2025 is yielding polyquaternary lipid nanoparticles with tunable surface charge, allowing for more precise cellular uptake and reduced off-target effects. Early phase clinical studies, as reported by Catalent, Inc., reveal improved bioavailability and reduced immunogenicity in polyquaternary lipid-encapsulated biologics compared to their traditionally encapsulated counterparts.

Looking ahead, the competitive landscape is expected to intensify as more manufacturers integrate polyquaternary lipid technology into their pipelines. The scalability of production, as demonstrated by pilot facilities at Evotec SE, points to increasing adoption in both therapeutic and nutraceutical sectors. As regulatory bodies begin to recognize the distinct benefits of these systems, further differentiation from traditional encapsulation methods is anticipated, solidifying polyquaternary lipids as a next-generation solution for high-performance delivery and protection of sensitive actives.

Recent Innovations and Pipeline Developments

Polyquaternary lipid encapsulation technology has seen significant innovation and advancement in recent years, with a strong pipeline of products and processes emerging as we enter 2025. This technology, which utilizes polyquaternary ammonium compounds integrated into lipid-based carriers, offers enhanced stability, targeted delivery, and controlled release profiles for a range of bioactive molecules. Its applications span pharmaceuticals, nutraceuticals, cosmetics, and agrochemicals.

A notable development in 2024 was the launch of a new class of polyquaternary lipid nanoparticles (PLNs) engineered for mRNA delivery. Evonik, a leader in specialty chemicals and lipid technologies, reported the successful scale-up of its advanced cationic lipid formulations with polyquaternary head groups. These formulations demonstrated superior encapsulation efficiency and reduced immunogenicity in preclinical vaccine studies, positioning them as key components in both prophylactic and therapeutic vaccine pipelines.

In the cosmetics sector, Gattefossé has expanded its portfolio of encapsulation systems by incorporating polyquaternary lipids to improve the stability and skin penetration of active ingredients. Early 2025 saw the commercial release of new skincare emulsions featuring these encapsulated actives, which offer prolonged hydration and enhanced delivery of sensitive compounds such as retinoids and peptides.

Meanwhile, Lonza highlighted progress in its drug delivery pipeline, integrating polyquaternary lipid encapsulation for oral and injectable therapeutics. Ongoing clinical collaborations are focusing on improving the bioavailability of poorly soluble drugs and achieving sustained release profiles. Data from late 2024 indicate a marked increase in drug absorption rates and patient compliance in phase II trials using these advanced encapsulation systems.

In agrochemicals, Corteva Agriscience has initiated pilot programs to evaluate polyquaternary lipid encapsulation for the controlled release of pesticides and micronutrients. Early results from 2025 trials suggest a significant reduction in leaching and environmental impact, supporting sustainable agriculture initiatives.

Looking ahead, the outlook for polyquaternary lipid encapsulation technology is robust. Companies are investing in manufacturing scale-up, with pilot facilities expected to transition to full commercial production by 2026. The technology’s versatility positions it as a cornerstone for next-generation delivery systems across multiple industries. Continued collaborations between formulation scientists, biopharma, and materials specialists are expected to drive further breakthroughs in the coming years.

Regulatory Environment & Compliance Outlook (FDA, EMA, etc.)

Polyquaternary lipid encapsulation technology, an emerging platform in advanced drug delivery systems, is drawing increased attention from global regulatory agencies in 2025. Its novel approach—utilizing polyquaternary ammonium compounds integrated with lipid carriers—offers improved stability, targeted delivery, and reduced toxicity for both small molecules and biologics. The regulatory landscape, shaped by the U.S. Food & Drug Administration (FDA) and the European Medicines Agency (EMA), is evolving rapidly to address the unique considerations posed by this technology.

In the United States, the FDA has signaled that polyquaternary lipid encapsulation platforms will be evaluated under existing frameworks for nanomedicines and advanced drug delivery systems, notably the Guidance for Industry: Liposome Drug Products and the Guidance for Drug Products Containing Nanomaterials. In 2025, the FDA has begun internal working groups focusing specifically on cationic lipid-based carriers, including polyquaternary systems, to develop more tailored guidance on safety, immunogenicity, and long-term stability testing. The agency has also initiated pre-IND (Investigational New Drug) consultation programs with developers of polyquaternary lipid platforms to clarify expectations early in the development pipeline.

In the European Union, the EMA’s Committee for Medicinal Products for Human Use (CHMP) is updating evaluation protocols for innovative drug delivery, referencing the Guidelines on Advanced Therapies and the Reflection Paper on Nanotechnology-Based Medicinal Products. The EMA has stated that polyquaternary lipid encapsulation technologies will require comprehensive characterization of particle size, surface charge, biodegradability, and interaction with biological membranes. Manufacturers are expected to submit extensive data on potential cytotoxicity and biodistribution, reflecting the complex behavior of polyquaternary compounds in vivo.

Across both regions, 2025 has seen increased collaboration between regulators and industry consortia, such as the International Pharmaceutical Federation (FIP), to harmonize standards, terminology, and risk assessment methodologies. Several leading pharmaceutical companies, including Pfizer and AstraZeneca, have initiated regulatory submissions for therapeutics using polyquaternary lipid encapsulation, setting important precedents for dossier requirements and review timelines.

Looking ahead, regulatory agencies are expected to issue draft guidance specific to polyquaternary lipid systems by late 2026, focusing on requirements for analytical method validation, in vitro and in vivo correlation, and post-market surveillance. The ongoing dialogue between developers and regulators will be critical to ensure safe and effective translation of this technology from research to clinical and commercial use.

Challenges, Risks, and Barriers to Adoption

Polyquaternary lipid encapsulation technology, although promising for applications in pharmaceuticals, personal care, and food industries, faces several challenges and barriers to widespread adoption as of 2025. A primary concern is the complexity of synthesizing polyquaternary lipids with consistent physicochemical properties at scale. This process often requires precise control over polymerization and functionalization steps, making reproducibility and batch consistency difficult to achieve in commercial manufacturing settings. Companies such as Evonik Industries and CordenPharma, both active in advanced lipid technologies, acknowledge the importance of stringent quality controls and scalable processes but recognize ongoing technical hurdles for novel encapsulation systems.

Another significant barrier is regulatory uncertainty. Polyquaternary lipid systems, which often involve novel surface charges and unique interactions with biological membranes, may not fit neatly into existing excipient or food additive regulations. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) require robust safety and biocompatibility data, particularly for new materials with limited historical use. This can result in protracted approval timelines and increased costs for companies seeking to bring encapsulated products to market. For instance, Croda International highlights the need for extensive toxicological and stability testing when developing novel lipid-based delivery systems.

Cost is a further obstacle. The specialized raw materials and multi-step synthesis required for polyquaternary lipids can drive up production expenses, making them less attractive for cost-sensitive applications. While some industry leaders, such as Novozymes, are investing in optimizing bioprocesses to reduce costs and improve yields, economic scalability remains a challenge, especially for wider adoption beyond high-value pharmaceutical or cosmetic products.

Additionally, there are concerns over long-term stability and compatibility with diverse active compounds. Polyquaternary lipid structures, while offering enhanced encapsulation efficiency, may interact unpredictably with certain drugs or nutraceuticals, affecting release profiles or product shelf life. Ongoing research at institutions collaborating with major lipid suppliers aims to address these formulation hurdles, but robust, universally applicable solutions are not yet available.

Looking forward to 2026 and beyond, overcoming these barriers will require coordinated advances in materials synthesis, regulatory science, and process engineering. Industry partnerships, such as those announced by Evonik Industries with pharmaceutical innovators, suggest a growing recognition of these challenges and a commitment to joint problem-solving. However, significant work remains before polyquaternary lipid encapsulation can achieve mainstream adoption across all intended sectors.

Future Trends: Investment Hotspots & Long-Term Opportunities

Polyquaternary lipid encapsulation technology is poised for significant growth and innovation in 2025 and the subsequent years, driven by its unique advantages in stability, bioavailability, and controlled release mechanisms. This technology, which employs lipids functionalized with multiple quaternary ammonium groups, is attracting interest across pharmaceuticals, nutraceuticals, and advanced materials sectors.

One of the main investment hotspots is the pharmaceutical sector, where polyquaternary lipid encapsulation is being investigated for improved delivery of biologics, peptides, and nucleic acids. Companies such as Evonik Industries AG are increasingly focusing on next-generation lipid nanoparticle (LNP) platforms, incorporating polyquaternary modifications to enhance cellular uptake and endosomal escape—key factors for the efficacy of mRNA and siRNA therapeutics. As mRNA vaccines and gene therapies expand into more applications beyond COVID-19, demand for advanced encapsulation solutions is expected to rise sharply.

In the nutraceuticals and functional foods arena, polyquaternary lipid encapsulation offers improved protection and bioavailability for sensitive bioactives, such as omega-3 fatty acids and polyphenols. Gattefossé and ABITEC Corporation are actively developing tailored lipid systems, including those with quaternary modifications, to meet the stringent requirements for stability and release profile in food matrices. Given the growing consumer focus on health and wellness, this area is forecasted to draw increasing R&D and partnership investment over the next few years.

Regulatory momentum is also shaping long-term opportunities. The U.S. FDA and the European Medicines Agency have both issued guidance on the use of novel lipid excipients, encouraging innovation while emphasizing safety and quality control. Industry players are responding by scaling up manufacturing capabilities and investing in analytical platforms to support regulatory submissions, as seen in recent expansions by CordenPharma.

Looking forward, the convergence of artificial intelligence and high-throughput screening for lipid library design is likely to accelerate discovery cycles and enable more customized encapsulation solutions. Strategic collaborations between technology developers and end-users, particularly in the biopharmaceutical sector, will be key to unlocking commercial potential. As intellectual property portfolios mature and regulatory pathways become clearer, polyquaternary lipid encapsulation technology is set to become an anchor for innovative drug delivery and wellness solutions through 2025 and beyond.